UK GDP expected to post modest growth in Q3

- The UK GDP is forecast to post a decent expansion in Q3.

- The BoE expects the economy to expand by 1.5% in 2025.

- GBP/USD seems to have met firm resistance near 1.3200.

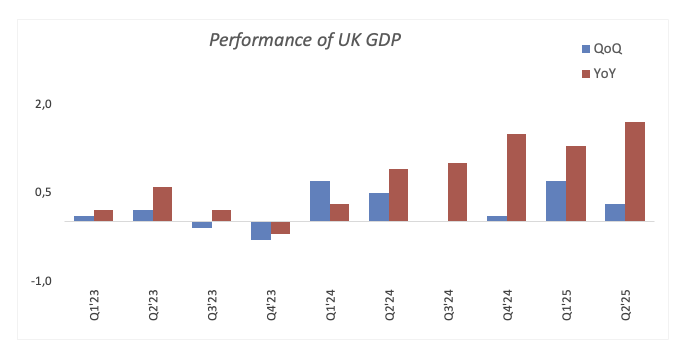

The UK’s Office for National Statistics (ONS) will release the advanced prints of the Q3 Gross Domestic Product (GDP) on Thursday. If the figures meet market consensus, the UK economy would have maintained its pace of expansion at 1.4% annualised, showing that momentum could have begun to stall. The QoQ report is expected to show a mild GDP growth of 0.2%.

At the Bank of England's (BoE) latest gathering, the Monetary Policy Committee (MPC) anticipated the domestic economy to grow by 1.5% in the current year.

According to projections, the BoE could further lower its policy rate by an additional 25 basis points at its December 18 gathering, particularly following a cooling labour market and a loss of momentum in domestic inflation.

Projections for the UK GDP

The Office for National Statistics (ONS) reported that the UK economy expanded 0.3% QoQ in the second quarter, compared with the 0.7% gain posted in the January-March period. On a monthly basis, the UK GDP expanded by a meagre 0.1% in September and is expected to remain flat in October.

In its latest meeting, the BoE downgraded its forecast for economic growth and now expects GDP to expand by 0.2% in Q3 (from “around 0.4%” in September).

Regarding inflation, the UK's Consumer Price Index (CPI) continues to rank among the highest within its major peers. As indicated by the most recent ONS report, in September, the headline CPI rose by 3.8% YoY, while the core print gained 3.5% YoY and 4.7% from services inflation.

When will the UK release Q3 GDP, and how could it affect GBP/USD?

The UK will release the preliminary Q3 Gross Domestic Product (GDP) on Thursday at 7:00 GMT.

Pablo Piovano, Senior Analyst at FXStreet, says, “GBP/USD’s current recovery appears to have met some decent hurdle around the 1.3200 region.”

“If bulls push harder, Cable could challenge its critical 200-day SMA in the 1.3270 region, prior to provisional barriers at its 55-day and 100-day SMA at 1.3382 and 1.3420, respectively. Further up comes the October top at 1.3527 (October 1), prior to the September ceiling at 1.3726 (September 17),” Piovano adds.

“On the flip side, the loss of the November base at 1.3010 (November 5) could see the next significant contention not before the April floor at 1.2707 (April 7),” he concludes.

Economic Indicator

Gross Domestic Product (MoM)

The Gross Domestic Product (GDP), released by the Office for National Statistics on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in the UK during a given period. The GDP is considered as the main measure of UK economic activity. The MoM reading compares economic activity in the reference month to the previous month. Generally, a rise in this indicator is bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Last release: Thu Oct 16, 2025 06:00

Frequency: Monthly

Actual: 0.1%

Consensus: 0.1%

Previous: 0%

Source: Office for National Statistics

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.