Ethereum Price Climbs Above $3,000, But Here’s Why $4,000 Will Be A Challenge

Ethereum price has climbed gradually in recent sessions, showing a slow but steady recovery. ETH has struggled to attract sustained investor support, which has limited upside momentum.

This lack of conviction makes reaching the long-anticipated $4,000 level increasingly challenging for the altcoin king despite improving broader market conditions.

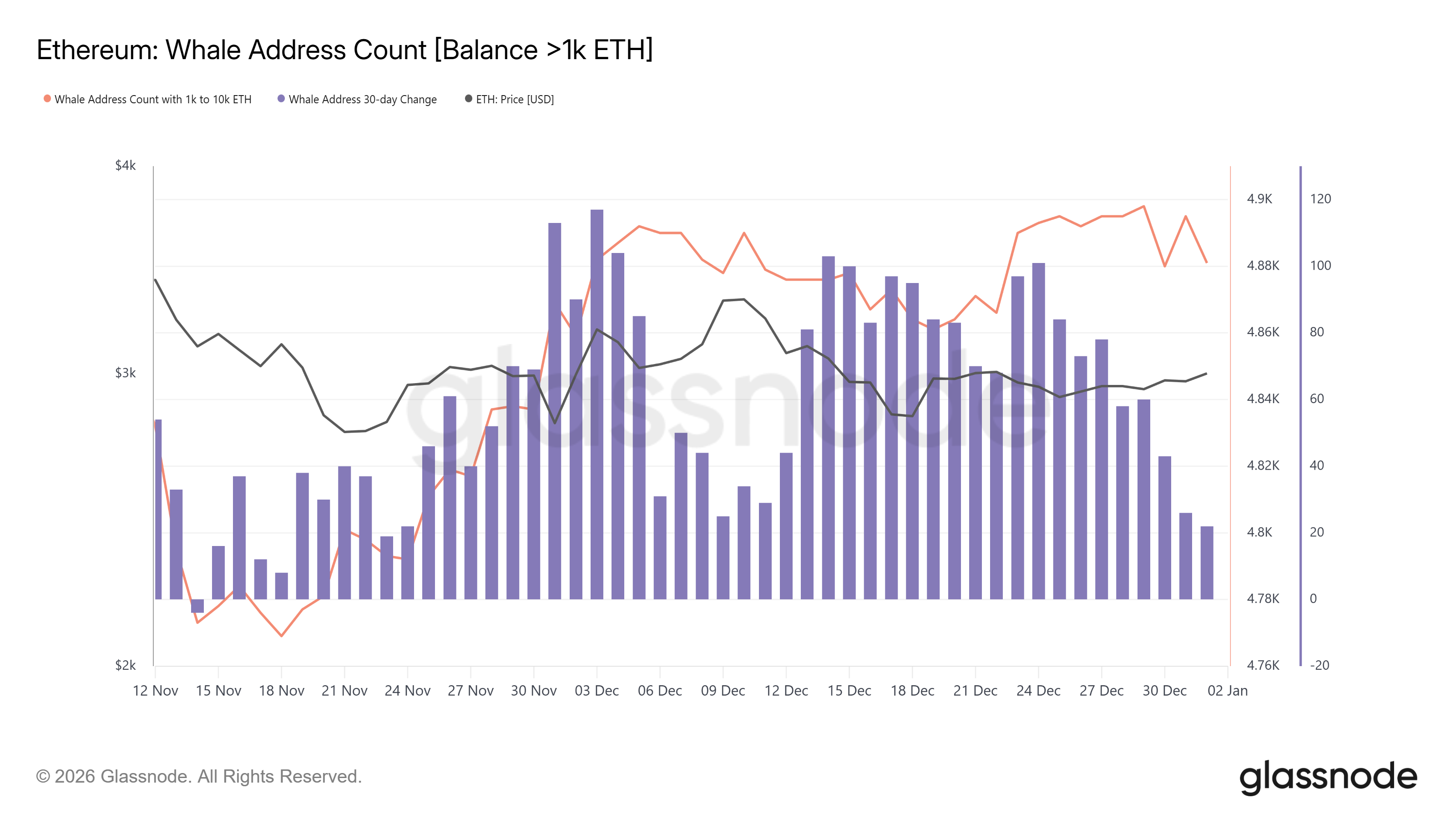

Ethereum Whales Continue To Decline

Whale activity reflects growing caution among large Ethereum holders. Data tracking whale addresses shows a decline in the 30-day change, indicating reduced participation from this influential cohort. Fewer whales maintaining or expanding positions often signal weakening confidence in near-term price appreciation.

This pullback suggests whales may be reassessing exposure amid limited growth prospects. Large holders typically accumulate during strong conviction phases. Their current retreat points to a bearish short- to mid-term outlook, adding pressure on Ethereum’s ability to sustain a strong rally without renewed demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Whale Address Count. Source: Glassnode

Ethereum Whale Address Count. Source: Glassnode

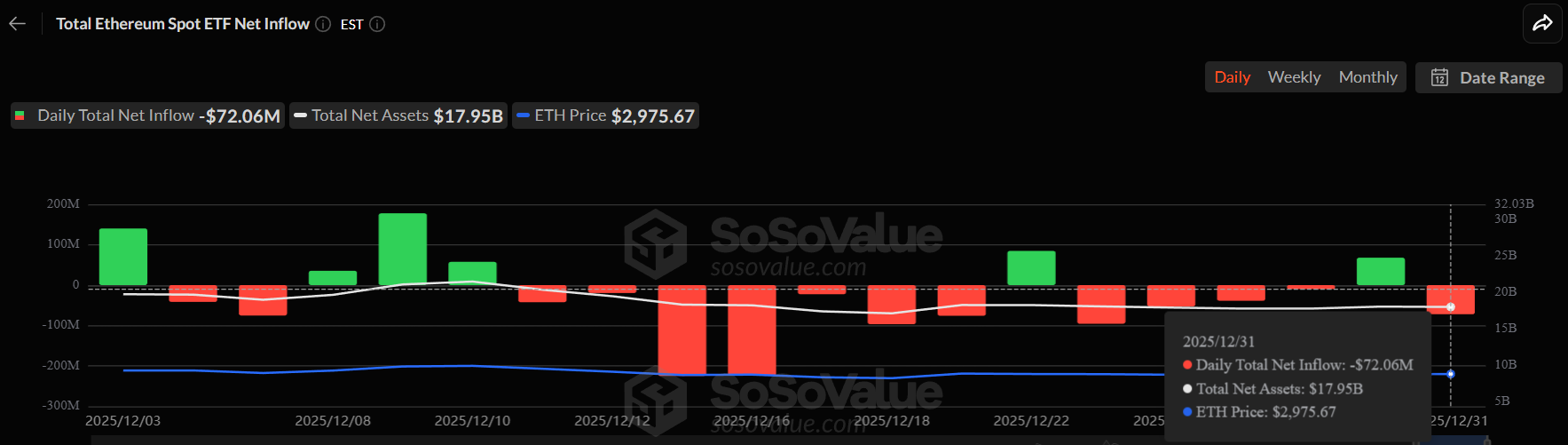

Macro indicators also highlight headwinds for Ethereum price recovery. ETH spot ETFs closed 2025 on a bearish note, recording net outflows totaling $72 million. This performance reflects cautious institutional sentiment during a period of broader market uncertainty.

Participation has remained muted entering the new year. Over the past month, ETH spot ETFs recorded inflows on only five occasions. This partial disengagement from institutional allocators limits liquidity support, reducing the probability of a sustained upside move without a clear macro catalyst.

Ethereum ETF Flows. Source: SoSoValue

Ethereum ETF Flows. Source: SoSoValue

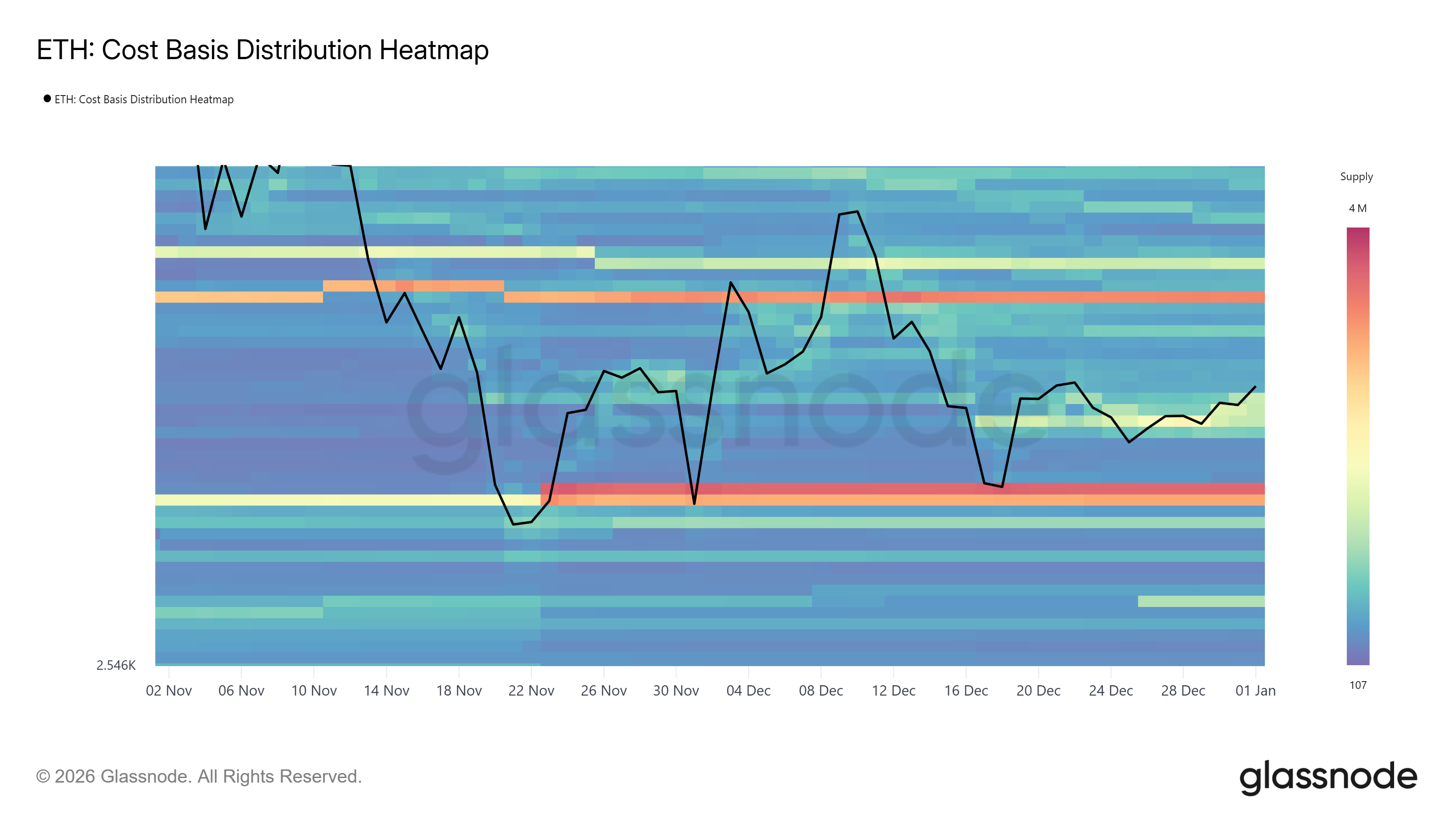

ETH Price Faces Critical Supply Zone

Ethereum price has shown early signs of strength in 2026. ETH recently reclaimed the $3,000 level, marking its first break above this resistance in 10 days. This move represents a psychological milestone, yet it remains only an initial step toward the broader $4,000 objective.

The next major hurdle lies 32% above current levels, with ETH trading near $3,014. Price action remains constrained within a descending wedge pattern. A confirmed breakout would require a decisive move above $3,131, which could shift momentum and attract fresh buyers.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

Reaching that level will be difficult due to the heavy overhead supply. The Cost Basis Distribution Heatmap shows approximately 2.83 million ETH accumulated between $3,151 and $3,172. This zone acts as resistance, as many holders may sell to break even once the price approaches it.

Without strong demand, Ethereum is likely to consolidate below $3,131. This range-bound movement could persist as sellers absorb rallies and buyers hesitate. Such consolidation reflects a market waiting for confirmation rather than committing aggressively to higher valuations.

Ethereum CBD Heatmap. Source: Glassnode

Ethereum CBD Heatmap. Source: Glassnode

Invalidation of the bearish thesis depends on renewed whale and macro support. Significant inflows into Ethereum through spot or ETF markets would signal restored confidence. Sustained institutional participation could help ETH break past $3,131 and extend gains toward $3,287, restoring momentum.