How Will the Fed’s Interest Rate Announcement Impact the Crypto Market This Week?

The FOMC is scheduled to meet tomorrow and the day after, possibly having huge implications for crypto. The market is teetering on the edge of a bear market, and cuts to the interest rate could juice some more growth.

However, Federal Reserve Chair Jerome Powell hasn’t been interested in these cuts, especially with concerns like inflation and tariffs. President Trump’s personal intervention may be the best hope for rate cuts and a bullish narrative.

The FOMC Could Decide Crypto’s Fate

The US Federal Open Market Committee (FOMC) is set to take place over March 18-19, and it could have major implications for US policy and the crypto market. Through this Committee, the Federal Reserve will make key decisions about the US economy, especially whether or not to cut interest rates. Lowered interest rates are highly bullish for crypto.

Previously this year, Fed Chair Jerome Powell signaled that he isn’t planning to cut interest rates. After this happened, it led to crypto outflows, but the FOMC is concerned with every sector of the US economy. Rate cuts are also linked with inflation, and the threat of tariffs already leads some community members to believe that Powell won’t budge.

However, the market is in a concerning place. The market was recently in a state of Extreme Fear, which has lessened somewhat. Despite this uptick in consumer confidence, the crypto industry doesn’t have a clear narrative to entice the average consumer. It isn’t enough for a market to stave off disaster; it must keep growing. So far, a good narrative hasn’t materialized.

All that is to say, the FOMC may be crypto’s best hope for creating one. The crypto market went through a huge rally after Trump’s election, but it stalled, and these gains have since been erased. Crypto is entangled with traditional markets, and a bear period could help trigger a recession. Somehow, the industry must find a way to rebuild investor confidence.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Could Trump’s Intervention Change the Equation?

The FOMC, in other words, could give the crypto industry a vital lifeline. Recently, the US CPI report revealed that inflation was less than expected, boosting crypto markets. This data point may help convince Powell that the US economy can handle another rate cut. However, the industry is not counting on this report to make the difference.

Instead, President Trump may use his sizable influence. He already supports rate cuts, for one thing. Trump has described himself as the “Crypto President,” and his administration has catered to the industry; he might lean on the FOMC as well.

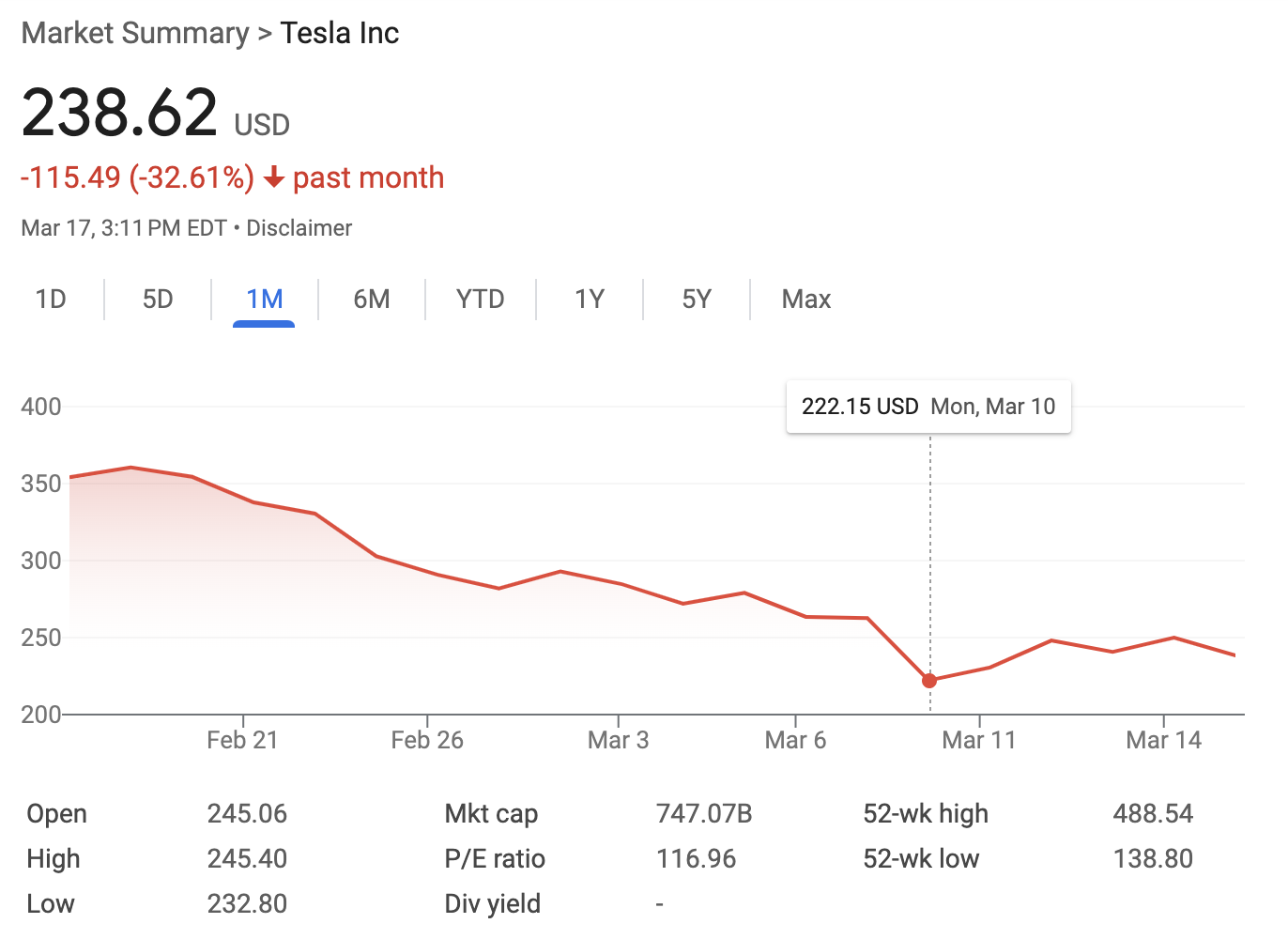

To name an example of how this could work out, one should consider Trump’s recent exhibition of Tesla products at the White House. Tesla’s stock price had been falling, sparking a belief that valuation could crash. However, after Trump gave his prominent endorsement on March 10, Tesla’s stock price perked up again. Tesla, too, is highly entangled with crypto markets.

Tesla (TSLA) Price Performance. Source: Google Finance

Tesla (TSLA) Price Performance. Source: Google Finance

In other words, President Trump is well aware of the power that market narratives can have over asset prices and is prepared to act to influence them. Trump’s intervention may sway the FOMC to cut rate cuts, thereby giving crypto a lifeline. Either way, the community is watching intently.