Ripple Price Forecast: XRP bullish comeback in focus ahead of US-China trade talks

XRP price solidly maintains $2.10 support, bolstered by increasing risk-on sentiment among large-volume holders.

Markets, including crypto, shift focus to the Fed interest rate meeting ahead of US-China trade talks.

The RSI’s indicator's pivotal movement around the midline signals XRP price consolidation and trader indecision.

Ripple (XRP) price is mum, holding firmly to support at $2.10, as consolidation extends on Wednesday, ahead of the Federal Reserve's (Fed) decision on interest rates and trade talks between the United States and China. The broader sideways movement reflected by Bitcoin's (BTC) choppy price action between $94,000 on the downside and $96,000 on the upside suggests that traders could wait for interest rate data to gauge the market's direction.

The CME Group FedWatch Tool shows that market participants expect the Federal Open Market Committee (FOMC) to leave interest rates unchanged at 4.25%-4.5%. According to the K33 Research weekly report, "the Fed's cautious stance stems from continued uncertainty driven by tariff policies and broader macroeconomic risks."

US-China trade talks set for this weekend

Tariff shocks between the US and China destabilized global markets in April as investors panicked. Tensions between the two economic giants accelerated beyond tariffs, with the US banning NVIDIA from exporting its specialized H20 computing chip to China. Similarly, Beijing halted the export of rare earth minerals to the US, as the government vowed to fight till the end.

However, experts have warned that the thawing trade tensions could have wider implications on global trade, prompting talks between the US and China's top officials.

"The current tariffs and trade barriers are unsustainable, but we don't want to decouple," US Treasury Secretary Scott Bessent said on Tuesday as he disclosed plans to meet China's top economic official, He Lifeng, in Switzerland this weekend.

Global markets, including crypto, will monitor the trade talks, hoping the two sides will agree to de-escalate tensions.

Bitcoin's uptrend has failed to make significant headway above $97,000 despite Exchange Traded Funds (ETFs) inflows exceeding 50,000 BTC between April 21 and May 2, highlighting caution among traders ahead of the FOMC meeting on Wednesday.

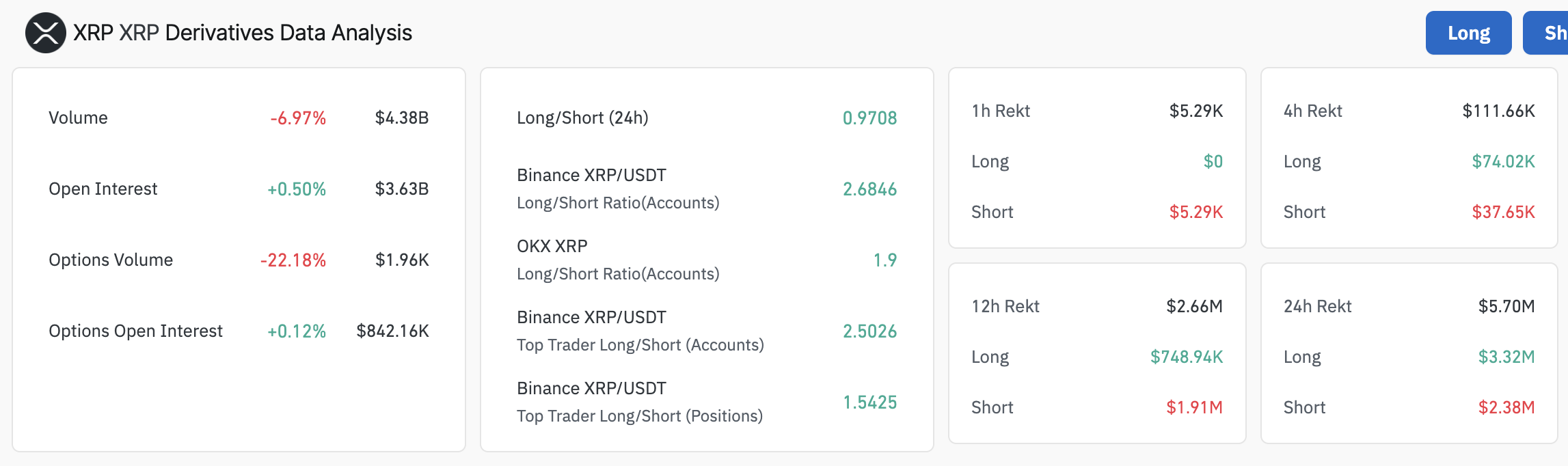

XRP's uptrend has been weighed down by trader indecision, underperforming major assets such as Bitcoin. The modest rise in Open Interest (OI) by 0.5% to $3.63 billion, per Coinglass data, signals a slight uptick in market participation.

However, the drop in trading volume by 6.97% to $4.38 billion caps the bullish outlook, suggesting low conviction, as few traders are buying or selling XRP.

XRP derivatives data | Source: CoinGlass

On-chain data on holder activity reveals that risk-on sentiment is improving. Santiment's Supply Distribution metric, shown below, reveals a steady rise in whale holdings for addresses with 1 million to 10 million XRP. This group now owns 9.44% of the total supply, a 1.2% increase from January 1's 8.24%.

The growing whale activity reflects strong investor confidence in XRP amid prolonged consolidation.

[07-1746597847072.38.23, 07 May, 2025].png)

XRP Supply Distribution metric : Source: Santiment

Can XRP price stage a recovery amid consolidation challenges?

XRP price moves broadly sideways between the 200-day Exponential Moving Average (EMA) at $1.99 and a confluence resistance created by the 50-day EMA and the 100-day EMA around $2.20.

A long-term descending trendline from January adds to the bulls' challenges to influence a rally toward $3.00.

The Relative Strength Index (RSI) indicator's gradual drop below the midline of 50 points to a strong bearish momentum with the potential to ignite losses below the short-term support at $2.10.

XRP/USD daily chart

Beyond the 200-day EMA support at $1.99, instability is expected to grip XRP, possibly resulting in larger-than-expected losses. Traders would focus on finding support at $1.80 and the April 7 low at $1.61 to collect liquidity before attempting another reversal.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.