Intel’s Foundry Business Faces a Turning Point in 2026 — Earnings Could Be the Latest Catalyst

TradingKey - Amid a wave of “Sell America” sentiment sweeping across U.S. tech stocks, Intel (INTC) has stood out, bucking the broader market downturn on Tuesday. The stock has risen nearly 140% over the past year.

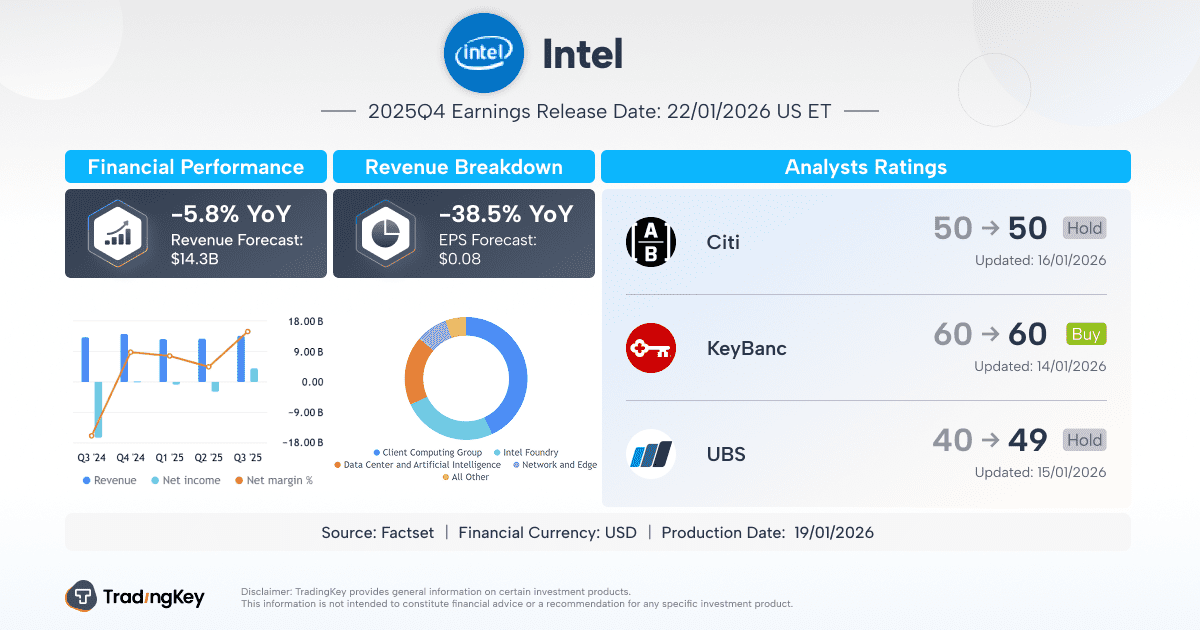

For investors, the next potential catalyst lies just ahead—Intel’s upcoming earnings report. According to Bloomberg consensus estimates, analysts expect Intel’s revenue to decline 1% in 2025 before rebounding 3% in 2026. That makes CEO Lip-Bu Tan’s forward guidance and tone on the outlook the centerpiece of this week’s earnings.

Investors Questioned Intel’s Foundry Business

Since 2021, Intel has committed more than $100 billion to global manufacturing expansion—with new meg-fabs in Arizona and Ohio at its core. Outside of TSMC (TSM) and Samsung (SSNLF), no other company matches this scale.But controversy lingers around the financials. Intel’s foundry division has posted multibillion-dollar operating losses over the past three years.

The company has worked tirelessly to revive its manufacturing arm—Intel Foundry Services (IFS)—but at the same time, market share in CPUs has steadily slipped to AMD (AMD) and Arm (ARM) designs. The business is stuck in a difficult loop: production missteps erode competitiveness, weak chip sales limit fab utilization, and low utilization further delays a manufacturing comeback.

For years, investors asked the same question: can Intel really catch up to TSMC and Samsung in process technology? Would the 18A or 14A nodes be delayed again or struggle with yields? That narrative is starting to shift. The latest technical updates show Intel’s 18A node is tracking close to expectations on both yield and performance, with power efficiency narrowing its long-standing gap. The question has evolved—from “Can they build it?” to “Is it commercially viable?”

And at this stage, customer acquisition becomes everything.

Scaling the 18A Node

Intel’s 18A process—an 18-angstrom (approximately 1.8-nanometer) technology—is its most advanced node ever and the centerpiece of its foundry turnaround. It’s the first to combine RibbonFET gate-all-around transistors with PowerVia backside power delivery, a design meant to close the gap in density and efficiency.

Intel announced plans to ramp 18A to volume production starting in late 2025. But the ultimate success will depend on yield progress. Yield determines wafer costs, gross margins, and whether the 18A node can become a scalable, profitable platform—not just a technical showcase.

Though Intel hasn’t disclosed exact yield figures, the company said in November that yields are improving steadily at around 7% per month, consistent with industry learning curves. KeyBanc Capital Markets estimates yields will climb to 65–75% by 2026.

Beyond 18A, Intel’s roadmap is clearing up. Its D1X fab in Oregon has already begun trial runs on 14A (1.4nm). Analysts forecast a further 15% performance-per-watt uplift, with 14A expected to reach the market by the end of 2027.

Intel is also pushing forward on glass substrate packaging, a structural upgrade expected to replace organic substrates and enable the extreme density and thermal performance required for future AI “superchips.”

Signs of Financial Stabilization

After two difficult years of survival mode, Intel finally appears to be stabilizing.The base case for 2025: “first stop the decline, then resume low-single-digit growth.”

That’s now showing up in indicators—revenue flattening, margins improving, cash flow strengthening, and foundry losses narrowing.

In Q3 2025, Intel delivered a decisive double beat: Revenue rose to $13.7 billion, up 3% year on year, topping the $13.1 billion consensus. Gross margin increased to 40% (non-GAAP), ahead of 36% guidance, thanks to product mix and cost discipline. Notably, the company reported $30.9 billion in cash and equivalents, including $5.7 billion from the CHIPS Act and $7 billion in private equity from NVIDIA (NVDA) and SoftBank (SFTBY).

Yet a note of caution remains. Intel’s Q4 guidance calls for gross margins to dip to 36.5%. The message is clear: technological progress comes at a cost. Even if 18A succeeds, the early ramp phase will pressure profits for several quarters before crossing into steady, high-margin production.

The Customer Question

Speculation is swirling about who Intel’s first major 18A clients will be.According to KeyBanc, Apple (AAPL) has joined as an 18A-P customer, with plans to use the node for entry-level Mac and iPad chips. Analyst John Vinh called it Intel’s “first big whale design win” and suggested Apple could eventually expand to 14A chips for lower-end iPhones.

Intel also stands to capitalize on capacity shortages at TSMC. Advanced packaging methods like CoWoS, essential for AI and high-performance chips, remain oversubscribed. Even major players like NVIDIA are struggling to secure adequate packaging supply.

Intel’s Fab 52 in Arizona—built for the 18A node—is now fully operational and led by a former TSMC packaging executive. According to industry news from November 2025, Intel’s foundry business has already onboarded Microsoft (MSFT), Tesla (TSLA), Qualcomm (QCOM), and NVIDIA as packaging-service customers, positioning itself as the critical backup to TSMC.

Though Intel has not formally confirmed these clients, sources indicate that IFS is targeting companies already sourcing wafers from TSMC’s Arizona fab—offering complementary packaging rather than head-on competition. This parallel strategy lets Intel extract value from the semiconductor ecosystem without directly threatening TSMC’s crown. And by forging packaging relationships first, Intel gains the inside track to eventually capture core manufacturing contracts.

Policy Tailwinds and Political Symbolism

The foundry story is also geopolitical. Intel has emerged as a symbolic “national champion” in the U.S. semiconductor revival narrative.Last year, SoftBank, NVIDIA, and even President Donald Trump personally backed billion-dollar investments into Intel—signals of its strategic importance.

Under the finalized CHIPS and Information Security Act, the U.S. government now holds roughly a 10% passive stake in Intel—officially cementing its national champion status. This structural support has added a sturdy policy floor to the share price.

Earlier this year, Trump doubled down, stating that the government is “honored to be a shareholder in Intel,” while praising CEO Lip-Bu Tan as “highly successful.”

Renewed Confidence, Renewed Ratings

Investor sentiment has begun to turn.On Tuesday, Intel shares jumped more than 7% after KeyBanc upgraded the stock from Sector Weight to Overweight, citing accelerating progress in manufacturing and strengthening demand for AI data center chips.

Citi (C) followed suit last week, raising its rating from Sell to Neutral and lifting its price target from $29 to $50, writing: “We believe Intel stands to benefit from advanced-packaging supply tightness at TSMC and enjoys a unique window of opportunity to attract found