Monero Price Hits All-Time High After a 60% Breakout, Here’s Why

Monero (XMR) climbed to a new all-time high on Wednesday, breaking above the $797 mark as investors piled into privacy-focused cryptocurrencies. The move capped a week-long rally that lifted XMR by more than 50%, making it one of the strongest performers in the crypto market.

The surge pushed Monero’s market value above $13 billion and briefly placed it among the top 15 cryptocurrencies by market cap. Trading volumes also spiked as buyers rushed to gain exposure.

Rising Demand for Financial Privacy

The main driver behind the rally is a sharp rise in demand for financial privacy. Across major markets, regulators are tightening KYC and anti-money-laundering rules. That has made it harder to transact anonymously on most blockchains.

As a result, more users are turning to coins that hide wallet balances, transaction amounts, and sender identities. Monero remains the largest and most battle-tested option in that category.

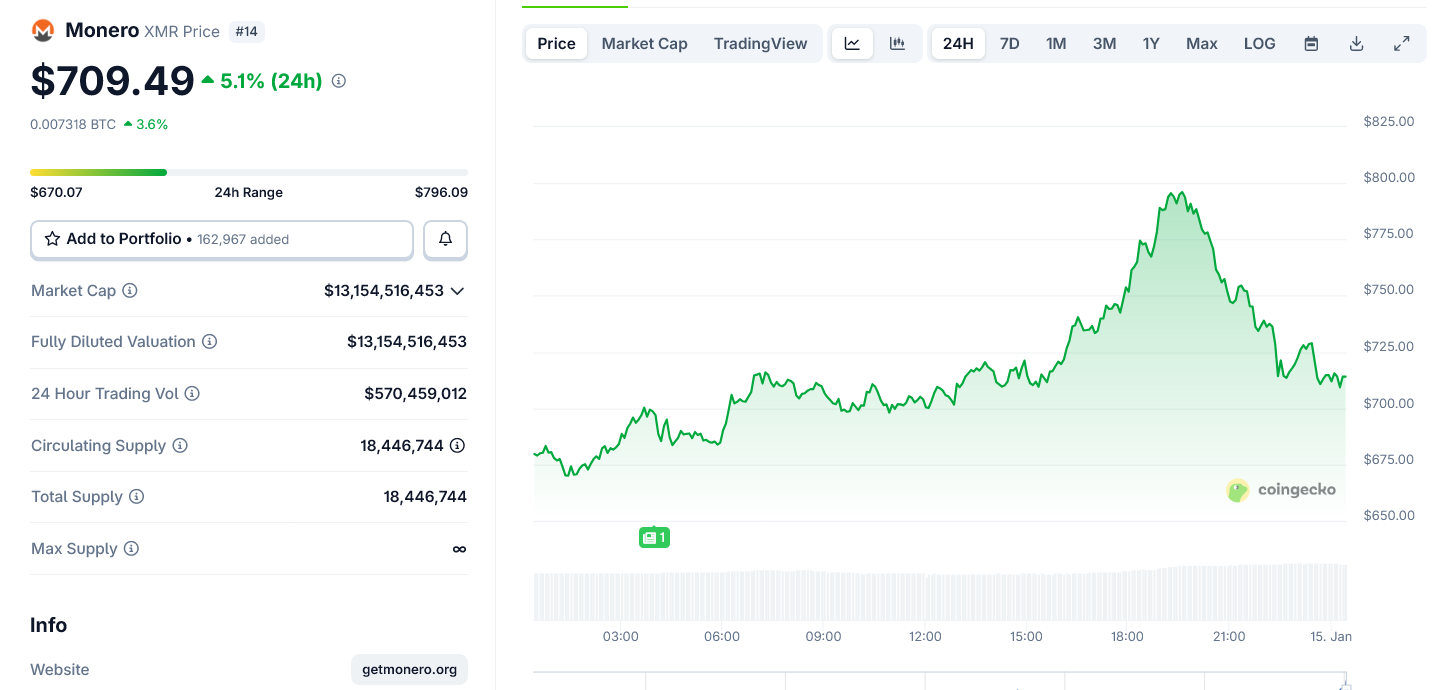

Monero All-Time High Near $800 on January 14. Source: CoinGecko

Monero All-Time High Near $800 on January 14. Source: CoinGecko

Paradoxically, bans and restrictions have fueled the rally rather than stopped it.

Earlier this week, Dubai’s financial regulator barred exchanges in the Dubai International Financial Centre from listing or promoting privacy coins.

Also, the European Union is preparing rules that would ban anonymous crypto accounts and privacy tokens from 2027.

Instead of killing demand, those moves triggered front-running behavior. Investors rushed to buy privacy assets before access becomes more limited.

Capital Rotated Out of Zcash

Monero also benefited from turmoil inside the Zcash ecosystem.

Zcash, its closest privacy-coin rival, lost momentum after governance disputes and the departure of its core development team.

As confidence faded, traders rotated capital into Monero, which is viewed as more decentralized and less dependent on a single foundation.

That shift added fuel to XMR’s breakout.

Monero also cleared multi-year resistance levels on the charts. Once it broke above the $600–$650 range, systematic traders and momentum funds joined the move.

Social media interest spiked, and liquidity followed. That created a feedback loop of buying that pushed prices toward $700.

CLARITY Act Drama Fueled the Rally

US crypto policy debates may also be helping the privacy narrative.

The Senate’s rewrite of the CLARITY Act would expand financial surveillance, strengthen reporting requirements, and give regulators broader access to transaction data across exchanges and DeFi platforms.

While the bill does not target privacy coins directly, it reinforces fears that on-chain activity will become more visible to governments.

That environment makes privacy-preserving assets more attractive, even for users who are not engaged in illicit activity.

Monero now faces heavy technical resistance near $700. Short-term pullbacks are likely after such a sharp move.

Still, the underlying trend is clear. As governments tighten oversight and restrict anonymity, demand for financial privacy is rising. For now, Monero remains the market’s main beneficiary.