Tom Lee’s Bitmine Stakes Over $1.2 Billion in ETH as Ethereum Awaits a Breakout Trigger

Ethereum continues to trade sideways, limiting upside momentum as broader market conviction remains fragile. ETH has struggled to establish a clear trend, keeping price action compressed near key technical levels.

With internal signals mixed, the altcoin leader now appears increasingly dependent on external catalysts to trigger a decisive breakout.

Bitmine’s Confidence In Ethereum’s Value Reaches New High

Bitmine recently disclosed that it has begun staking Ethereum from its corporate treasury, reinforcing long-term confidence in the network. The firm currently holds 4.11 million ETH, representing roughly 3.41% of total circulating supply. This strategic allocation positions Bitmine among the largest institutional Ethereum holders globally.

Out of its total holdings, approximately 40,627 ETH, valued at $1.2 billion, has already been staked. Bitmine plans to expand staking operations further through its upcoming Made in America Validator Network, or MAVAN, scheduled for early 2026.

“At scale (when Bitmine’s ETH is fully staked by MAVAN and its staking partners), the ETH staking fee is $374 million annual (using 2.81% CESR), or greater than $1 million per day,” stated Galaxy Digital and personal investor, Tom Lee.

Ethereum Holders’ Actions Come Into Consideration

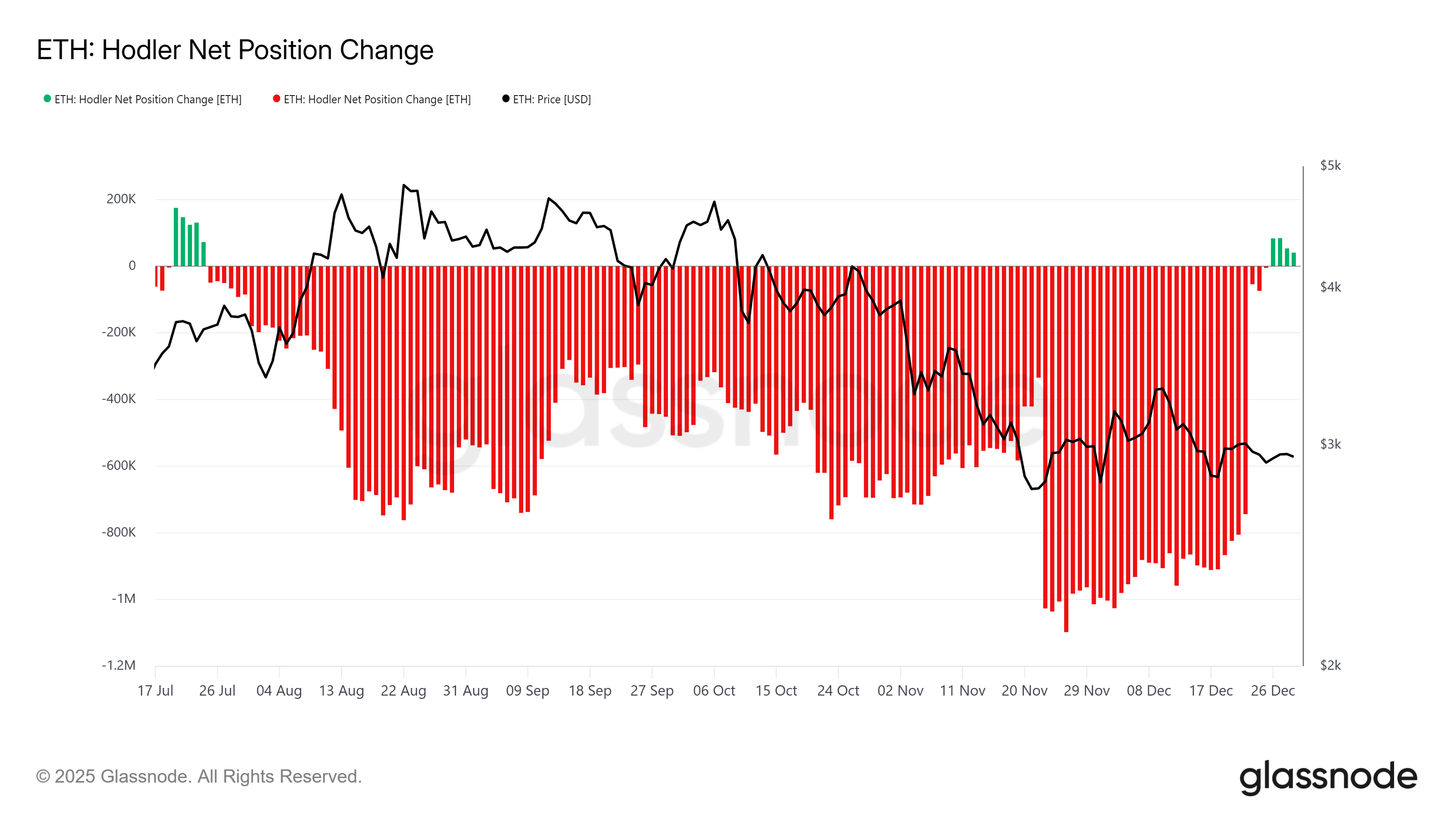

Investor behavior across the Ethereum market remains divided. Long-term holders, often viewed as the asset’s structural backbone, have resumed accumulation after months of persistent distribution. This shift follows nearly five months of steady outflows that previously weakened long-term supply stability.

The renewed HODLing trend is constructive for Ethereum’s recovery outlook. Long-term holder resilience often dampens volatility during uncertain periods. Their return to accumulation suggests improving confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum HODLer Position Change. Source: Glassnode

Ethereum HODLer Position Change. Source: Glassnode

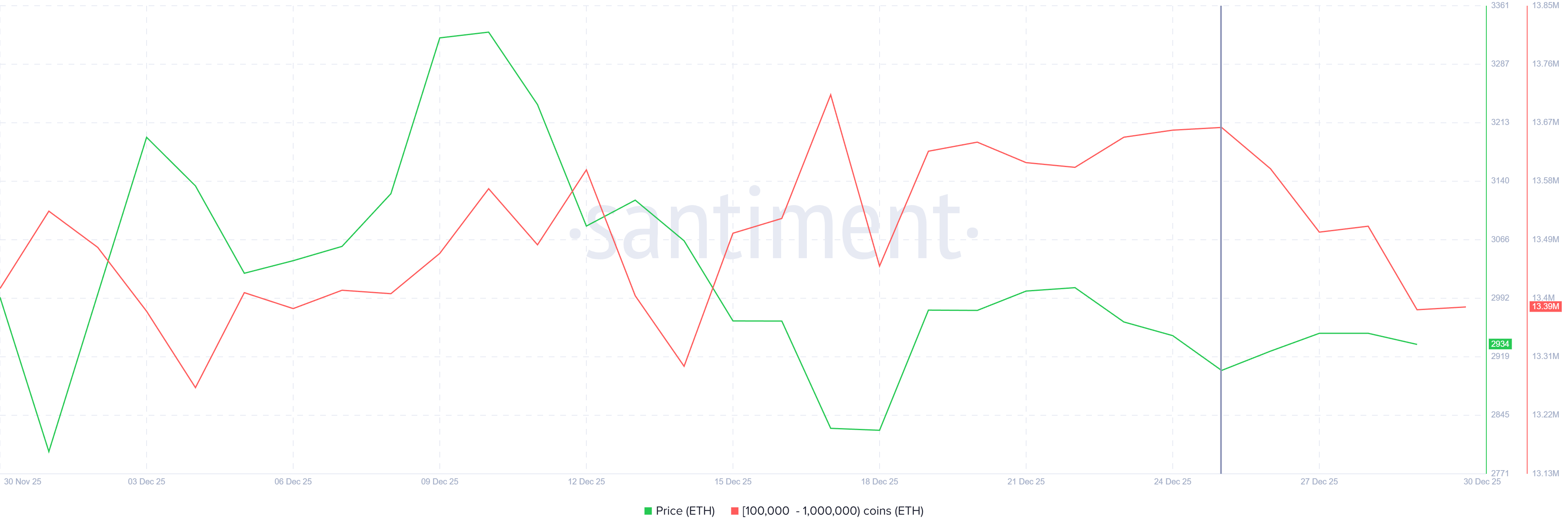

Whale activity, however, presents a contrasting signal. Within the last five days, addresses holding between 100,000 and 1 million ETH have sold roughly 270,000 ETH. At current prices, this distribution exceeds $793 million, adding notable supply pressure to the market.

This behavior indicates discomfort among large holders regarding near-term downside risks. Whale selling often reflects defensive positioning rather than outright bearish conviction. Still, reduced exposure suggests limited confidence in an immediate recovery.

Ethereum Whale Holding. Source: Santiment

Ethereum Whale Holding. Source: Santiment

ETH Price Awaits A Clear Direction

Ethereum price is at $2,941 within an asymmetrical triangle pattern, signaling indecision. Price remains constrained between resistance near $3,000 and support around $2,902. This tightening range reflects balanced buying and selling pressure, with volatility steadily compressing as the pattern matures.

Mixed investor signals cloud near-term direction, yet Bitmine’s aggressive staking strategy introduces a bullish narrative. Sustained optimism could help ETH reclaim $3,000 and target $3,131 by early January 2026. Thus, a confirmed breakout would require a decisive close above $3,131.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

Failure to align broader sentiment with Bitmine’s outlook may trigger a correction. Furthermore, a drop below $2,902 would invalidate the pattern, exposing Ethereum to a decline toward $2,796. Such a move could initiate a short-term downtrend, undermining recovery expectations.