Ripple Price Prediction: XRP signals breakout as spot ETF prospects brighten

- XRP holders’ confidence grows as the chances of XRP spot ETF approvals jump to 85% from 65% in less than two months.

- XRP remains above support at $2.20, highlighted by a confluence of the 50- and 100-day EMAs.

- Traders anticipate a breakout above descending trendline resistance, backed by a buy signal from the MACD indicator.

- Still, discussion around XRP relative to other top cryptocurrencies has declined, increasing downside risks.

Ripple (XRP) price remains firmly supported at $2.20, while trading at $2.22 at the time of writing on Friday. The XRP community is growing increasingly confident in its holdings amid renewed optimism for the approval of spot XRP Exchange Traded Funds (ETFs) following the change in leadership at the Securities and Exchange Commission (SEC). If XRP confirms a break above a four-month descending trendline in the daily time frame, gains could accelerate towards $3.00.

XRP spot ETF approval chances jump

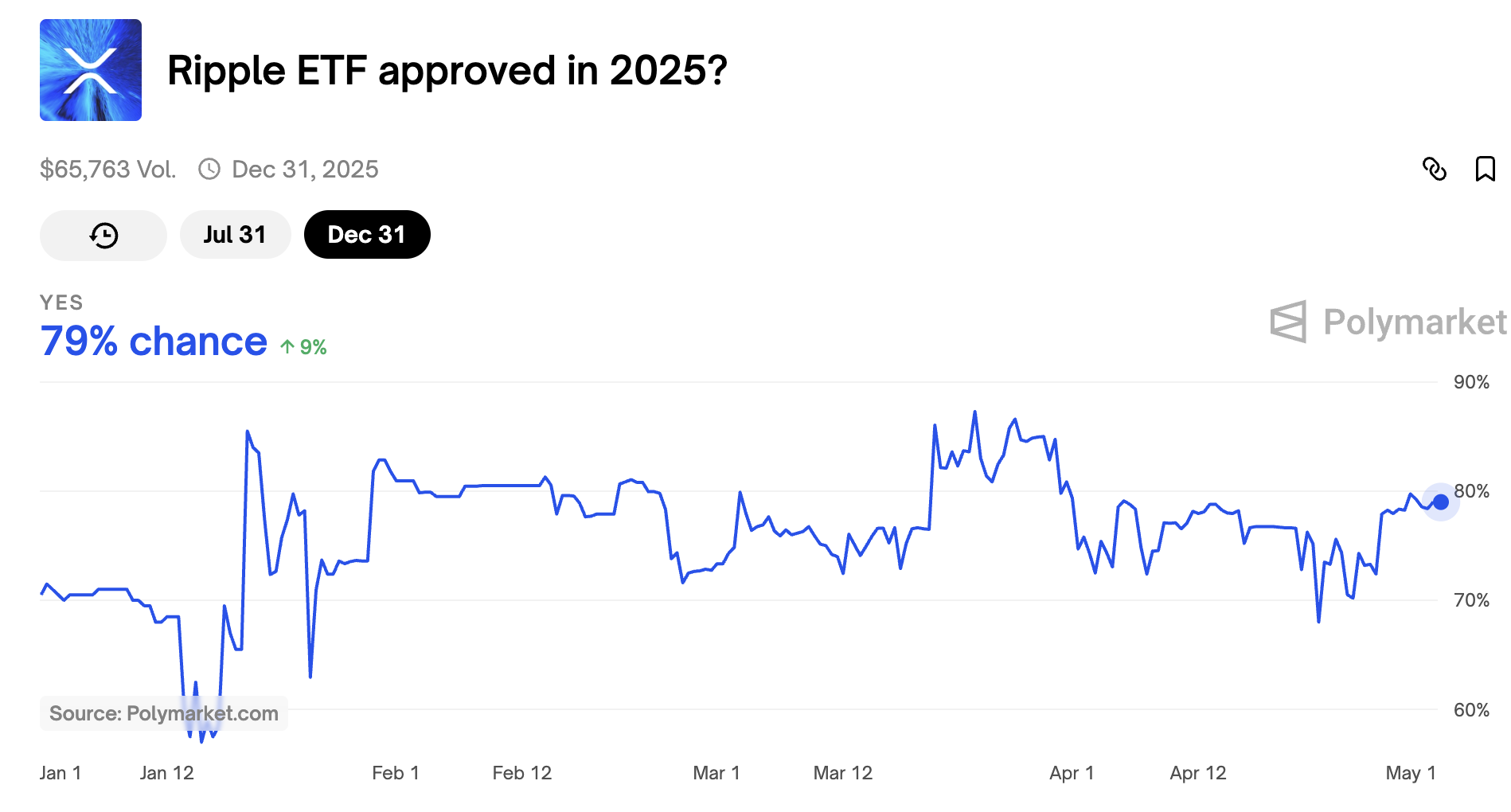

The change of leadership at the SEC, with Paul Atkins as the Chair of the regulatory agency, has seen the chances of an XRP spot ETF approval jump to 85% from 65% in just two months. According to Santiment, “traders are now predicting new all-time highs for XRP, and betting platforms like Polymarket reflect this shift, with 79% odds of approval by the end of the year.”

Spot XRP ETF approval odds | Source: Polymarket

The prospects of a spot XRP ETF approval have remained steady despite the SEC postponing its decision on Franklin Templeton’s spot ETF proposal until June 17. The approval of the spot ETF could significantly alter investment dynamics surrounding XRP, potentially attracting substantial institutional interest and propelling the token into the mainstream financial sector.

XRP uptrend could gain momentum

XRP’s price holds firmly to confluence support at $2.20, established by the 50- and 100-day Exponential Moving Averages (EMA). Despite the pivotal movement around this level in the past week, XRP shows signs of the uptrend’s continuation towards a medium-term target of $3.00.

A buy signal in the Moving Average Convergence Divergence (MACD) indicator reinforces the bullish momentum. This signal was confirmed on April 12 when the MACD line (blue) crossed above the signal line (red).

Additionally, the indicator’s movement above the center line, accompanied by the expansion of green histograms, increases the likelihood of a breakout above the descending trendline, as illustrated on the daily chart.

XRP/USDT daily chart

Traders should prepare for possible drawdowns at $2.50 and $2.80 supply zones. Selling due to profit-taking could overwhelm bullish momentum at these levels, slowing the uptrend or even leading to reversals.

The SuperTrend indicator’s sell signal highlights the potential selling pressure in XRP’s recovery path. This indicator sends a sell signal when it flips above the token’s price, changing color from green to red. Traders should consider the position of the SuperTrend when making decisions.

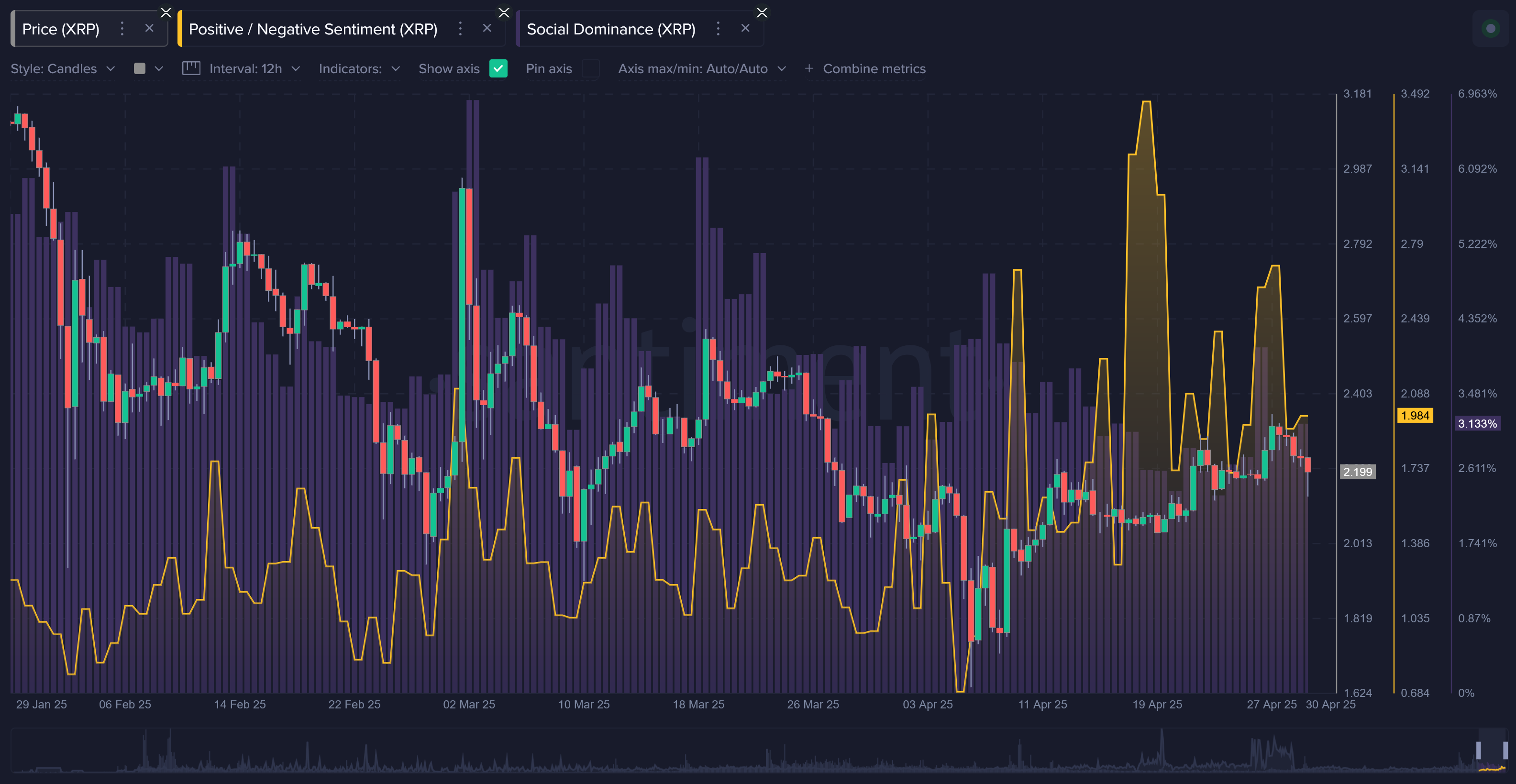

Meanwhile, Santiment’s biweekly market update notes that chatter about XRP, compared to other top cryptocurrencies, has steadily declined over the past three months. This downtrend in social dominance could hold back XRP’s uptrend.

XRP’s ratio of bullish vs. bearish commentary | Source: Santiment

In the event that support at $2.20 gives way, and the XRP price slides, traders would look to the 200-day EMA at $1.99 for a potential rebound. Beyond this level, volatility could spike, creating instability and accelerating losses toward XRP’s April 7 low at $1.61.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.