This High-Growth Energy Stock Is Up 400% in 2025. Here's 1 Key Reason Why Its Power Solution Is Winning.

Key Points

Bloom Energy produces solid oxide fuel systems for on-site power.

Bloom inked a $5 billion strategic partnership with Brookfield.

The company has seen four straight quarters of increased sales.

- 10 stocks we like better than Bloom Energy ›

Bloom Energy (NYSE: BE) is on the frontlines of a potentially disruptive technology in the energy sector: solid oxide fuel cell systems, or "energy servers," as Bloom names them.

These fuel cells turn fuel, like natural gas and hydrogen, into electricity without combustion. As such, they emit fewer emissions than traditional grid generators and can provide around-the-clock power to data centers, hospitals, utilities, industrial plants, and other facilities needing reliable power.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Bloom Energy's fuel cells at a cafe. Photo source: Bloom Energy.

Ever since Bloom went public in 2018, investors have seen potential in its energy technology, especially its capacity to turn hydrogen into electricity with zero carbon emissions. The stock, however, has only recently taken off, skyrocketing over 400% this year.

The reason isn't just that Bloom has potential; it's that Bloom is finally converting its potential into serious kinetic energy.

Why Bloom's power solution is winning

Bloom's solid oxide fuel cells are fast to deploy, scalable, and designed for 24/7 power generation. Those traits are essential to one of the company's biggest opportunities: AI data centers. As CEO K.R. Sridhar put it recently: "Bloom is at the center of a once-in-a generation opportunity to redefine how power is generated and delivered."

That opportunity was on full display this quarter. In October, Bloom inked a $5 billion strategic partnership with Brookfield to build more advanced AI factories. Brookfield wants to combine its industrial know-how with Bloom's fuel cells to build an AI infrastructure capable of powering advanced models.

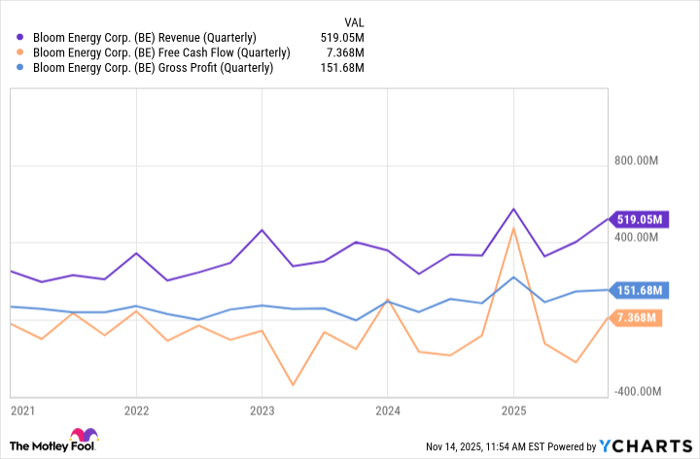

The company's momentum has been showing up in top-line growth. Its third-quarter revenue, for example, hit a record $519 million, up 57% from last year. This marks its fourth straight quarter of record sales.

BE Revenue (Quarterly) data by YCharts

As AI computing continues to ramp up, more and more companies will likely need the on-site power that Bloom can provide. Its margins are improving, and cash flow looks like it's heading in the right direction. For investors who are already betting on the future of AI, few energy stocks are as complementary to that vision as this one.

Should you invest $1,000 in Bloom Energy right now?

Before you buy stock in Bloom Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bloom Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Steven Porrello has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.