Fed Signals Rare Japanese Yen Intervention: What Does it Mean for Bitcoin?

Global markets are on high alert as Japan’s yen stages its largest move in six months.

The move fuels speculation that Japan, potentially with US support, may intervene to stabilize the currency.

Yen Intervention Alert

Japan’s Prime Minister, Sanae Takaichi, warned against “abnormal” yen movements, sending the dollar-yen pair tumbling from the brink of 160 to 155.6 per dollar.

Notably, this had been its strongest level of 2026 and the sharpest one-day gain since August.

Traders note that short yen positions are at decade highs, heightening the risk of market turbulence if the currency weakens further.

“With short yen positions at decade highs and elections approaching, officials appear ready to act again, especially if the currency weakens further,” wrote market commentator Walter Bloomberg.

Adding to the volatility, the New York Federal Reserve (Fed) reportedly contacted major banks about the yen. Notably, such a step often seen as a precursor to coordinated currency intervention.

Historical precedent suggests that joint US–Japan action can be highly effective. Past interventions, including the 1985 Plaza Accord and the 1998 response to the Asian Financial Crisis, stabilized the yen, weakened the dollar, and propelled global assets higher.

Analysts now caution that a coordinated intervention could yield results similar to those seen in 2008, creating a significant liquidity boost for global markets.

“The Fed is intervening to save the yen,” CFA Michael Gayed noted, highlighting that a Japanese-only intervention could force the Bank of Japan to sell US Treasuries to acquire dollars, potentially destabilizing global debt markets.

Instead, coordinated action with the US could prevent such a fallout, while intentionally devaluing the dollar to support the Japanese yen.

Global Markets Brace for Impact: Dollar Weakness, Yen Strength, and Crypto Volatility

Market strategists point to the wider implications of such a move. Selling dollars to buy yen would weaken the greenback, increasing global liquidity and benefiting asset prices across stocks, commodities, and crypto.

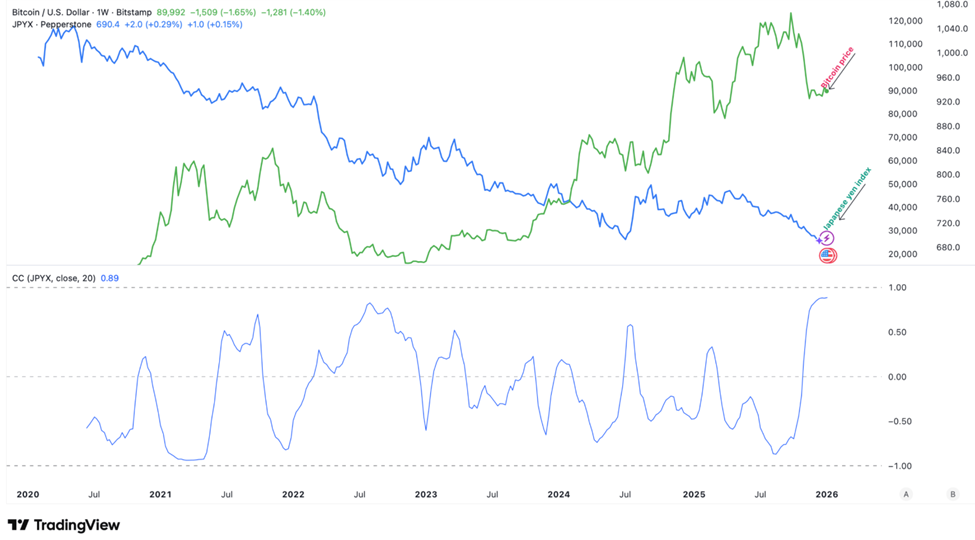

Bitcoin, for instance, has one of its strongest positive correlations with the yen and an inverse relationship with the dollar.

A weaker dollar could set the stage for a major repricing in crypto markets, though short-term volatility is likely as leveraged yen carry trades unwind.

In August 2024, a modest Bank of Japan rate hike strengthened the yen, triggering a six-day $15 billion crypto sell-off, including Bitcoin dropping from $64,000 to $49,000.

Treasury Risks and Investor Opportunities: Navigating Yen Strength and Dollar Weakness

US Treasury exposure is another key concern. Analysts warn that stress in Japan’s government bond market could spill over into US Treasuries, affecting global interest rates and safe-haven flows.

The macro picture is equally significant, as a weaker dollar could make US debt easier to manage and exports more competitive. However, markets could face turbulence as traders adjust to sudden yen strength.

Therefore, the setup is both risky and historically bullish for investors. If the Fed and Japan act in concert, the move could trigger a broad market rally. Such an outcome would provide long-term upside for equities, commodities, and digital assets.

However, short-term adjustments and liquidation pressures could create temporary pain, particularly for leveraged positions in yen-funded trades.

It explains why traders and policymakers alike are watching the yen, because the outcome could go beyond determining the trajectory of the dollar and yen. Rather, it could also set the stage for one of the most consequential macro setups of the year.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.