Gold price slips after robust US jobs data, trade optimism

- XAU/USD slumps, set to lose over 2.5% weekly as traders scale back Fed rate cut bets and risk appetite improves.

- April NFP beats estimates; unemployment steady at 4.2%, curbing aggressive Fed easing expectations.

- China says the US is open to trade talks, boosting sentiment and pressuring Gold.

Gold (XAU/USD) price edged down over 0.35% on Friday, poised to end the week with losses of over 2.50%. An improvement in risk appetite due to easing trade tensions alongside a strong labor market report in the United States (US) prompted investors to book profits ahead of the weekend. At the time of writing, XAU/USD trades at $3,226 after retreating from a daily high of $3,269.

Overnight news revealed that China’s commerce ministry said the US was willing to begin trade talks and tariffs and reassured Washington that Beijing’s door is open for discussions.

Bullion prices extended their losses on the headline that Nonfarm Payrolls in April crushed estimates, with the Unemployment Rate holding firm compared to March numbers. XAU/USD’s drop towards the day’s low of $3,222 was precipitated by traders reducing their bets that the Federal Reserve (Fed) would cut rates three times instead of four.

US Treasury yields rose sharply, but the US Dollar Index (DXY), which tracks the Greenback's performance against a basket of six other currencies, tumbled 0.20% to 99.98.

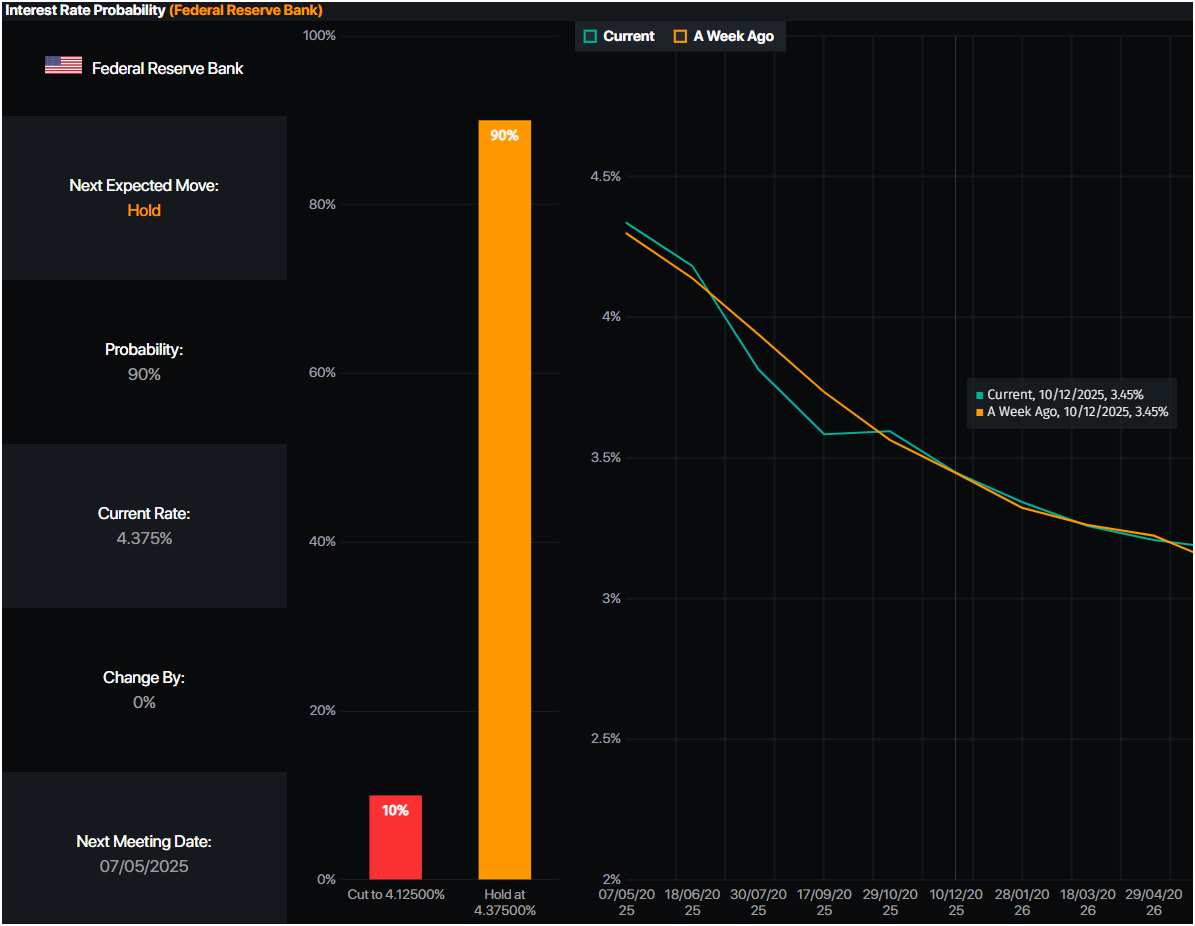

After the data release, investors rushed to price in 78 basis points of Fed rate cuts, as revealed by data from Prime Market Terminal.

Source: Prime Market Terminal

Next week, Gold traders are eyeing the release of the Federal Reserve’s monetary policy meeting, during which the US central bank is expected to keep rates on hold.

Daily digest market movers: Gold price edges lower as US Treasury yields jump

- Recently released data pushed US bond prices down, increasing US Treasury yields. The US 10-year Treasury note yield is soaring nine basis points, up to 4.312%. At the same time, US real yields rallied nine and a half bps to 2.062%, as shown by the US 10-year Treasury Inflation-Protected Securities yields.

- US Nonfarm Payrolls increased by 177K in April, down from the downwardly revised number of 185K in March but exceeding estimates of 130 K. Earlier in the week, a dismal ADP National Employment Change report suggested that companies were hiring fewer people than the NFP revealed.

- The US Unemployment Rate remained unchanged at 4.2%, which is aligned with forecasts and might prevent the Federal Reserve (Fed) from easing its policy.

XAU/USD technical outlook: Gold price remains bullish but poised to drop below $3,200

The Gold price correction extended below $3,250 after traders tried to reclaim $3,270 but failed. The Relative Strength Index (RSI) shows that sellers are gathering steam; hence, a drop below the $3,200 figure is likely.

In that outcome, the next support would be the April 3 high, which turned support at $3,167. Once surpassed, the next stop would be the 50-day Simple Moving Average (SMA), at $3,080. Conversely, if buyers lift Gold prices above $3,300, it would clear the path to challenge $3,350, followed by $3,400.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.