As Warren Buffett Enters Retirement, An Overlooked Berkshire Trade From Last Year Is Back in Focus. Should Investors Be Worried Heading Into 2026?

Key Points

One of Buffett's core investment philosophies is to invest in the S&P 500.

Last year, Berkshire Hathaway sold out of two notable ETF positions.

The stock market is hovering near all-time highs as 2026 approaches.

- 10 stocks we like better than Vanguard S&P 500 ETF ›

As the end of 2025 draws near, the investment community is getting ready to bid farewell to Warren Buffett. For nearly 60 years, the Oracle of Omaha helped turn Berkshire Hathaway into one of the most well-respected investment firms in history.

But beginning in 2026, longtime Buffett steward Greg Abel is taking over as CEO. With Buffett's days at the helm nearing an end, investors are naturally poring over some of Berkshire's notable decisions over the last year. Against this backdrop, a curious move from the end of 2024 has come back into focus.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let's take a look at this particular trade and assess what it could mean as the markets soar to new heights into 2026.

Image source: The Motley Fool.

Remember when Berkshire unloaded its S&P 500 ETFs?

One of Buffett's greatest pieces of advice was telling investors to buy the S&P 500 index. By investing in the index, you automatically gain exposure to a multitude of industry sectors, instantly creating a diversified portfolio. The S&P 500 also provides investors with a healthy balance of blue chip, growth, and dividend stocks.

Given these dynamics, it's not surprising that Berkshire complemented its individual stock positions with two S&P 500-themed exchange-traded funds (ETFs): The Vanguard S&P 500 ETF (NYSEMKT: VOO) and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY).

Back in February, Berkshire released its 13F filing for the fourth quarter of 2024. A 13F is a document filed with the Securities and Exchange Commission (SEC) which breaks down the buying and selling activity at institutional investment funds during the prior quarter. According to Berkshire's Q4 13F, the firm dumped its respective positions in both the Vanguard S&P 500 and SPDR S&P 500 sometime late last year.

Image source: Getty Images.

With the markets roaring higher into the new year, should investors follow Buffett's move?

I can't say what exactly influenced Buffett's decision to exit Berkshire's S&P 500 ETFs. However, I can take a solid guess. A chief part of Buffett's investment philosophy is that he does not chase hype. In fact, Buffett is considered a contrarian -- often going against the grain of what other "smart money" investors are doing.

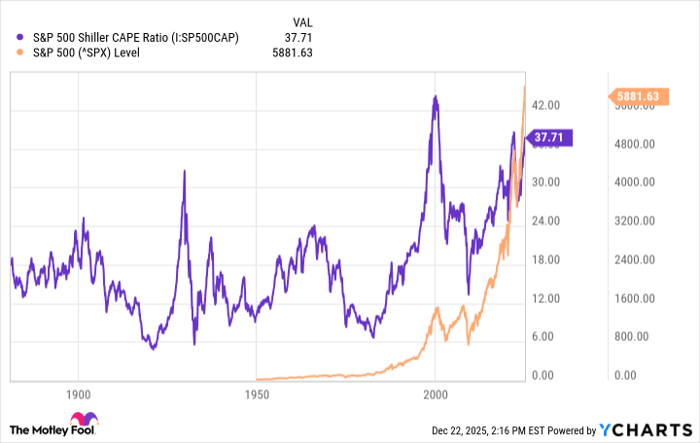

At the end of 2024, the S&P 500 Shiller CAPE ratio hovered around 37. The CAPE ratio is a useful tool because it measures inflation-adjusted earnings over a period of 10 years relative to the current level of stock prices.

As the trends in the chart below make clear, the CAPE ratio had only reached near this level twice before -- the end of the 1920s, and in the year 2000. In both cases, the stock market experienced pronounced corrections after the CAPE ratio peaked -- during the Great Depression and the bursting of the dot-com bubble.

S&P 500 Shiller CAPE Ratio data by YCharts.

My thinking is that Buffett may have viewed the market as unsustainably frothy, as the S&P 500 has been propped up by a small cohort of mega-cap stocks -- most of which have benefited from the rise of artificial intelligence (AI).

What's ironic is that the S&P 500 is on pace for its third straight year of double-digit gains in 2025. Once again, technology stocks have ushered in a prolonged period of bullish momentum. Does this mean Buffett's decision to sell the S&P 500 ETFs was ill-timed? Not necessarily.

Buffett is a prudent investor and is always looking for a good deal. In my eyes, Buffett simply didn't see any attractively valued stocks at the time he sold out of the Vanguard and SPDR ETFs. This may be what influenced Berkshire to collect some gains and earn easy passive income through interest on Treasury bills and a growing stockpile of cash.

The CAPE ratio is now closer to 40 -- higher than it was at the end of last year. While this would suggest that the market is becoming even more heated, and thereby lending validation to the idea of a correction on the horizon, the chart above makes one thing abundantly clear. Whether you invested in the S&P 500 during all-time highs or decided to buy the dip during bear markets, long-term trends show that investing in the index has been a profitable decision overall, as Buffett has long suggested.

For this reason, I do not think investors necessarily need to follow Buffett's moves to a "t." Furthermore, given the robust long-run average returns across the S&P 500, I see no reason to panic going into 2026 -- despite the markets roaring even higher.

Should you buy stock in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $504,994!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,156,218!*

Now, it’s worth noting Stock Advisor’s total average return is 986% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 25, 2025.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.