Will Tron (TRX) Reach an All-Time High This Cycle Amid IPO Rumors?

Tron (TRX) is gaining momentum as the network prepares to go public via a $210 million reverse merger with SRM Entertainment on Nasdaq. The move has pushed TRX up 10% and positioned Tron Inc. to follow a MicroStrategy-style model by holding large amounts of TRX on its balance sheet.

At the same time, Tron is dominating stablecoin flows, with $694.5 billion in USDT transfers during May and $55.7 million in monthly revenue—ranking just behind Tether and Circle. With political backing, strong fundamentals, and rising institutional interest, TRX could be poised for this cycle’s major breakout.

Tron to Go Public in $210 Million Merger as TRX Surges 10%

Tron is set to go public in the U.S. via a $210 million reverse merger with SRM Entertainment on Nasdaq, pushing TRX up 10% to $0.29.

The newly formed company, Tron Inc., will adopt a MicroStrategy-style strategy by holding large amounts of TRX on its balance sheet.

This move comes just months after the SEC paused its fraud case against Justin Sun and signals growing regulatory leniency under a pro-crypto Trump administration.

Dominari Securities, which has strong ties to Eric Trump, is leading the deal. Trump is expected to take a leadership role at Tron Inc.

Sun has also deepened his relationship with the Trump family, reportedly investing in their DeFi venture and attending crypto-related events.

With Circle’s IPO still fresh, Tron’s listing adds momentum to the wave of crypto firms entering public markets.

Tron Posts $55.7 Million in Revenue as USDT Activity Hits Record Highs

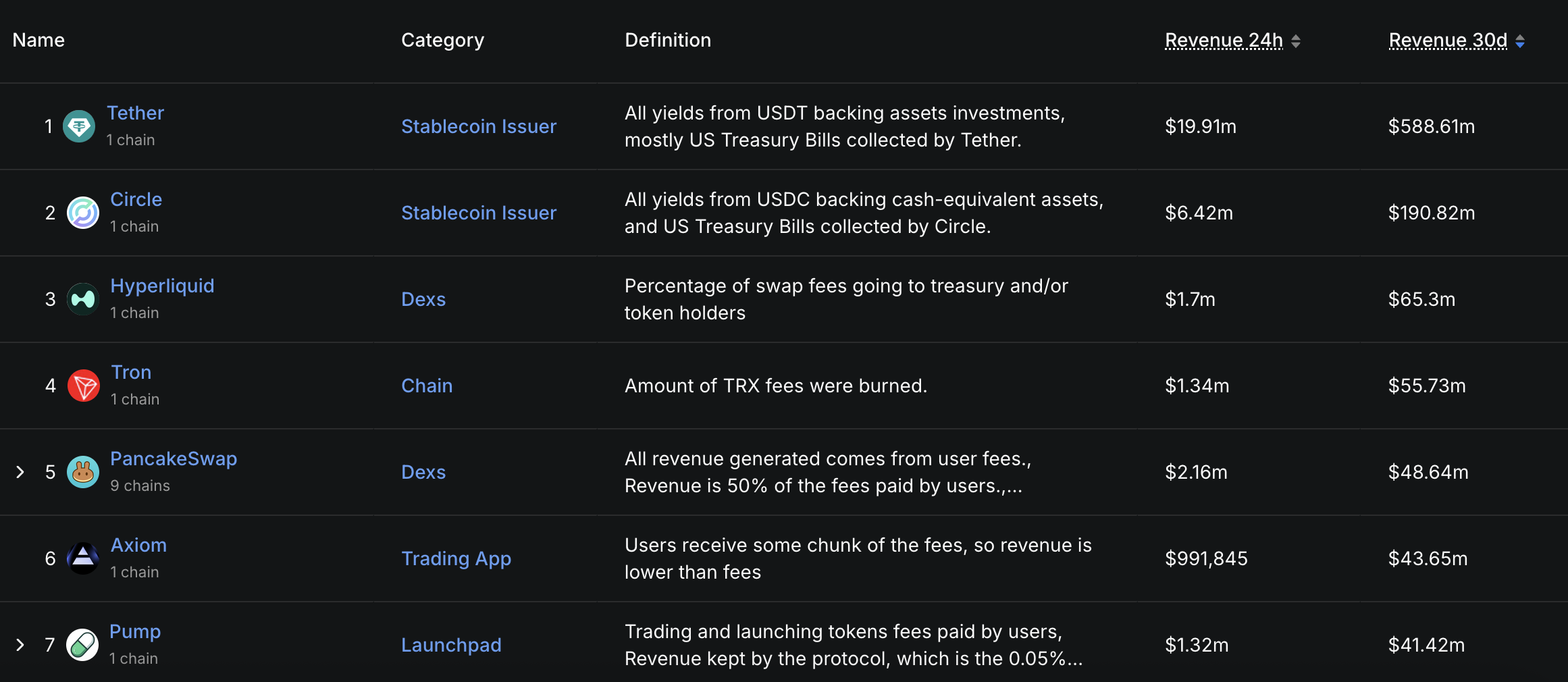

Tron remains one of the top revenue-generating crypto platforms, recording $55.7 million in revenue over the past 30 days—ranking just behind Tether, Circle, and Hyperliquid. In the last 24 hours alone, it brought in $1.34 million in revenue.

However, despite its impressive revenue, Tron still trails in decentralized exchange (DEX) volume. It ranks 11th among all chains, with $3.65 billion in DEX volume over the past month and just $40.4 million in the last 24 hours.

The gap suggests that while Tron excels in stablecoin and payments infrastructure, its DeFi presence remains relatively limited.

Biggest Crypto Applications in Revenye (30 Days). Source: DeFiLlama.

Biggest Crypto Applications in Revenye (30 Days). Source: DeFiLlama.

Tron continues to dominate stablecoin activity, with whales driving nearly 60% of May’s record $694.54 billion in USDT transfers on the network.

The total USDT supply on Tron surged 36% over the past six months—from $58 billion to $79 billion—solidifying its position as the leading blockchain for stablecoin transactions. It now surpasses Ethereum in both supply and daily volume.

With over 2.4 million daily USDT transfers and $23.7 billion daily volume, Tron has become the go-to network for large-scale stablecoin movement.

May also marked a record month for TRX, with 490.3 billion tokens transferred, equivalent to $121.2 billion. As institutional demand for stablecoins rises, Tron’s growing volume suggests it’s becoming a critical layer for global digital payments.

Can TRX Reclaim $0.50 This Cycle? On-Chain Strength Says Yes

TRX is currently trading about 62% below its all-time high, but recent momentum and structural developments suggest a breakout could be on the horizon.

If TRX price manages to break above the key resistance at $0.30, it could open the door for a move toward $0.45 and potentially $0.50 if the uptrend gains strength.

TRX Price Analysis. Source: TradingView.

TRX Price Analysis. Source: TradingView.

The catalyst? Tron’s $210 million reverse merger to go public on Nasdaq, its alignment with politically influential figures like Eric Trump, and its MicroStrategy-style strategy to hold large TRX reserves—all positioning the token for increased institutional exposure this cycle.

Fundamentally, Tron is thriving. With $55.7 million in 30-day revenue and a record $694.5 billion in USDT transfers during May—59% of which came from whale-sized transactions—the network is proving its dominance in the stablecoin sector.

TRX also saw an all-time high in monthly transfer volume, moving over $121 billion worth of tokens in May alone.