Today’s Market Recap: Tech Rally Lifts Wall Street as S&P 500 Nears All-Time High

Track the Market Trend

TradingKey - On February 9, 2026, U.S. equities extended recent gains. The S&P 500 climbed 0.45% to end Monday’s session at 6,964, while the Nasdaq Composite advanced 0.90% to 23,239, supported by continued strength in technology and software-related shares.

In the infrastructure-focused software industry, Microsoft (MSFT) gained 3.13% to close at $413.71, and SAP (SAP) rose 3.48% to finish at $210.41, reflecting widespread momentum across large-cap enterprise software providers.

Oracle (ORCL) surged 9.66% to settle at $156.61, following an upgrade from D.A. Davidson, which raised the stock to Buy and increased its price target. Renewed investor interest in Oracle’s positioning within AI and cloud markets further contributed to the rally.

Hims & Hers Health (HIMS), a direct-to-consumer telehealth company, fell 16.03% to end the day at $19.33. The sharp decline followed news of a lawsuit filed by Novo Nordisk (NVO), adding to Friday’s regulatory concerns over the use of unapproved medical compounds.

TeraWulf (WULF), which operates bitcoin mining assets with a focus on renewable energy and AI infrastructure, jumped 16.52% to $16.65. The stock soared after Morgan Stanley initiated coverage with an Overweight rating and a $37 price target, citing the company’s favorable position in scalable AI data centers and clean-energy-powered infrastructure capacity.

After Sanae Takaichi secured her electoral win, Japanese authorities issued a warning that they would be closely watching currency fluctuations. The yen snapped a six-day losing streak, climbing over 1% after falling to its lowest intraday level in two weeks.

Gold (XAUUSD) prices also saw a notable rebound, rising more than 2% during the session and briefly climbing back above the $5,000 threshold.

Market Headline

Novo Nordisk faces regulatory backlash over Wegovy advertising claims. Shares of Novo Nordisk slid intraday after the U.S. FDA criticized an advertisement for the weight-loss drug Wegovy as “false or misleading.” The agency stated that the promo exaggerated the effectiveness of the oral GLP-1 therapy by implying it was superior to other drugs in its class, and presented it as addressing broad lifestyle issues without adequate scientific backing. The Danish pharmaceutical giant’s U.S.-listed stock, which had earlier climbed over 7%, ended the session with less than a 3% gain following the FDA’s warning.

Alphabet taps global markets with record-breaking multi-currency bond issuance. Alphabet raised $20 billion in a U.S. dollar debt offering, surpassing its original $15 billion goal, and broke new ground by issuing a 100-year sterling bond—the first by a tech firm in nearly three decades. The offering comes amid surging AI investment needs, with tech giants projected to spend over $650 billion this year on AI infrastructure. Alphabet plans to use the proceeds for long-term capital expenditures tied to AI development. This also marks the company’s debut bond issuance in the Swiss and UK markets, reflecting its push for broader global funding channels.

EU intensifies antitrust scrutiny with new Meta (META) investigation over WhatsApp API access. The European Union is preparing an antitrust lawsuit against Meta Platforms, accusing the company of using WhatsApp's dominant position to restrict third-party competitors—particularly those developing AI tools. According to regulators, Meta blocked access to its messaging API, preventing rivals from offering integrated services. The EU is seeking emergency interim measures to compel open access while the case proceeds. Meta has denied the allegations, calling the proposed enforcement both unsubstantiated and disproportionate. The case reaffirms the EU's determination to establish AI-era antitrust frameworks that prevent tech incumbents from abusing platform power.

SpaceX shifts lunar ambitions into focus as Musk postpones Mars goal. Elon Musk has revised the company’s timeline, shifting attention from colonizing Mars to establishing a permanent base on the Moon. Once critical of lunar missions—calling them "distractions"—Musk now envisions a city on the Moon within 10 years, citing its feasibility and closer proximity. He estimates reaching Mars will take at least two more decades. The pivot marks a practical reassessment of SpaceX’s strategic roadmap, with renewed focus on near-term lunar construction and robotic infrastructure deployment by 2027.

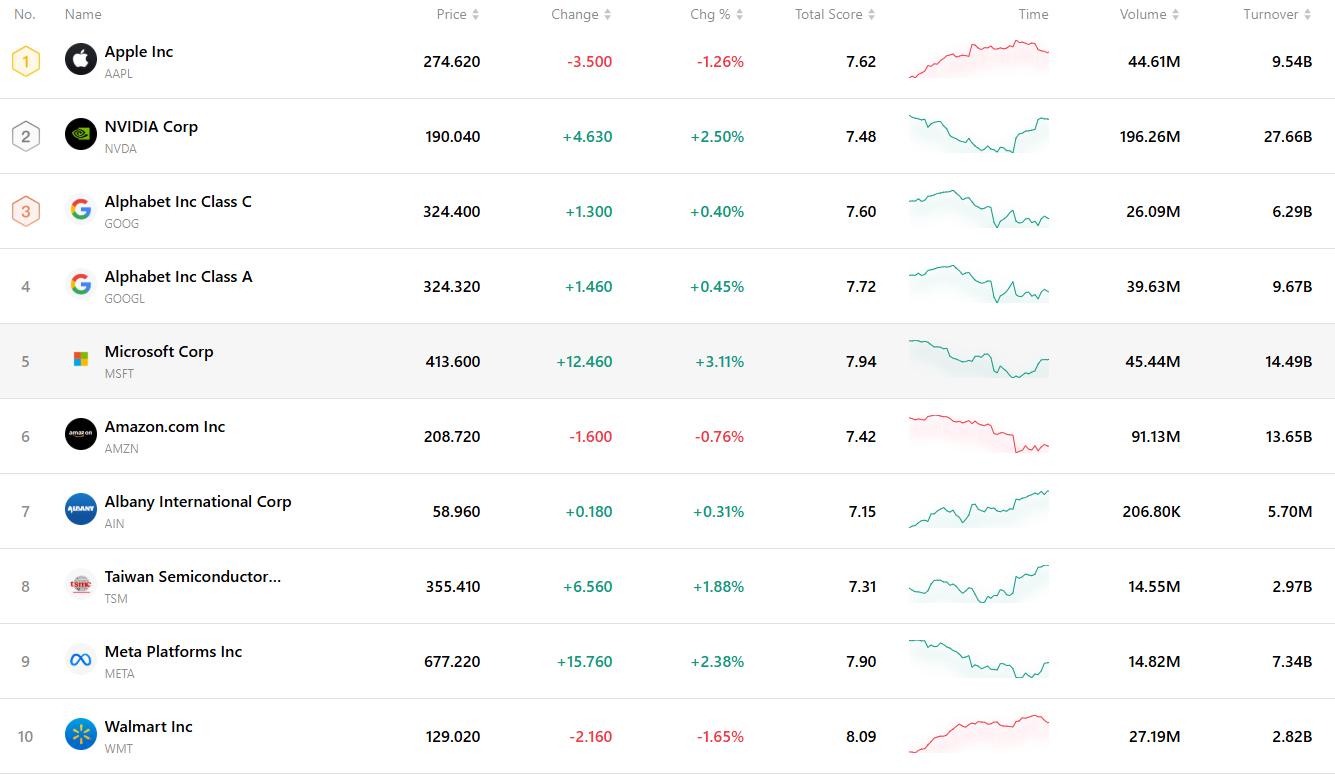

Top 10 Most Traded Stocks

The chart below highlights the ten most actively traded stocks in the current market. With their substantial trading volumes and high liquidity, these names serve as key benchmarks for tracking global market dynamics.