Canada CPI expected to ease slightly in October as markets assess BoC policy path

- Canadian inflation is expected to edge lower in October.

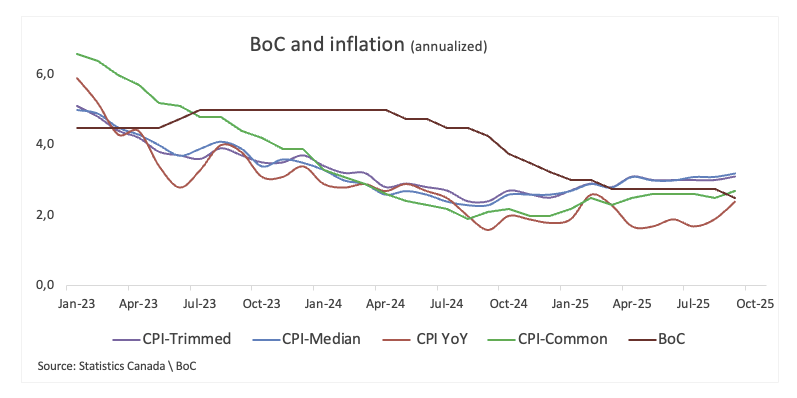

- The core CPI is still seen well above the BoC’s 2% goal.

- The Canadian Dollar managed to regain some composure this month.

All eyes will be on Monday’s inflation report, as Statistics Canada releases October’s CPI figures. The data will give the Bank of Canada (BoC) a much-needed update on price pressures ahead of its December 10 meeting, where policymakers are widely expected to keep rates steady at 2.25%.

Economists see headline inflation rising 2.3% in October, still above the BoC’s target after September’s 2.4% reading. On a monthly basis, prices are expected to edge up just 0.1%. The bank will also closely monitor its preferred core measure, which experienced a 2.8% YoY increase in September, following a 2.6% increase in August.

Analysts remain uneasy after last month’s inflation pickup, and the risk of US tariffs feeding into domestic prices is adding another layer of uncertainty. For now, both markets and the Bank of Canada appear poised to exercise caution.

What can we expect from Canada’s inflation rate?

The Bank of Canada cut its benchmark rate by 25 bps to 2.25% in October, a move that largely matched what markets were expecting.

At that meeting, Governor Tiff Macklem struck a cautiously optimistic tone. He said policy is now providing “some stimulus” as the economy loses momentum, and although consumption is likely to cool, he stressed that one soft data point wouldn’t be enough to shift the bank’s broader view. Still, he didn’t completely dismiss the possibility of two negative quarters. He also warned that equity valuations look “stretched”, hinting at growing unease beneath the surface.

Senior Deputy Governor Carolyn Rogers echoed that vigilance, noting the Canadian Dollar is still doing its job as a shock absorber and pointing to widening regional contrasts in the housing market. Both she and Macklem acknowledged that financial-stability risks have become part of the conversation again.

For markets, Monday’s headline CPI number will be the first thing they latch onto. But inside the BoC, the spotlight will be on the details, especially the Trimmed, Median, and Common core measures. The first two remain stuck above 3%, a level that continues to worry policymakers, while the Common measure has drifted higher as well, still comfortably above the bank’s target.

When is the Canada CPI data due, and how could it affect USD/CAD?

Markets will be dialled in on Monday at 13:30 GMT, when Statistics Canada releases October’s inflation numbers. Traders are on edge about the possibility that price pressures remain stubborn, keeping the uptrend firmly intact.

A hotter-than-expected print would fuel worries that tariff-driven costs are finally making their way to consumers. That kind of signal would likely push the Bank of Canada into a more cautious stance, at least in the near term. It could also give the Canadian Dollar a bit of short-term support, as investors brace for a policy path that hinges increasingly on how trade tensions evolve.

Pablo Piovano, Senior Analyst at FXStreet, notes that the Canadian Dollar has managed to appreciate since its lows earlier this month, prompting USD/CAD to slip back toward the key 1.4000 region. Meanwhile, further gains appear likely while above the key 200-day SMA near 1.3930.

Piovano indicates that the resurgence of a bullish tone could motivate spot to confront the November ceiling at 1.4140 (November 5), ahead of the April top at 1.4414 (April 1).

On the flip side, Piovano points out that a key support lines up at the 200-day SMA at 1.3929, prior to the October floor at 1.3887 (October 29). The loss of this region could spark a potential move toward the September valley at 1.3726 (September 17), seconded by the July trough at 1.3556 (July 3).

“In addition, momentum indicators remain constructive: the Relative Strength Index (RSI) lingers near the 53 level, while the Average Directional Index (ADX) eases toward 25, suggesting a still firm trend,” he says.

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Oct 29, 2025 13:45

Frequency: Irregular

Actual: 2.25%

Consensus: 2.25%

Previous: 2.5%

Source: Bank of Canada

Economic Indicator

BoC Consumer Price Index Core (YoY)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: Mon Nov 17, 2025 13:30

Frequency: Monthly

Consensus: -

Previous: 2.8%

Source: Statistics Canada