2 Outstanding Dividend Stocks That Are Too Cheap to Ignore

Key Points

Both stocks trade at once-in-a-decade low valuations and have all-time high dividend yields.

Each company leads in its niche, but both are battling through minor challenges.

Despite rocky results recently, these two stocks are the epitome of Steady Eddie operators.

- 10 stocks we like better than Zoetis ›

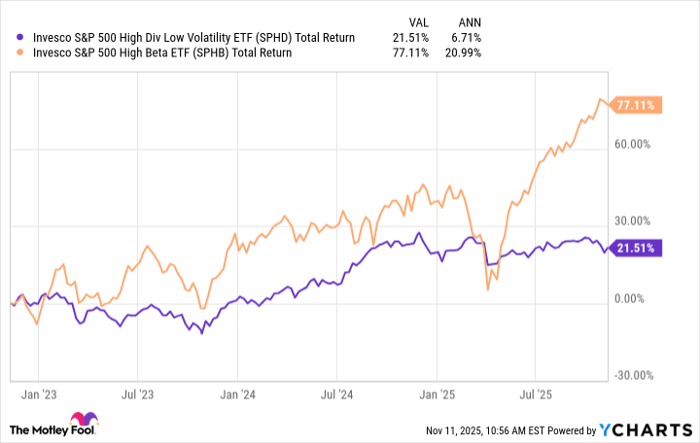

The chasm between higher-volatility growth stocks and low-beta dividend stocks continues to grow wider by the day. Consider the following chart that shows the total returns of these groups of stocks over the last three years. This divergence leaves many dividend stocks trading at rather attractive valuations despite growth stocks pushing the market to new all-time highs.

Here are two dividend stocks that have seemingly been left behind but are now simply too cheap to ignore as leaders in their respective niches.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

SPHD and SPHB Total Return Levels data by YCharts.

Zoetis: Too cheap to ignore at a once-in-a-decade valuation

Zoetis (NYSE: ZTS) creates medicines, vaccines, diagnostics, and other animal health solutions and is home to 17 blockbuster products that generate over $100 million annually. Powered by these offerings, the company is the global leader in animal healthcare, holding the No. 1 spot in sales for the companion animal, cattle, and fish species.

However, despite being the leading provider of healthcare solutions across both the pets and livestock markets, Zoetis has lost half its market value since 2022.

The company struggled to lap a pandemic-aided boost that saw pet adoptions boom, which spurred a rise in vet visits. Now, the company has whiffed on multiple earnings reports over recent quarters, and its promising new monoclonal antibody (mAbs) drugs for osteoarthritis (OA) pain in dogs and cats have largely disappointed.

However, with Zoetis shares now trading at just 20 times earnings -- by far its lowest-ever level -- the company deserves a long look from dividend investors. First, the company's innovation engine remains as strong as ever. To this point, while its Librela and Solensia osteoarthritis drugs have disappointed so far, Zoetis has already created longer-lasting versions of these mAbs, which would reduce injections from monthly to quarterly.

Continuously producing next-generation upgrades like this is what Zoetis has built a lengthy track record of success upon. Visiting a vet four times a year is a much easier pill to swallow than making a monthly visit, so the pending release of these new mAbs could help the company more effectively treat OA in cats and dogs.

Image source: Getty Images.

Second, the company's livestock unit acts as a nice counterbalance to Zoetis' companion animal operations. While both segments are arguably non-discretionary thanks to how much pet owners love their furry friends, maintaining a healthy livestock may be even more essential spending. With protein demand only projected to rise over the foreseeable future, the company's vaccines and medicines should remain essential for years to come.

Lastly, despite its substandard earnings recently, Zoetis' profitability and cash returns to shareholders remain elite. The company still maintains a return on invested capital (ROIC) of 22%, meaning that it successfully generates outsize profits from its new products. Stocks with high ROICs like this have a history of beating the market, as this article suggests.

Armed with these profits, Zoetis has grown its dividend by 19% annually over the last decade -- all while buying back shares and lowering its share count by 1% each year. With its 1.7% dividend yield at an all-time high -- and only using 34% of the company's net income -- Zoetis looks like a perfect "buy-the-dip" candidate today for dividend investors.

If Zoetis is cheap, Nomad Foods is ubercheap

Nomad Foods (NYSE: NOMD) is the leading frozen foods provider in Europe, particularly in the protein and vegetables categories. Generating two-thirds of its sales from meat and vegetable staples, Nomad is No. 1 in brand awareness, preferences, and brand equity in 12 of the 15 countries where it sells.

Despite its leadership position, Nomad stock has plummeted 62% from its all-time high in 2021, leaving it to trade at its lowest ever ratio of enterprise value to earnings before interest, taxes, depreciation, and amortization (EBITDA) of 7.

This deeply discounted valuation and the company's struggling share price have the business priced as though it is slowly going out of business, rather than valued as a leader in its industry. That said, Nomad saw sales and adjusted earnings decline by 2% and 11% in its latest quarter as unusual weather disrupted the frozen food category's typically steady growth.

While I really (really) don't like companies blaming weather for sales declines, the fact that it was an industrywide problem for the frozen food market (rather than a Nomad-specific problem) lends some credence to this notion. It shouldn't be a long-term problem.

If anything, Nomad's focus on meat and vegetables in the frozen food category should be a long-term tailwind for the company as healthier food options continue to grow in importance and popularity across the globe. With its growth products, such as new chicken offerings and protein bowls, jumping 34% in the last quarter, the company is proving capable of adjusting to customers' preferences.

Despite these simple innovations, Nomad's Steady Eddie nature, and management's expectations for free cash flow to grow by 15% annually through 2028, the market is pricing the stock like it is going bankrupt.

Speaking to this divergence between Nomad's share price and its solid operations, Franklin Martin, the company's co-founder and co-chairman, explained: "Because of this dislocation, we have been prioritizing share repurchases as the primary use of Nomad's cash flow after dividends are paid. This will remain our priority for capital allocation as long as our stock remains so undervalued."

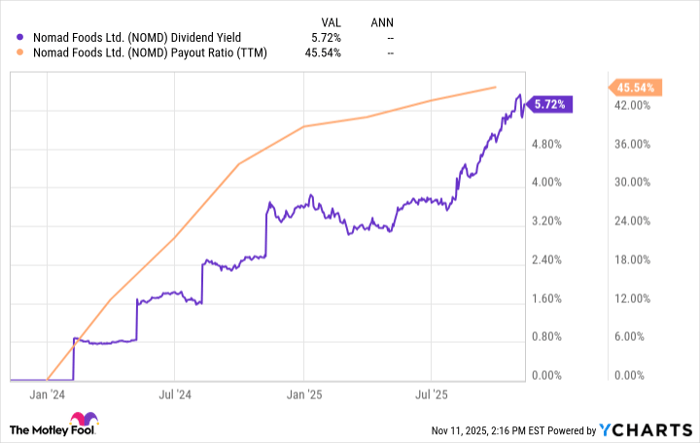

Management has already reduced its share count by 4% annually over the last five years and sounds determined to continue doing so. Furthermore, the company has started paying a new dividend that already yields 5.7%, but only uses 46% of Nomad's net income.

NOMD Dividend Yield and Payout Ratio data by YCharts.

With Chief Financial Officer Ruben Baldew also announcing that he was personally buying $1 million worth of shares in Nomad during the latest earnings call, the company looks like a deeply discounted buy. Any time management not only repurchases shares as a company but also buys shares for themselves, it should catch investors' attention.

Should you invest $1,000 in Zoetis right now?

Before you buy stock in Zoetis, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zoetis wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Josh Kohn-Lindquist has positions in Nomad Foods and Zoetis. The Motley Fool has positions in and recommends Zoetis. The Motley Fool has a disclosure policy.