Pump.fun's test of the last line of defence in focus as revenue, retail interest shrink

- Pump.fun is under heavy selling pressure, falling over 3% intraday to $0.00186.

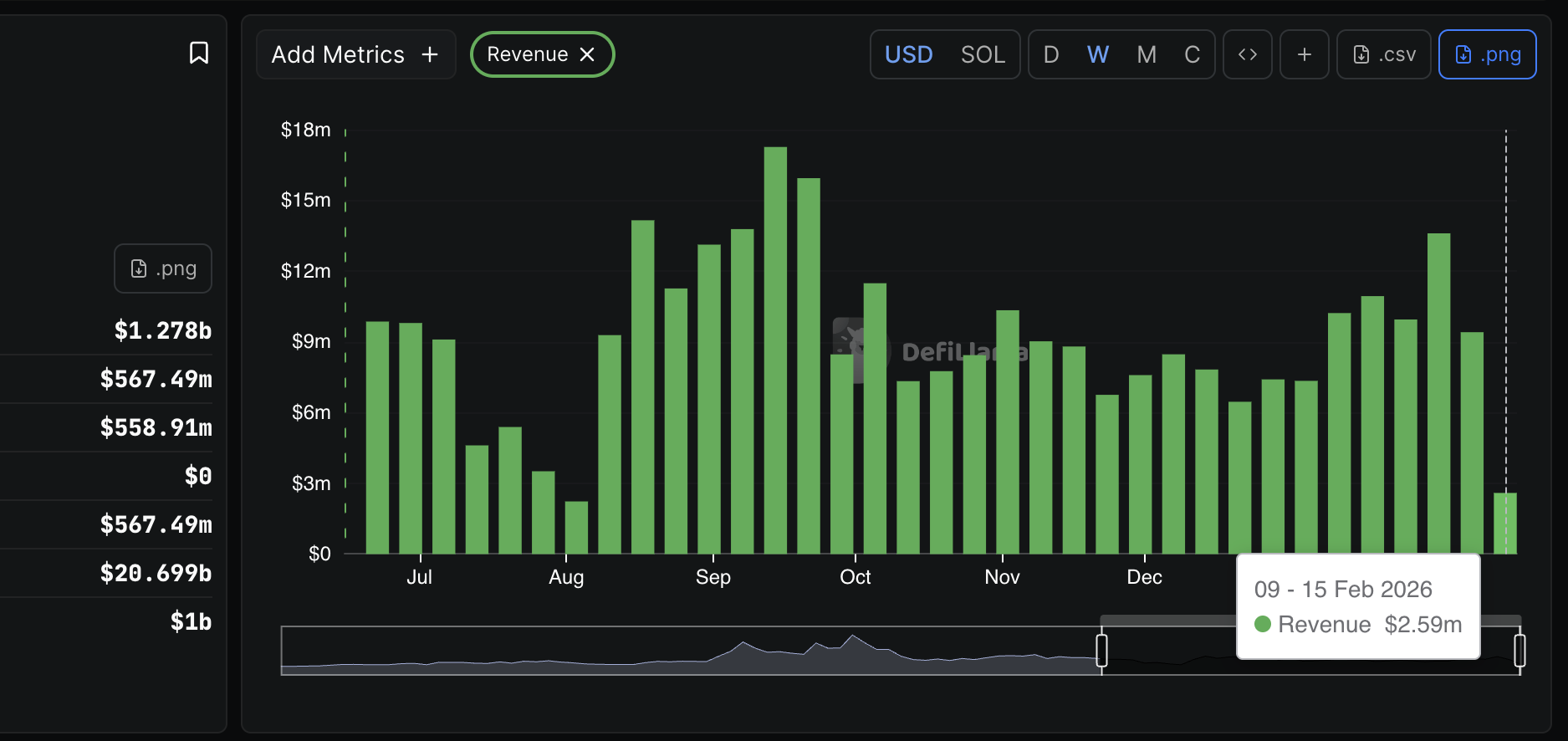

- Weekly platform revenue dropped to $9.4 million for the week ending Sunday from $13.6 million.

- Pump faces a weak derivatives market, with futures Open Interest down to $155 million on Wednesday.

Pump.fun (PUMP) is extending its decline for the fifth consecutive day, trading at $0.00186 at the time of writing on Wednesday. Low platform revenue, fees and a weak derivatives market are among the factors weighing on the meme coin launchpad and trading platform.

Pump.fun retail interest, platform revenue dip

The dominant risk-off sentiment continues to keep traders on the sidelines, narrowing investor sentiment, as derivatives weaken. Pump.fun futures Open Interest (OI) holds around December lows of approximately $155 million on Wednesday, down from $162 million the previous day.

In contrast, OI expanded to a record $1.23 billion in mid-September, around the time PUMP hit a new all-time high of $0.00900, undermining retail interest. The steady decline in the futures OI suggests that investors lack confidence in PUMP's short-term outlook and are unwilling to open new positions.

Pump.fun's platform revenue, on the other hand, has declined to $9.4 million for the week ending Sunday, from $13.6 million, indicating that meme coin trading activity has slowed, mirroring the headwinds in the broader cryptocurrency market.

The weekly revenue averages $2.6 million so far this week. Pump.fun channels most of the platform's revenue into the token buyback program, designed to reduce supply and support PUMP's long-term growth.

Despite the token buyback program, frequent token unlocks increase the circulating supply. On Tuesday, 10 billion PUMP tokens, worth approximately $20 million at the time, were released, adding downside pressure amid broader bearish sentiment in the crypto market.

Technical outlook: PUMP sell-side pressure deepens, approaches key support

Pump.fun edges lower toward support, tested on Friday at $0.00167, while the 50-day Exponential Moving Average (EMA) at $0.00246, the 100-day EMA at $0.00277 and the 100-day EMA at $0.00355 limit the upside. All three moving averages are sloping downward, upholding a bearish momentum bias.

The Relative Strength Index (RSI) is declining to 36 on the daily chart, reinforcing the bearish thesis. A further drop into oversold territory could accelerate PUMP's downtrend, pushing it below the $0.00167 support.

Moreover, the Moving Average Convergence Divergence (MACD) indicator remains below the signal line on the daily chart, reinforcing the bearish outlook and prompting traders to close long positions in favour of selling PUMP. Below the immediate support at $0.00167, PUMP may drop toward $0.00100.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.