$1.33B Ethereum Whale Just Moved Another $120M USDT to Binance – Details

Ethereum is showing signs of weakness as it struggles to reclaim higher price levels amid sustained selling pressure and broader market uncertainty. After several failed attempts to break above key resistance near $3,600, the asset remains range-bound, reflecting the cautious sentiment across the crypto market. Despite this, several analysts believe the current phase could represent the final shakeout before Ethereum begins its next major rally.

According to recent on-chain data, large holders — including institutional players and crypto whales — continue to accumulate ETH even as volatility persists. This steady inflow from big buyers suggests growing confidence in Ethereum’s long-term potential, particularly as network fundamentals remain strong and liquidity conditions begin to stabilize.

The divergence between price weakness and whale accumulation highlights a recurring pattern seen in previous cycles, where accumulation intensifies near local lows before a significant recovery. While short-term traders remain defensive, long-term investors appear to be positioning ahead of a potential breakout once macro conditions improve.

Whale Activity Signals Renewed Ethereum Accumulation Ahead of Potential Rally

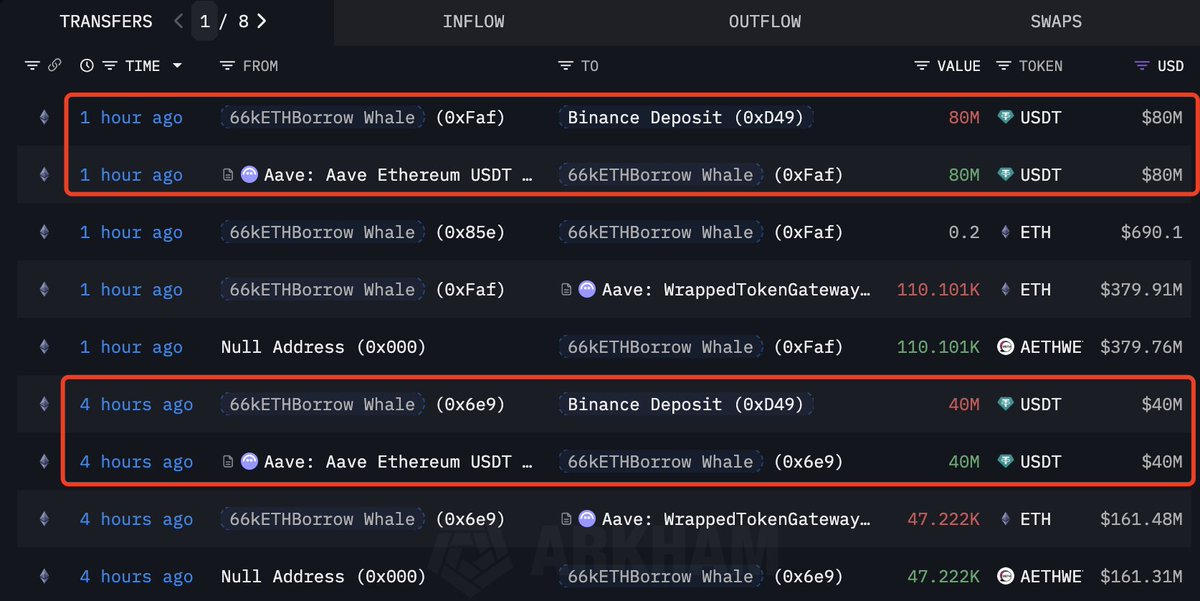

According to on-chain data, the well-known Ethereum whale “66kETHBorrow” — already one of the most active large buyers in recent weeks — has made another major move. After purchasing 385,718 ETH worth roughly $1.33 billion since early November, this whale has now borrowed an additional $120 million USDT from Aave and transferred it to Binance, a move widely interpreted as preparation for further accumulation.

Such behavior from a high-capital market participant often signals renewed confidence in Ethereum’s medium-term outlook. By leveraging borrowed funds, the whale is increasing exposure, suggesting expectations of a significant price rebound. This type of leveraged accumulation can create upward pressure on the market, especially when liquidity is thin and sellers are exhausted.

However, this strategy also carries risks. If Ethereum fails to sustain its current support near $3,400–$3,500, the whale could face mounting liquidation pressure — amplifying volatility across the broader market. Still, the scale and persistence of these purchases indicate that smart money continues to buy the dip, positioning ahead of what could be a major recovery phase.

Ethereum Consolidates Above as Bulls Attempt to Regain Control

The daily Ethereum chart shows a clear consolidation pattern forming above the $3,450–$3,500 zone, signaling an ongoing battle between bulls and bears. After weeks of selling pressure, ETH is attempting to stabilize, finding support at the 200-day moving average (red line), which continues to act as a critical long-term defense level.

Despite failing to reclaim the 50-day moving average (blue line), currently near $3,700, the structure suggests that downside momentum is weakening. Recent candles show tighter ranges and declining volume, often a sign of equilibrium before a potential breakout. For Ethereum to confirm a shift in trend, bulls need a decisive close above $3,650, which would open the door toward $3,900–$4,000, where the next key resistance cluster sits.

On the downside, if ETH loses the $3,400 support zone, the next major area of interest lies around $3,100, aligning with previous reaction lows and the psychological barrier where buyers have historically stepped in.

Featured image from ChatGPT, chart from TradingView.com