Bitcoin Price Forecast: BTC eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

- Bitcoin price stabilizes around $95,000 on Tuesday; a breakout suggests gains towards $100,000.

- US spot Bitcoin ETFs recorded an inflow of $591.29 million on Monday, continuing the inflows since April 17.

- MicroStrategy announced that it has acquired 15,355 BTC for $1.42 billion, bringing its total holding to 553,555 BTC.

- Arizona passes a bill that allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically Bitcoin.

Bitcoin (BTC) price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded an inflow of $591.29 million on Monday, continuing the trend since April 17. Moreover, MicroStrategy (MSTR) announced that it had acquired 15,355 BTC for $1.42 billion, and the US state of Arizona passed a bill that allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically BTC.

Institutional demand continues the trend of inflows

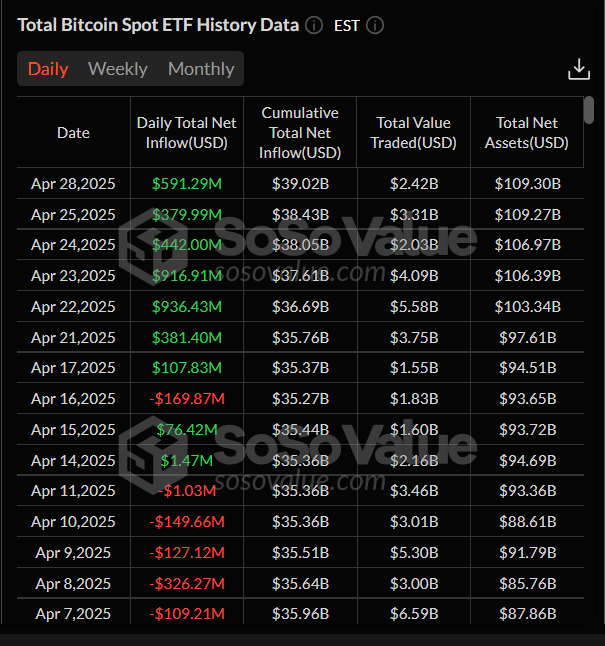

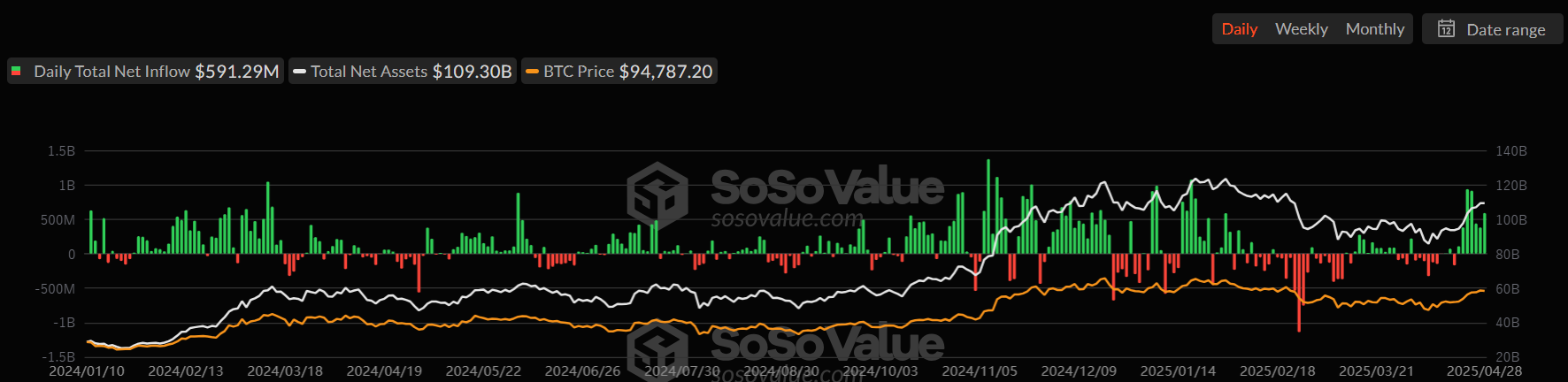

Bitcoin institutional demand remained strong as the week started. According to SoSoValue data shown below, the US spot Bitcoin ETF recorded an inflow of $591.29 million on Monday, continuing the trend of inflows since April 17. If these inflows continue and intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

Corporate demand for BTC shows strength

MicroStrategy announced on Monday that it has acquired 15,355 BTC for $1.42 billion at an average price of $92,737 per BTC. The firm added 6,556 BTC last week and currently holds 553,555 BTC.

Corporate companies’ demand for BTC and their addition to reserves are generally bullish for Bitcoin’s price, driven by increased demand, reduced circulation, and positive market sentiment. Bitcoin will likely experience more stable price growth over the long term if this trend continues.

Arizona could be the first state to hold BTC as reserve

According to the Bloomberg Government report, Arizona’s Bitcoin Reserve Bill SB1025 was passed on Monday, which allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically Bitcoin.

The bill is now sent to Democratic Governor Katie Hobbs’s desk, and if signed, the state would be the first to require public funds to invest in Bitcoin. Arizona will become the first US state to hold Bitcoin as a reserve asset, which could set a precedent for other states, such as New Hampshire and Texas, also listed in the State Reserve Race.

Bitcoin Price Forecast: BTC bulls eye for $100,000 mark

Bitcoin price broke above its 200-day Exponential Moving Average (EMA) at $85,000 early last week, rallying 11.14% until Friday. However, BTC failed to close above its March high of $95,000 and declined slightly over the weekend. On Monday, BTC rose slightly and retested the $95,000 level. At the time of writing on Tuesday, it is stabilizing around this level.

If BTC breaks and closes above $95,000 on a daily basis, it could extend the rally to retest its next daily resistance at $97,000. A successful close above this level could extend additional gains to retest its psychological resistance at $100,000.

The Relative Strength Index (RSI) on the daily chart holds at 67 after being rejected around its overbought level of 70 on Saturday, indicating fading bullish momentum. However, given the current market sentiment and increasing institutional and corporate demand, this may be a pause or consolidation before the next leg of the upward trend.

BTC/USDT daily chart

However, if BTC fails to close above the $95,000 resistance level and faces a pullback, it could extend the decline to find support around the $90,000 psychological importance level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.