Is SoundHound a Millionaire-Maker Stock?

Key Points

SoundHound AI is seeing widespread adoption.

The stock would need to transform into a large software company to achieve this feat.

- 10 stocks we like better than SoundHound AI ›

SoundHound AI (NASDAQ: SOUN) hasn't been the best stock pick in 2025. At the start of the year, it was coming off an impressive run to end 2024, and the stock heavily sold off. It rallied throughout the year, although it has been a victim of heavy sell-offs again as investors fear an AI bubble forming. The stock is down about 30% from its high set just a few weeks ago, but is this dip a buying opportunity?

The runway for SoundHound AI's platform looks enormous, and the results look promising, with some speculating that SoundHound AI could be your ticket to becoming a millionaire.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

SoundHound AI is seeing success in multiple industries

SoundHound AI is doing what many companies before it have already done: combine artificial intelligence with audio recognition. This has been available for multiple years through digital assistants like Siri and Alexa, but those products often leave users frustrated by their performance. SoundHound AI's platform is far more impressive and can outperform human counterparts in applications like drive-thru orders.

While restaurant or order processing is an important sector for SoundHound AI to capture, it also has several other exciting areas in which it's acquiring clients. SoundHound AI is attempting to replace human-to-human interactions in areas where face-to-face communication isn't possible. This includes insurance, healthcare claims, and financial services. All of these are massive areas where companies spend billions of dollars annually on customer service representatives. If SoundHound AI can replace those agents effectively by deploying generative AI-powered ones instead, it could be one of the most successful investments of the AI arms race.

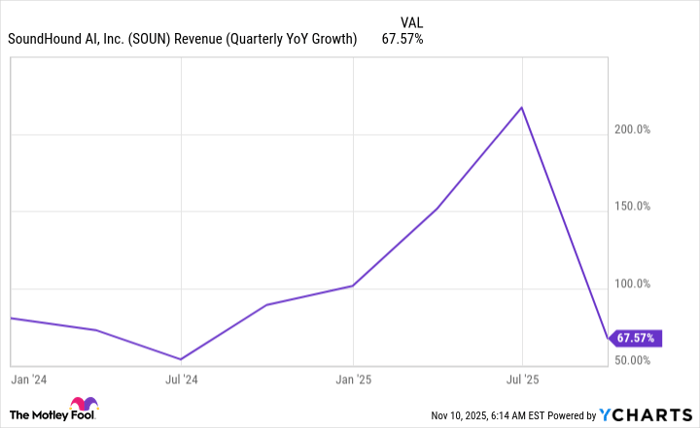

SoundHound AI is seeing that success already, with Q3's revenue rising 68% year over year to $42 million. However, some investors were disappointed because that's a slowdown from previous growth rates.

SOUN Revenue (Quarterly YoY Growth) data by YCharts

However, that's not fair to SoundHound AI, as that spike in growth over the past few months is due to the acquisition of a few companies. Acquisitions boost growth rates because their revenue didn't exist in the previous comparison quarters. Instead, investors should be focusing on organic growth rates. Organic growth rates strip out acquired business revenue, leaving true growth. While SoundHound AI didn't report that exact figure, it has noted in previous conference calls that it expects its organic growth rate to top 50% for the "foreseeable" future.

That's impressive and shows why SoundHound AI could become a millionaire-maker stock. But when could investors expect something like that to happen?

100 baggers don't happen overnight

To determine if SoundHound AI could be a millionaire-maker stock, we need to set a returns threshold. If you invested $999,000 into the stock, then a slight move up could make you a millionaire. What investors are really looking for is a stock that will provide life-changing returns. I think using 100x returns is a fair starting point, as it would turn $10,000 into $1 million.

Currently, SoundHound AI has a market cap of $5.9 billion. So if it delivered 100x returns, it would be worth nearly $600 billion. That's about the size of Visa or Oracle.

However, this phenomenon won't happen overnight, and larger companies are starting to become more and more common, so it's more reasonable to look at companies a third of that size. Several software companies fall into this range so that it wouldn't be in uncharted territory.

Still, SoundHound AI would need its product to become the go-to audio-to-AI platform and have performance that delivers excellent results. A factor that SoundHound AI cannot control is consumer reception, as it's possible that it could have a great product. But if consumers don't accept it, it forces SoundHound AI's clients to pivot back to a human strategy.

Time will tell what happens, but I'd be surprised if SoundHound AI can deliver the growth necessary for a 100x return. Still, if it becomes widely adopted and used, it can deliver excellent returns over a long time frame, although at an increased risk compared to some AI stocks.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,230!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,187,967!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Visa. The Motley Fool has positions in and recommends Oracle and Visa. The Motley Fool has a disclosure policy.