Chainlink risks further losses in early 2026 despite the ecosystem growth

- Chainlink trades in the red for the fourth consecutive month, risking a drop to a single-digit market price.

- Coinbase partners with Chainlink for using bridge infrastructure to boost wrapped assets growth, following the launch of the Base-Solana bridge a week earlier.

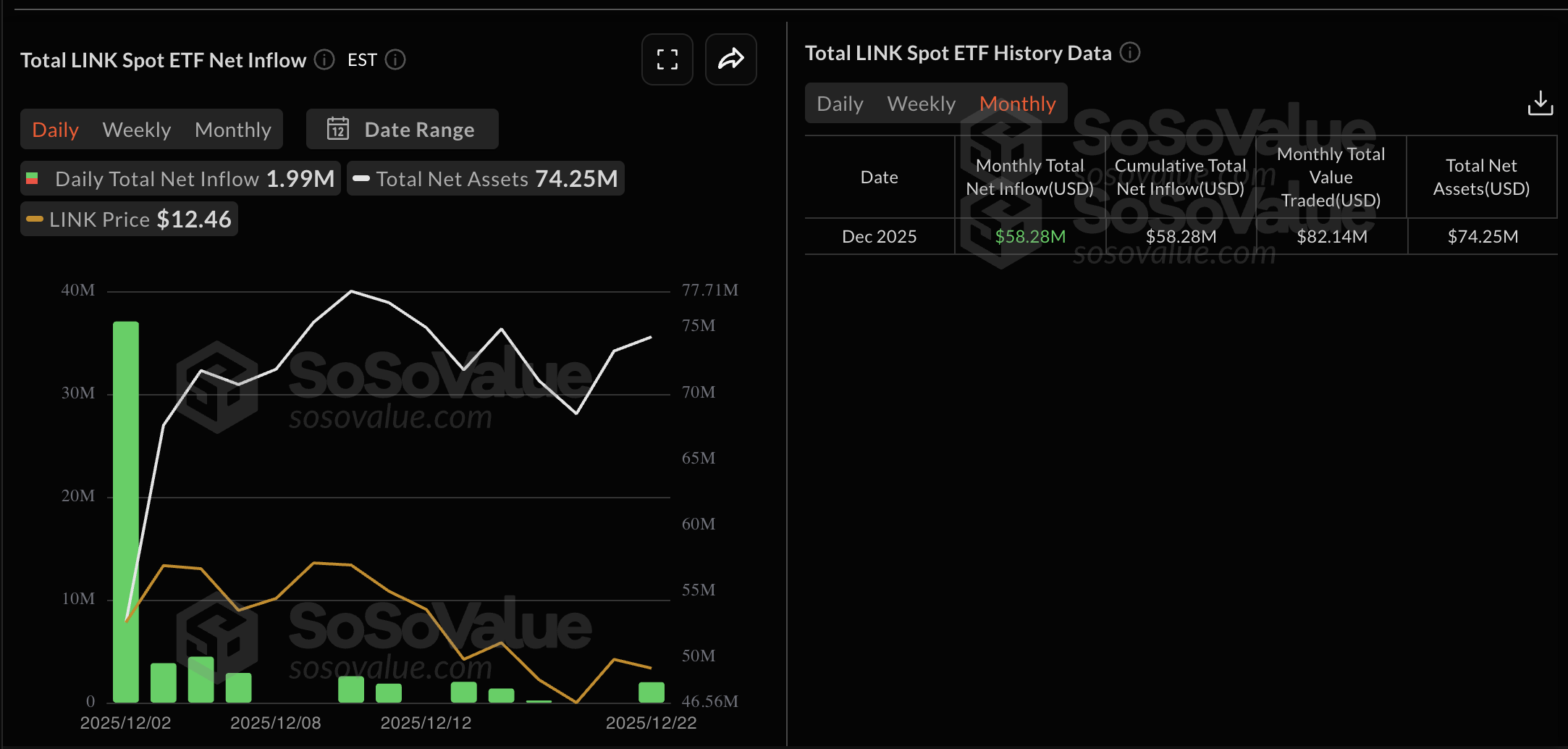

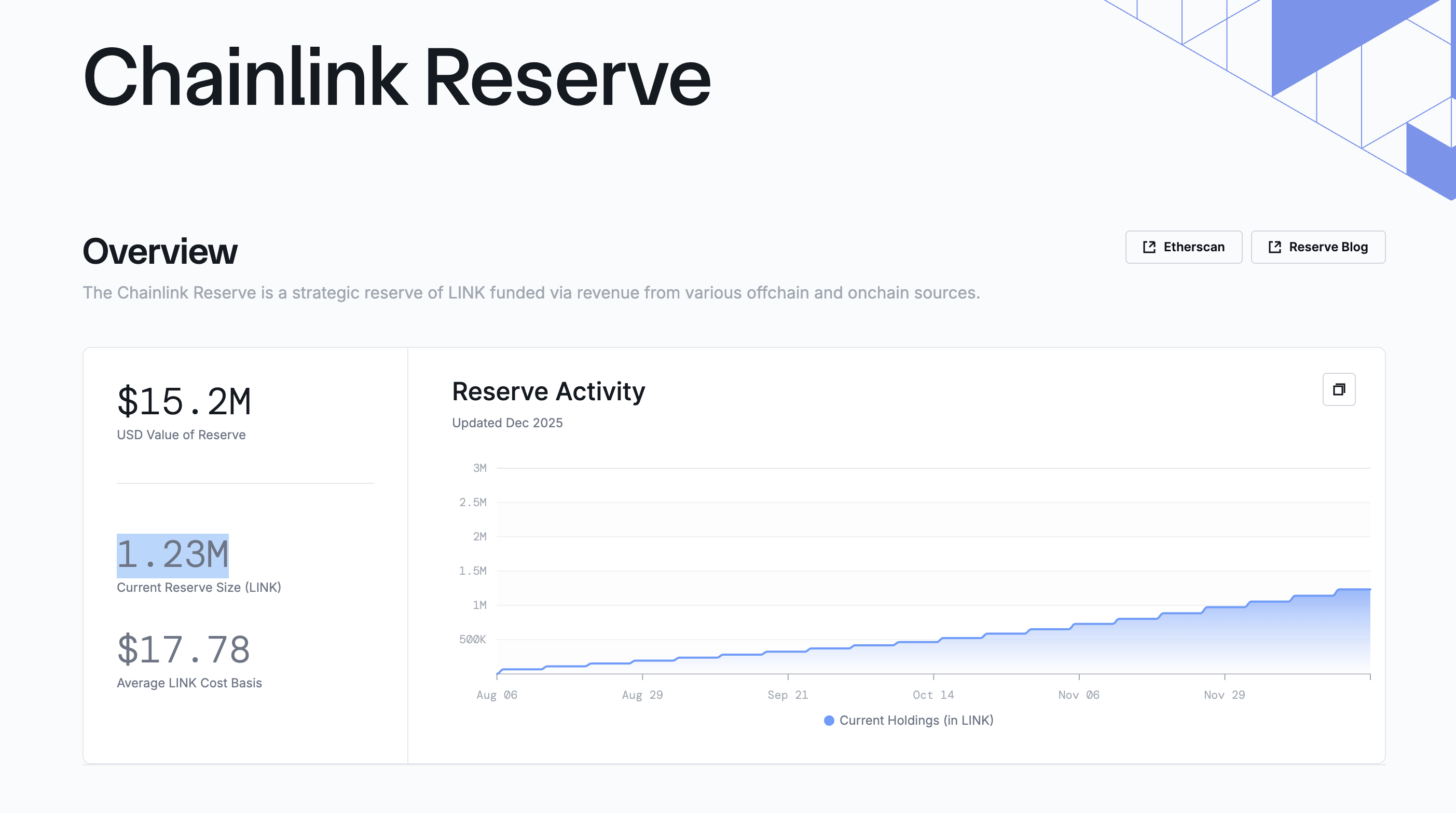

- Chainlink ETFs record a monthly inflow of $58.28 million so far in December, amid the expansion of the reserve to 1.23 million LINK.

Chainlink (LINK) is down 2% at press time on Tuesday, adding to a nearly 5% decline in December so far. The oracle token risks a negative close for the fourth straight month, potentially signaling a bearish start to 2026.

The declining trend overlooks the Chainlink ecosystem expansion with the Coinbase partnership and Base-Solana bridge in December, and the Swift partnership in September. Meanwhile, institutional and internal team support remains steady, with net inflows into LINK-focused Exchange Traded Fund (ETF) and Chainlink reserve growth, holding over 1.23 million LINK.

The technical outlook remains bearish as the broader cryptocurrency market is still under pressure, and influential figures, such as Cardano founder Charles Hoskinson, opt for Pyth Network over Chainlink.

Chainlink enables Coinbase-Solana interoperability

Chainlink announced a partnership with Coinbase on December 11 to provide bridge infrastructure via the Cross-Chain Interoperability Protocol (CCIP) to boost the growth of Base-wrapped assets, including cbBTC, cbETH, cbDOGE, cbLTC, cbADA, and cbXRP.

Josh Leavitt, Senior Director of Product Management at Coinbase, said, "We chose Chainlink because they are an industry leader for cross-chain connectivity. Their infrastructure provides a reliable means to expand Coinbase Wrapped Asset offerings."

The new partnership comes a week after the Base-Solana bridge went live, which is secured by the same Chainlink CCIP. This enables asset transfers between two blockchains, potentially leading to an "always-on" capital market.

Additionally, Chainlink partnered with Swift in September, an ISO20022-certified global payments system, to develop a rail system that will enable blockchains to execute transactions using Swift messages. This helps banks maintain their Swift-based backend systems and explore tokenized assets with faster settlement and cross-chain interoperability.

Institutions and core team confidence persist amid a strengthening network

Grayscale’s LINK-focused ETF recorded a total of $58.28 million inflows in December so far, with $1.99 million of inflows on Monday, after two consecutive sessions of net-zero flows.

On the other hand, the Chainlink Reserve, funded by the platform’s revenue, has acquired 1.23 million LINK tokens at an average price of $17.78, as of Tuesday.

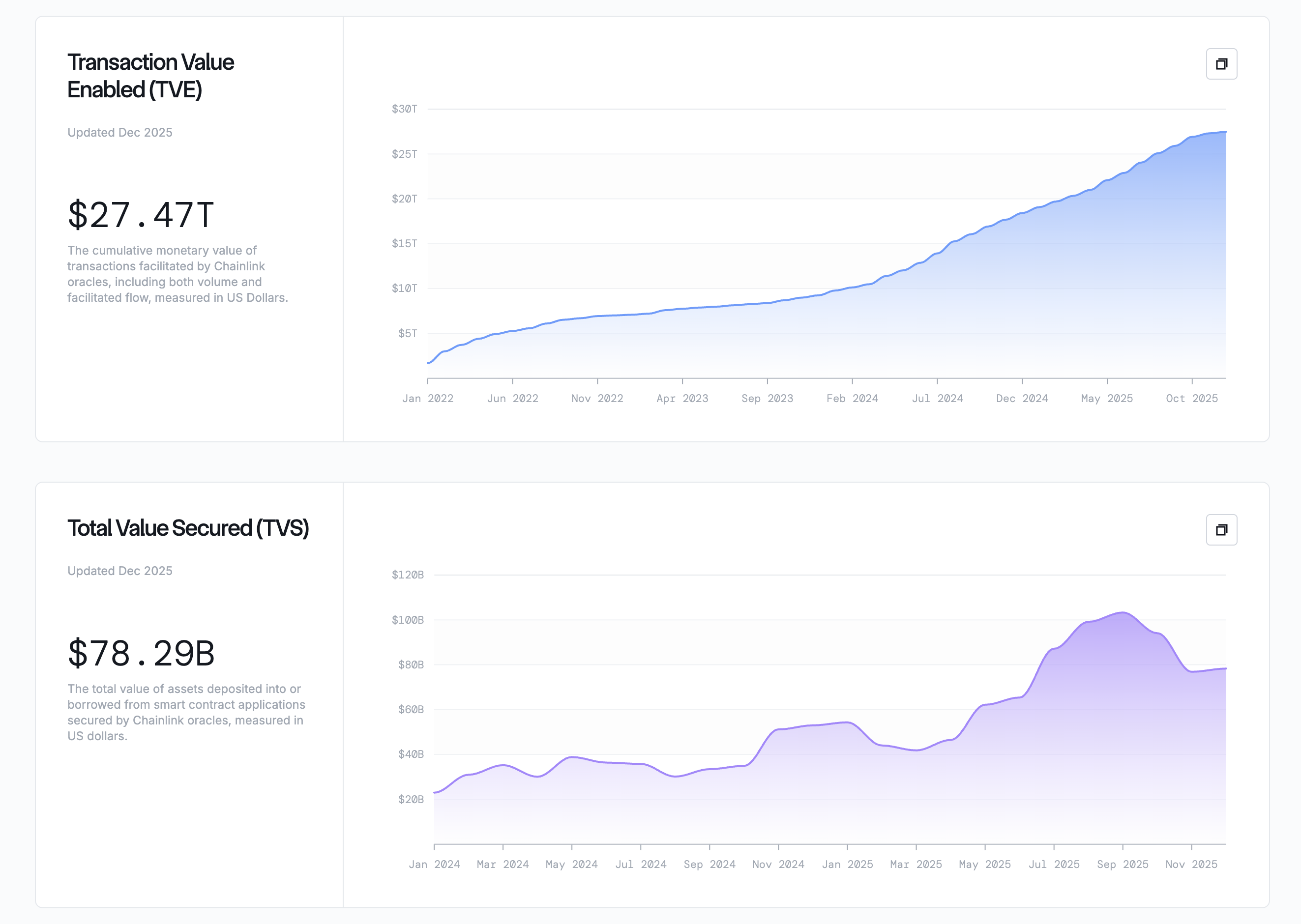

On the network side, Transaction Value Enabled (TVE) – total value of transactions facilitated by Chainlink oracle – stands at $27.47 trillion on Tuesday, while the Total Value Secured (TVS) is at $78.29 billion, up from $76.87 billion in November. This indicates a steady rise in the oracle’s demand.

Still, in a recent interview, Charles Hoskinson, founder of Cardano, explained that Pyth Network provides a cheaper alternative than Chainlink as an oracle with institutional-grade features. Such competitions from other oracles could intensify the race for improvements in the segment.

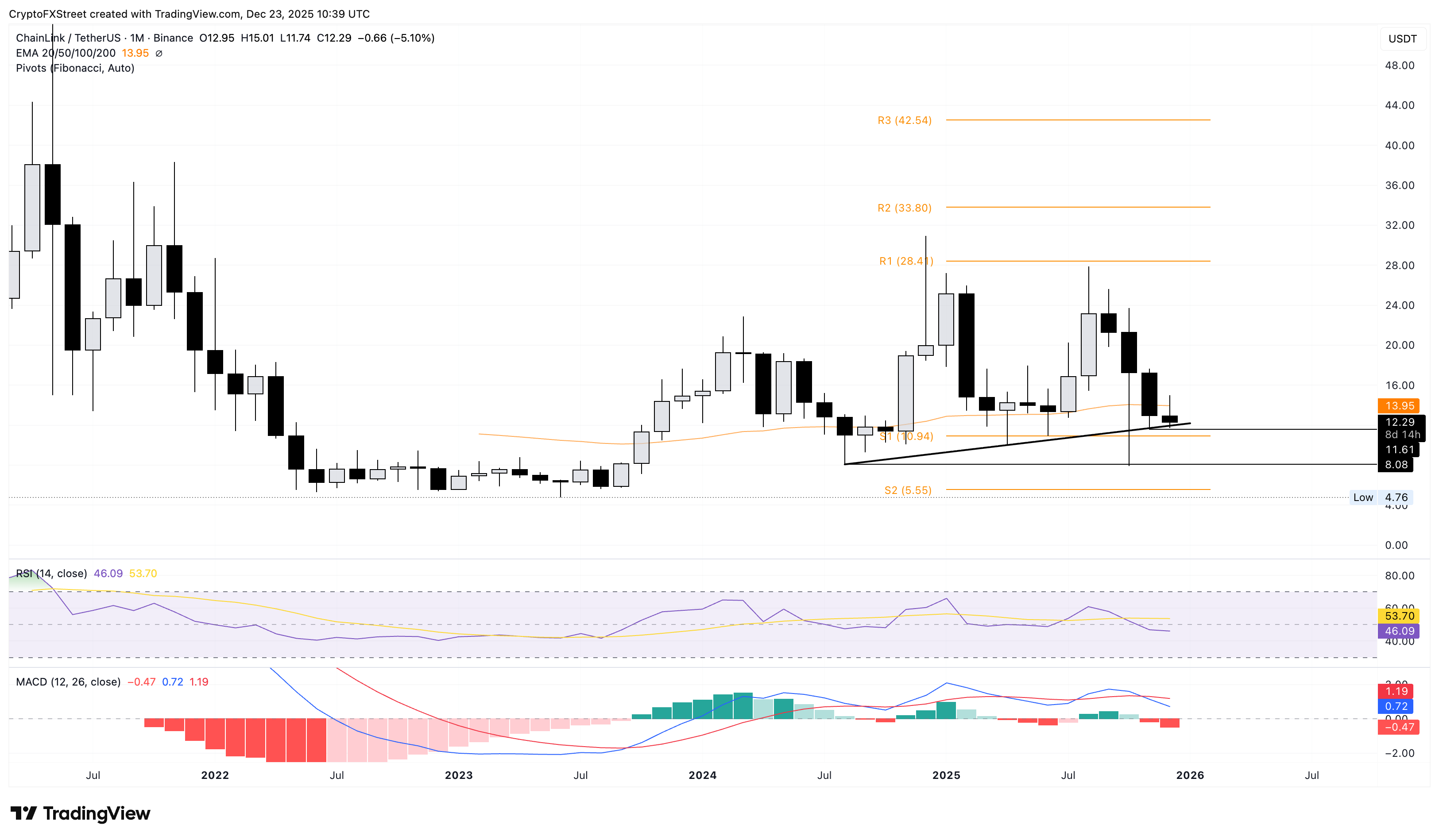

Chainlink risks a steeper correction below $10

Chainlink trades close to $12 at press time on Tuesday, down from the December 9 high of $15.01. The fourth consecutive bearish month pressures a support trendline connecting the August 2024 and April 2025 lows, near the S1 Pivot Point at $10.94.

If LINK clears the November low at $11.61 with a decisive monthly close, it could extend the decline to the August 2024 low at $8.08. Beyond this, Chainlink threatens a drop to the S2 Pivot Point at $5.55, close to the 2023 annual low of $4.76.

The technical indicators on the monthly chart show a decline in buying pressure. The Relative Strength Index (RSI) is at 46, crossing below the halfway line, while the Moving Average Convergence Divergence (MACD) crosses below the signal line, indicating a renewed bearish momentum.

Looking up, a potential rebound from the $11.61 could test the $20 round figure.