Should You Buy Canopy Growth Stock Before Feb. 6?

Key Points

Canopy Growth's stock has been in a seemingly endless tailspin in recent years.

It has, however, had brief periods where it has rallied, sometimes even after earnings.

Poor fundamentals and a troubling outlook make this a highly risky stock to invest in today.

- 10 stocks we like better than Canopy Growth ›

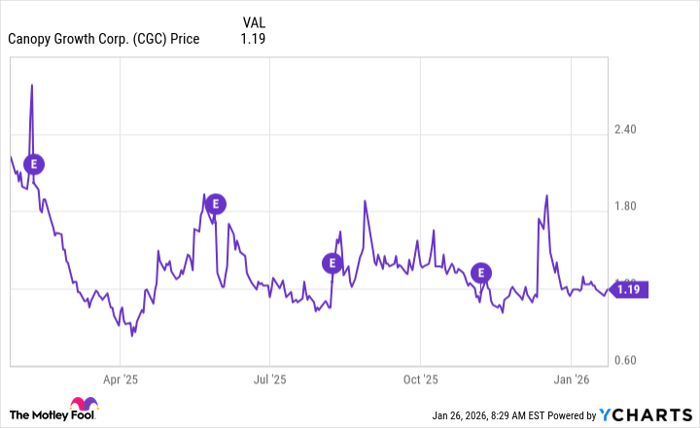

Canadian-based pot producer Canopy Growth (NASDAQ: CGC) is coming off another tough year on the markets. In 2025, its share price collapsed by 58%, and the year before that, it was down a staggering 46%. Things have gone from bad to worse for the business over the years, as it has struggled to grow, and hopes of the U.S. legalizing marijuana simply haven't come to fruition.

But with so much bad news baked into its share price already, it may potentially make for an appealing buy for contrarian investors. Next week, on Feb. 6, Canopy Growth reports its third-quarter earnings for fiscal 2026 -- should you buy the pot stock before then?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Could earnings give Canopy Growth's stock a boost?

While shares of Canopy Growth have been on a downward trajectory for multiple years, there have been periods of bullishness along the way. And the last time it posted earnings in November, the stock experienced a brief boost.

CGC data by YCharts

While large positive earnings surprises aren't the norm for a company that has been struggling with profitability and organic growth, that doesn't mean Canopy Growth still can't outperform expectations -- a key determinant in which direction the stock goes in after earnings.

In its most recent earnings report, which went up until the end of September, Canopy Growth reported cannabis net revenue of 51 million Canadian dollars, which rose 12% compared to the previous year. The company also drastically reduced its net loss from CA$128.3 million to just CA$1.6 million as it incurred less impairment and restructuring expenses, while benefiting from an increase in other income.

Despite its beaten-down valuation, Canopy Growth isn't worth the risk

Historically, Canopy Growth hasn't been a good stock to invest in. It might rise in value after earnings if its results prove to be better than expected, but it's likely to fall afterward, just like it has done in the past. Until its fundamentals change and there is a reason to be optimistic about its long-term growth and prospects for sustainable profitability (there's typically lots of noise on its financials, which can impact the bottom line), this will remain a highly risky stock to own.

Canopy Growth has burned through more than CA$88 million just from its day-to-day operations over the past year. This is not a company that's in a good position to grow in the future. It makes for a poor growth stock, which is why its track record is as awful as it is for investors. Even if you're willing to take on some risk, you're probably better off steering clear of Canopy Growth.

Should you buy stock in Canopy Growth right now?

Before you buy stock in Canopy Growth, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Canopy Growth wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $448,476!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,180,126!*

Now, it’s worth noting Stock Advisor’s total average return is 945% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 30, 2026.

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.