Trump's $3.3 trillion 'Big Beautiful Bill' could propel Bitcoin past $120,000 by July end

- Bitcoin's brief surge above $110,000 last week highlights strong macroeconomic tailwinds.

- Bitget Research Chief Analyst Ryan Lee points to President Trump's tax bill as a key catalyst for Bitcoin's price rally.

- A potential increase in money supply, record US equities performance, and expansive fiscal policy could push Bitcoin to $120,000 by the end of July.

Bitcoin (BTC) is consolidating above $108,000 on Tuesday following a brief but strong rally last week that topped resistance at around $110,527. Despite the largest cryptocurrency by market capitalization trading near all-time highs, overall market activity and trading volume remain subdued.

This slowdown can be attributed to low retail interest and uncertainty surrounding the United States' (US) tariff policy developments. On Monday, President Donald Trump placed new tariffs on 14 countries, starting August 1.

Beyond the macroeconomic uncertainty, the focus has quickly shifted to the One Big Beautiful Bill Act (OBBBA), which President Trump signed on July 4. The bill introduces major tax reforms that could trigger an increase in the federal deficit by $3 to $4 trillion, according to the K33 Research report, which is released every Tuesday.

Experts weighing in on the OBBBA believe that it could have a positive impact on Bitcoin. Bitget Research Chief Analyst Ryan Lee predicts that macroeconomic tailwinds could boost the BTC price to $120,000 by the end of July on the backdrop of record US equities performance, a potential increase in money supply, and expansive fiscal policy.

Bitcoin could rally toward $120,000 by July-end, says Bitget Research Chief Analyst Ryan Lee

To gain a holistic perspective on the impact of the One Big Beautiful Bill Act, FXStreet reached out for exclusive comments from Bitget, the third-largest cryptocurrency exchange, with a 24-hour trading volume of approximately $2.1 trillion, according to CoinGecko.

US fiscal spending has continued to boost corporate profits and personal income despite the ongoing debt ceiling debate. The labor market remains steady amid what appears to be tamed inflation.

Meanwhile, Bitget Research Chief Analyst Ryan Lee predicts a significant increase in Bitcoin's price, augmented by expectations of progressive monetary expansion.

"Given these conditions, Bitcoin is well-positioned to break its previous high in July, with upside potential toward $120,000 by month-end. Institutional demand and consistent spot Exchange Traded Fund (ETF) inflows continue to reinforce bullish momentum," Lee told FXStreet.

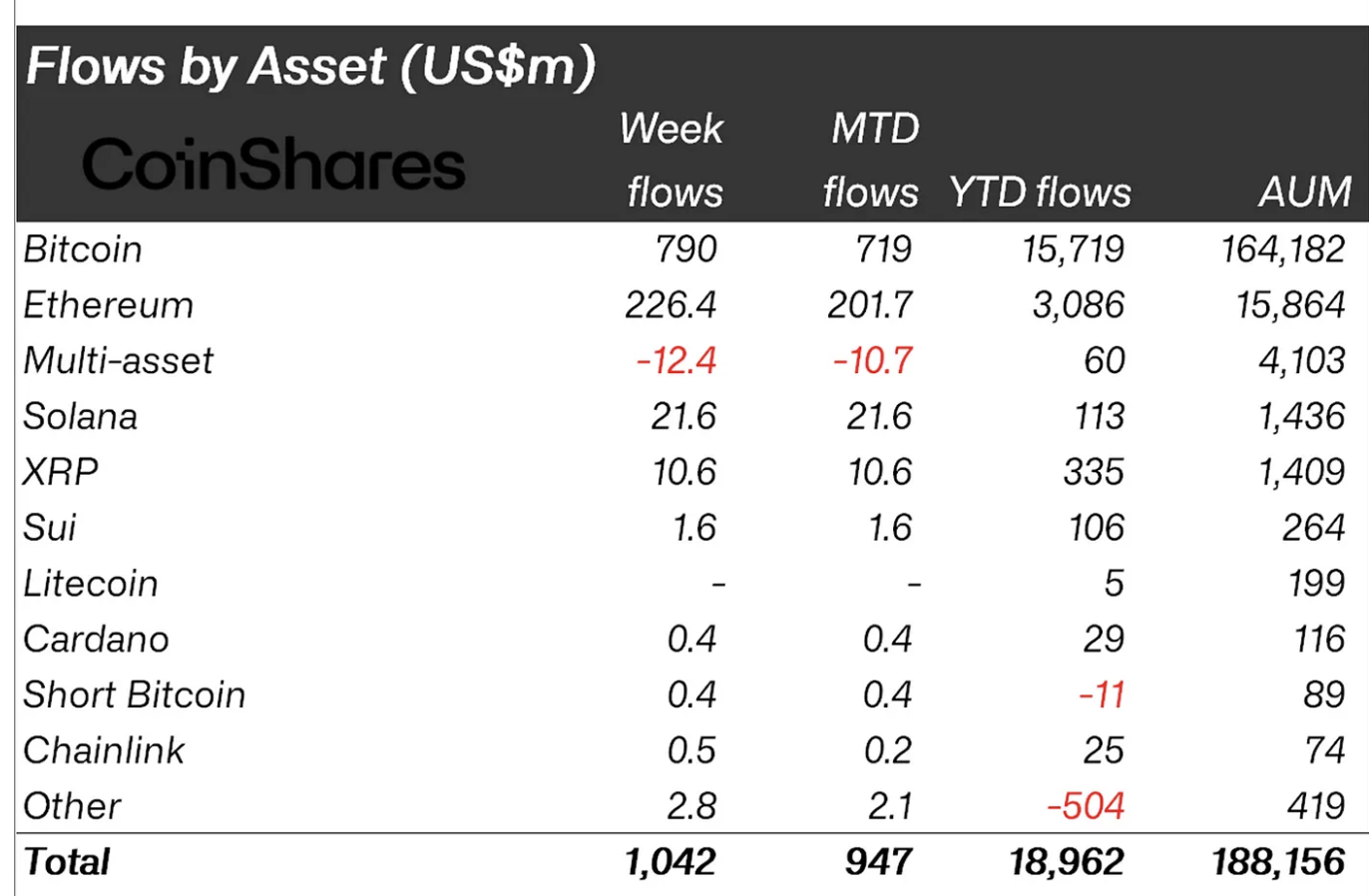

CoinShares reported on Monday that inflows into BTC-related digital investment products averaged $790 million last week. The cumulative inflows totaled approximately $1.03 billion, which accelerated the assets under management to $188 billion.

The majority of inflows originated from the US at $1 billion, with Canada and Brazil recording outflows.

"Bitcoin investment products saw inflows of US$790m last week, marking a slowdown from the previous three weeks, which averaged US$1.5bn. The moderation in inflows suggests that investors are becoming more cautious as Bitcoin approaches its all-time high price levels," the CoinShare report states.

Digital investment products stats | Source: CoinShares

When asked about the impact of the One Big Beautiful Bill Act, projected by the Congressional Budget Office to add $3.3 trillion to the US deficit over the next decade, Bitget's COO, Vugar Usi Zade, told FXStreet the key element is the potential excess capital in circulation that is likely to emanate from unmonitored money printing.

"The United States is already in significant debt, currently pegged at $36.21 trillion, a figure that has prompted investors to diversify their capital into other assets, such as Bitcoin and Ethereum," Zade stated. "The 'One Big Beautiful Bill' will potentially increase this debt ceiling, a move justified by proponents as a means to help the government function better. However, for the financial market, it will result in US Dollar (USD) devaluation, presenting a major adoption case for Bitcoin, Ethereum, and other risk assets," the COO added.

Regarding the impact of the implementation of higher tariffs and the extension of the deadline to August 1, Zade noted that the associated liquidity is not new to the crypto market. He argues that Bitcoin has been dealing with tariff uncertainty since the start of President Donald Trump's second term and that the cryptocurrency market is gradually pricing in the perceived volatility, "with each deadline resulting in short-term price suppression."

"There is no doubt the market will face fluctuations ahead of the new August deadline, but the overall impact may not last so long. It is also worth noting that the current trade scene is no longer one that comes with much negative pressure," Zade explained.

On the other hand, President Trump has requested that Congress fast-track the passage of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) bill, preferably before the recess expected in early August. The legislation, if signed into law, would boost clarity in the stablecoin arena, paving the way for institutional adoption in the broader digital currency environment.

"While its (GENIUS Act) influence will pale in comparison to the EU's MiCA, which has a broader scope, issuers will nonetheless have a clear framework for engagement," Zade commented.

Stablecoins enable investors to easily inject liquidity into the crypto market by stacking Bitcoin and other altcoins, such as Ethereum. Zade said that these stable digital coins serve as a conduit for liquidity into crypto assets, as they are essentially equivalent to holding the US Dollar (USD).

"Should the legislation pass as intended, it may attract more institutional investors, as they are generally drawn to sectors with some form of regulatory clarity," Zade added.

Technical outlook: Bitcoin eyes near-term breakout

Bitcoin's price is extending intraday gains, printing a green candle and trading at $108,712 at the time of writing. The price remains above a recently broken descending trendline, which has been in place since Bitcoin reached its all-time high of $111,954 on May 22.

BTC/USDT daily chart

There's potential for a breakout above resistance tested at around $110,527 on Monday, backed by a robust technical structure. The upward-trending moving averages, including the 50-day Exponential Moving Average (EMA) at $105,274 and the 100-day EMA at $101,507, underscore the strong technical picture. In the event of a trend reversal, these levels could serve as tentative support, limiting price movement below the $100,000 level.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.