Gold Prices Soar — So Why Is the World’s Largest Gold Miner Cutting Jobs?

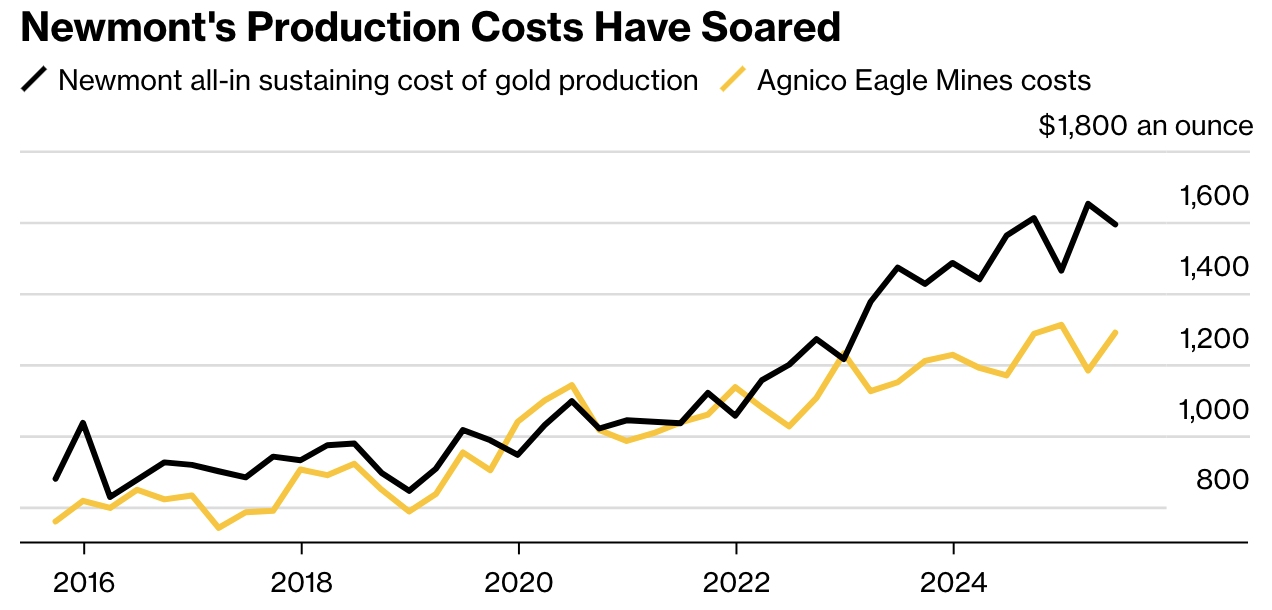

TradingKey - Despite gold prices hitting record highs, Newmont Corporation (NEM.US), the world’s largest gold miner, is under severe cost pressure and is now planning large-scale layoffs to reduce expenses. According to Bloomberg, the company has launched a comprehensive cost review with the goal of cutting its All-In Sustaining Costs (AISC) by as much as $300 per ounce — a reduction of about 20%.

[Source: Bloomberg]

In 2023, Newmont acquired Newcrest Mining for $15 billion, expanding its portfolio to around 20 mines and entering the copper mining business. While the deal significantly increased its scale, it also brought substantial cost burdens. In Q1 2025, Newmont’s AISC surged to a record high of $1,651 per ounce. Although it dipped to $1,593 in Q2, it still remains nearly 25% higher than low-cost peers like Agnico Eagle.

The high costs are largely attributed to assets inherited from Newcrest, including the Lihir mine in Papua New Guinea and the Cadia mine in Australia. These operations are in challenging phases of their lifecycle, requiring continuous capital investment. Analysts note that years of underinvestment have led to deteriorating infrastructure and persistently high operating costs.

Even though gold prices briefly surpassed $3,500 per ounce in April — sending Newmont’s stock up nearly 95% year-to-date — rising energy, labor, and material costs have eroded much of that margin. The company expects costs to remain elevated in the second half of the year.

A Newmont spokesperson confirmed the company is advancing the cost and productivity improvement plan announced in 2024, with organizational restructuring as a key component. Over the past few weeks, executives have held discussions with departments across the business about potential job cuts and the elimination of long-term incentive programs — though final decisions have not yet been made.

This cost-cutting drive, unfolding against a backdrop of record-high gold prices, underscores the immense challenges mining giants face in integrating large acquisitions and achieving operational efficiency. For Newmont, the path to profitability is no longer just about high gold prices — it’s about survival through discipline and transformation.