Down 63%, Should You Buy the Dip on The Trade Desk Stock?

Key Points

The Trade Desk delivered better-than-expected results, but may be losing ground in programmatic advertising.

The stock trades at a premium valuation even after the substantial pullback it has experienced this year.

A potential slowdown in The Trade Desk's growth doesn't bode well for the stock's future.

- 10 stocks we like better than The Trade Desk ›

The Trade Desk (NASDAQ: TTD) stock has taken a big beating on the market in 2025, losing 63% of its value as of this writing. This sharp drop witnessed by the programmatic advertising provider has been fueled by a slowdown in its growth rate, concerns about rising competition from the likes of Amazon, and an expensive valuation.

However, the company did deliver some good news for investors with a better-than-expected showing in the third quarter of 2025. The Trade Desk released its Q3 results on Nov. 6. Its numbers and guidance both exceeded expectations. Does this suggest a potential turnaround for the stock's fortunes? Let's find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The Trade Desk is growing at a decent pace, but it needs to do better

The Trade Desk's Q3 revenue increased 18% year over year to $739 million. The company's non-GAAP earnings, however, increased at a much slower pace of 10% to $0.45 per share. These numbers aren't promising for a stock that is trading at 61 times trailing earnings.

Of course, The Trade Desk is trading at a significantly cheaper earnings multiple right now than it was at the beginning of the year, but it is still well above the tech-laden Nasdaq-100 index's price-to-earnings (P/E) multiple of 34. The Trade Desk's adjusted earnings have increased by just 10% in the first nine months of 2025. So, the premium valuation that the company is carrying even after its substantial pullback doesn't seem justified.

Meanwhile, the company's revenue guidance of $840 million for the current quarter is better than the $830 million consensus estimate. But the problem is that it points toward an estimated jump of just 13% from the year-ago quarter. So, the Trade Desk's growth rate is set to drop further, and that isn't good news for investors, considering its rich valuation.

The Trade Desk's slowing growth suggests that it may be losing ground in the fast-growing programmatic advertising market where bigger players such as Amazon have been making big moves of late. According to Grand View Research, the programmatic advertising space could clock 23% in annual growth through 2030.

The Trade Desk, therefore, is now growing at a slower pace than the industry in which it operates. That suggests a potential loss of market share, which isn't surprising considering the companies it is competing against.

The competition is turning out to be the company's Achilles' Heel

The Trade Desk's cloud-based programmatic ad platform helps marketers and brands purchase ad inventory and reach their audience using real-time data across different platforms such as video, audio, connected television (TV), and others. Its artificial intelligence (AI)-driven ad platform analyzes 13 million impressions each second "to help advertisers buy the right ad impressions, at the right price, to reach the target audience at the best time."

However, the advent of a well-heeled rival in the form of Amazon into the connected TV advertising space seems to have knocked the wind out of The Trade Desk's sails. Though management insists that Amazon isn't a direct competitor in the programmatic ad market, as the e-commerce giant prioritizes its own inventory, the recent moves made by Amazon suggest that it is becoming a bigger player in this space.

Amazon has struck deals with Walt Disney and Netflix in recent months to enable purchasing programmatic ad inventory on ESPN, Hulu, Disney+, and Netflix. The tech giant has started integrating its programmatic ad platform with Disney and Netflix's content platforms, and that may be one of the reasons why The Trade Desk's growth is taking a hit.

Moreover, The Trade Desk management remarked on the latest earnings call that as supply is "significantly outstripping demand in our industry, our clients can be very deliberate in which ad impression they select." So, it seems that The Trade Desk is having difficulty attracting advertisers to its platform.

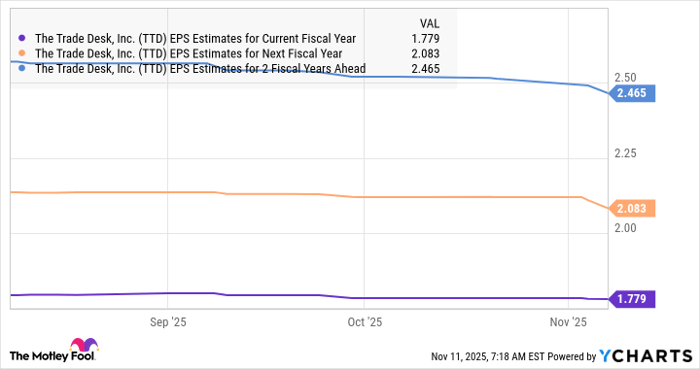

TTD EPS Estimates for Current Fiscal Year data by YCharts.

As such, it is easy to see why The Trade Desk's earnings growth isn't expected to pick up enough momentum over the next couple of years to justify the expensive valuation it commands.

That's why it would be a good idea for investors to stay on the sidelines as this tech stock could drop further even after the significant slide in its stock price this year thanks to the headwinds discussed above.

Should you invest $1,000 in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $622,466!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,426!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Netflix, The Trade Desk, and Walt Disney. The Motley Fool has a disclosure policy.