Where Will Amazon Stock Be in 3 Years?

Key Points

Amazon's advertising business is helping to drive its e-commerce growth.

Additionally, Amazon Web Services (AWS) experienced an excellent quarter.

Overall, Amazon is showing that it's still a force to be reckoned with today.

- 10 stocks we like better than Amazon ›

Amazon (NASDAQ: AMZN) has been an up-and-down investment. Depending on the time frame, it may not have been as successful as many investors had hoped. Over the past five years, Amazon has dramatically underperformed the S&P 500. The index is up about 90%, while Amazon's stock is up nearly 50%. That's horrible underperformance, and plenty of other stocks would have delivered superior returns.

If you flip the timeframe to begin in 2023, when the AI megatrend began, Amazon's stock is up an incredible 190% versus the S&P 500's 75% rise. That's a huge difference, and with its recent outperformance, it may indicate that Amazon could be slated to underperform the market moving forward after a few years of incredible success.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

So, where will Amazon stock be in three years? Let's find out.

Image source: Getty Images.

Amazon is split into two primary business segments

Most investors are familiar with Amazon's core business. You'd be hard pressed to find someone who hasn't purchased something from Amazon, or isn't a Prime member. The service is incredibly useful, and Amazon is a primary reason why the U.S. has a thriving e-commerce market.

However, these aren't the fastest-growing business units. During Q3, Amazon's online stores grew at a 10% pace while third-party seller services grew revenue at a 12% pace. Those are the best results those divisions have posted in several quarters, as these units were consistently posting high single-digit growth over the past few years.

Amazon's commerce growth has come from an ancillary business that has emerged onto the scene in a big way: advertising. Amazon's advertising business is massive and growing because it sits on a goldmine of data. Because customers come to Amazon's website to buy an item, Amazon has fantastic data for properly marketing to a particular consumer. This information is vital for companies looking to diversify their products, and it has become a lucrative business for Amazon.

Additionally, Amazon Web Services (AWS) experienced an excellent quarter. AWS is Amazon's cloud computing wing, and it's benefiting from two tailwinds. Cloud computing is a key beneficiary of the artificial intelligence revolution, as multiple companies don't have the capabilities to build a massive data center for their AI aspirations. Furthermore, many businesses are transferring their workloads from on-premise to the cloud, boosting AWS in an unrelated way.

With AWS's revenue reaccelerating to 20% growth after being stuck at a growth rate in the high-teens range for a few quarters, this is a huge deal. AWS's Q3 showcases that it's still a go-to option in the cloud computing realm, making investors more bullish on the stock. But where does all that place Amazon three years from now?

Amazon's present is setting up future success

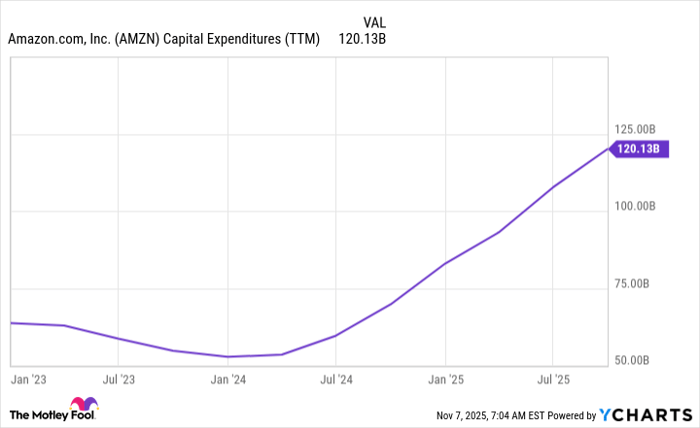

Amazon's primary growth divisions, AWS and advertising, are capitalizing on multi-year growth trends, and their revenue should continue to increase rapidly over the next few years. However, one item that will continue to be a drag on Amazon's results is its massive capital expenditures. Just like all of the other AI hyperscalers, Amazon is spending a ton on AI computing capacity, which is absorbing almost all of its cash flows.

While Amazon has spent a ton on capital expenditures over the past 12 months, it also expects that this figure will expand during 2026.

AMZN Capital Expenditures (TTM) data by YCharts

That worries some investors, but the demand is clearly there for computing, as AWS's revenue continues to soar. I could see this being a concern if growth was slowing, but with it reaccelerating, Amazon is making the right move.

Amazon is growing its revenue at an above-average pace, and this is combined with high-margin divisions (AWS and advertising) growing at a faster rate than the rest of the company. I think this combination makes Amazon a compelling stock pick over the next three years. It's one of the best AI hyperscaler stocks to buy today, and investors can still get in at a reasonable price point because Amazon has actually underperformed the S&P 500 this year.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,230!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,187,967!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.