Cathie Wood Predicts Bitcoin Has Bottomed. Is Now The Best Time to Buy? How to Buy BTC?

Is now the time to buy the dip in Bitcoin?

TradingKey - Since October 1, 2025, Bitcoin (BTC) experienced a maximum drawdown of up to 36%, briefly nearing the $80,000 mark. Currently, despite a slight rebound, Bitcoin's price performance remains sluggish, hovering around $85,000.

Regarding Bitcoin's weakened price performance, ARK Invest founder Cathie Wood stated in an interview on December 14, "During the October 11 flash crash, Bitcoin was the most liquid among all crypto assets. As the relevant information has been digested, the market may have bottomed out. "

Bitcoin Price Chart, Source: TradingView.

Bitcoin Price Chart, Source: TradingView.

According to Jasper De Maere, a trading strategist at Wintermute, Bitcoin may not have bottomed out yet, but it is already in an oversold state in the short term. From a technical structure and psychological perspective, $80,000 represents a strong support level, forming a high-value entry point that warrants a speculative buy.

The question then arises: Which platforms allow Bitcoin purchases? How can one buy BTC? If you are a beginner, how should you safely and effectively purchase Bitcoin? This article comprehensively addresses these questions, helping you invest in Bitcoin securely and avoid common pitfalls.

Do you truly understand Bitcoin?

Prior to this, you may have heard of, or even thoroughly researched, Bitcoin, but you might not truly understand it. In recent years, to address Bitcoin network congestion and facilitate its regulatory compliance, a large number of " Bitcoin variants ", which has led to widespread confusion among many, especially newcomers, making it difficult to distinguish between legitimate and illegitimate options.

Strictly speaking, Bitcoin can be categorized into three types: (1) the original Bitcoin issued by Satoshi Nakamoto on the Bitcoin network; original Bitcoin; (2) wrapped Bitcoin issued on non-Bitcoin networks; wrapped Bitcoin; (3) regulated spot Bitcoin ETFs .

Category | Definition | Name and Issuer | Quantity |

Original Bitcoin | Native asset existing on the Bitcoin mainnet | BTC (Satoshi Nakamoto) | 21 million coins |

Wrapped Bitcoin | Tokenized versions of original Bitcoin 'wrapped' onto other chains (e.g., Ethereum, BNB Chain), typically pegged 1:1 to original BTC | -WBTC (BitGo) -renBTC (Ren Protocol) -tBTC (Keep Network / Threshold Network) -iBTC (Interlay) -BTCB (Binance) | Fluctuates with market demand; quantity is not fixed but will not exceed 21 million coins |

Spot Bitcoin ETF | Issued by asset management companies, holding real Bitcoin as the underlying asset, but not at a 1:1 ratio; instead, one Bitcoin is divided into different shares | -IBIT (BlackRock) -FBTC (Fidelity) -GBTC (Grayscale) -ARKB (Ark Invest & 21Shares), -BITB (Bitwise) -BRRR (Valkyrie), HODL (VanEck) -BTCW (WisdomTree) -BTCO (Invesco Galaxy) -DEFI (Hashdex) -EZBC (Franklin Templeton) | Fluctuates with market demand |

What are the ways to purchase Bitcoin?

When people talk about buying Bitcoin, they usually refer to buying spot Bitcoin, which was primarily popular before 2017 because, in its early days, Bitcoin's price volatility was significant enough to meet investors' needs. In recent years, Bitcoin's price movements have become less dramatic, failing to satisfy the market's demand for volatility. Consequently, major exchanges have successively developed and launched futures products, known in the industry as "contracts," including delivery futures and perpetual contracts.

So, what exactly are the differences between spot trading, delivery futures contracts, and perpetual contracts, and who are they suitable for, respectively? Details are as follows:

Type | Definition | Expiration Date | Leverage | Suitable for | Risk Characteristics |

Spot | Bitcoin as issued by Satoshi Nakamoto; involves holding the actual asset | No expiration date | No leverage | Long-term investors, individuals who wish to hold real assets | Requires self-custody of assets |

Delivery Futures Contract | A contract to deliver Bitcoin at an agreed-upon price on a specific future date | Has a fixed expiration date, such as current week, next week, current quarter, next quarter | Leverageable, typically 1–100x | Medium to short-term speculators, hedgers | Faces mandatory liquidation/settlement upon expiration, but can also be actively closed before maturity |

Perpetual Contract | A contract that continues indefinitely, unless liquidated or actively closed | No expiration date | Leverageable, typically 1–100x | Speculators who prefer short-term trading and seek high leverage | Funding rates can be a significant cost, and there is a high risk of liquidation |

Which platforms can one use to purchase Bitcoin?

Bitcoin is the world's largest cryptocurrency, boasting the largest market capitalization and best liquidity. Nearly every platform offering cryptocurrency trading lists both Bitcoin spot and futures contracts, making it available for purchase on these platforms.

If you wish to purchase native Bitcoin or wrapped Bitcoin, you might consider dedicated cryptocurrency trading platforms, which are primarily divided into two categories: the first being centralized exchanges (CEXs), including Binance (BNB), Coinbase (COIN), Bybit, and others; the second category consists of decentralized exchanges (DEXs), primarily Uniswap (UNI), Hyperliquid (HYPE), ASTER, and others.

It is important to note that Bitcoin spot ETFs are not available on the aforementioned platforms but rather on stock exchanges, primarily in the U.S. stock market, including NYSE Arca, Cboe BZX, and NASDAQ. Additionally, Canada's Toronto Stock Exchange and Cboe Canada have also listed relevant products; consequently, Bitcoin can also be purchased through these platforms.

How do beginners safely buy Bitcoin online?

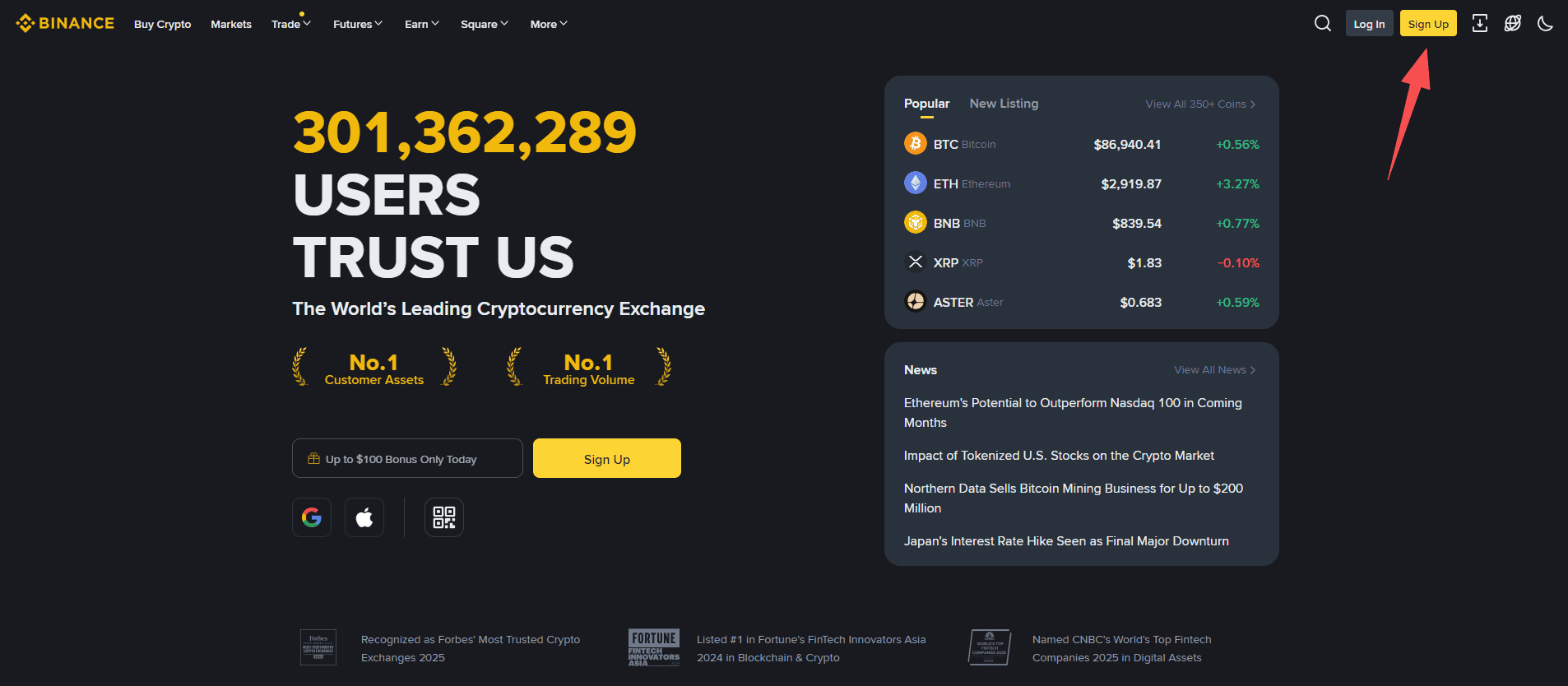

Before new users purchase Bitcoin, they must first select a trustworthy platform that meets their trading needs. As the operational procedures across various platforms are largely similar, we will use the world's largest cryptocurrency exchange, Binance as an example to illustrate the specific purchasing process.

Step One: Register an Account and Complete Identity Verification

- Register an account using your email address or mobile phone number

- Upload identification documents and a selfie to complete KYC verification

Step Two: Deposit Funds You can transfer funds to your exchange account using the following methods, including bank transfer, credit card, or third-party payment services (such as LINE Pay, Apple Pay, PayPal).

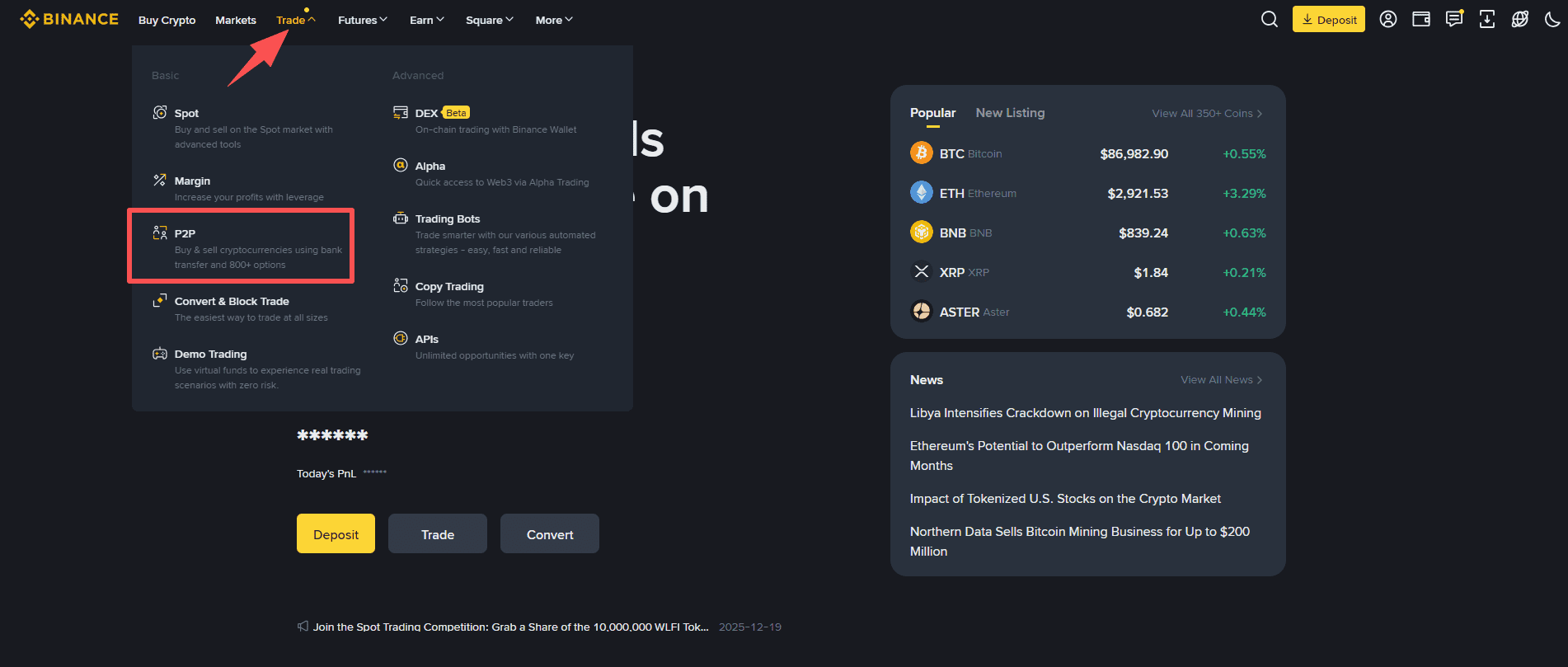

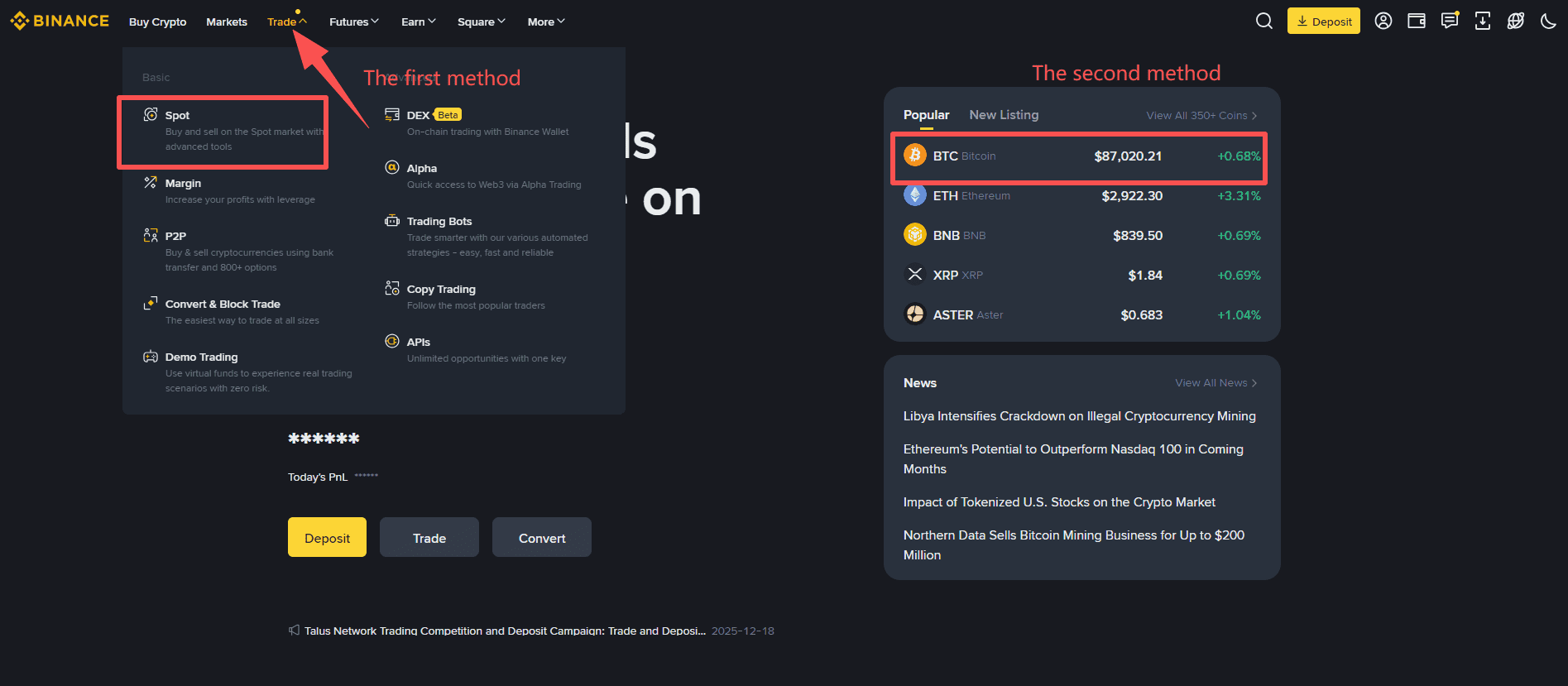

Step Three: Purchase Bitcoin

Navigate to the 'Trade' page or directly select 'BTC', then enter the desired amount, choose between a 'Market Order' or 'Limit Order', and click to purchase.

What should be noted when purchasing Bitcoin?

Buying Bitcoin typically involves three stages: pre-trade, in-trade, and post-trade. Each stage requires careful consideration, as errors in operation or falling victim to pitfalls can easily lead to losses.

Pre-Trade

Firstly, capital management is crucial. Ensure you invest only disposable funds, and that the investment size is within your acceptable risk tolerance for potential losses. It is highly inadvisable to purchase Bitcoin with borrowed funds, as beginners, due to their inexperience, are highly susceptible to losses. After incurring losses, they might be tempted to borrow more, leading to a vicious cycle that can gradually lead to severe financial distress. Secondly, always choose compliant, legitimate, and large-scale exchanges to avoid asset losses due to regulatory issues or even fraud.

In-Trade

After preparing for the trade, it is essential to familiarize yourself with the specific operating procedures to avoid missing opportunities or incurring unnecessary losses due to unfamiliarity with the process. Many beginners easily make a fundamental mistake: intending to buy but ultimately selling, or intending to sell but ultimately buying and sometimes do not even realize their error until after the operation is complete.

Post-Trade

After purchasing Bitcoin, it is crucial to securely safeguard your account password or wallet private key. Never click on unfamiliar links, nor should you blindly trust claims of high returns on deposited cryptocurrencies and transfer your assets. In short: there are no free lunches, and what you desire might very well be a trap set by others. Furthermore, after buying Bitcoin, beginners often constantly monitor its candlestick charts, anticipating price increases. However, continuous monitoring can adversely affect their mindset: they worry about a decline after a rise, leading to a quick sale; then, they worry about an increase after a sale, prompting them to buy again. This constant churn not only generates transaction fees but often results in buying high and selling low.