Ethereum Price Forecast: ETH surges above $3,400 on back of robust treasuries, derivatives, and on-chain boost

Ethereum price today: $3,350

- Ethereum treasury firms have accumulated over 570,000 ETH in the past two months.

- Ethereum open interest increased by 1.84 million ETH in July, while funding rates have remained modest.

- The total amount of ETH in staking pools has surged by 1.51 million ETH since the beginning of June.

- ETH could flip the $3,470 resistance and rally to $3,600 after smashing key hurdles.

Ethereum (ETH) briefly surged above $3,400 on Wednesday, driven by increased demand from crypto treasury companies and strong interest in its derivatives and spot markets.

ETH stretches its rally amid strong corporate and retail interest

Ethereum continued its impressive performance on Wednesday, outperforming every token among the top 20 cryptocurrencies by market capitalization — except for DOGE — with a 10% rise over the past 24 hours. The move has stretched its weekly gains above 25%.

These developments follow the adoption of an ETH treasury by several low-cap, publicly listed companies. In the past two months, Nasdaq-listed firms SharpLink Gaming (SBET), BitMine (BMNR), Bit Digital (BTBT), BTCS and GameSquare (GAME) have raised over a billion dollars to launch their respective ETH reserves. These firms have purchased over 570,000 ETH during the period, according to data from the Strategic ETH Reserve website.

In an interview with CNBC earlier this month, BitMine board Chairman and Fundstrat CIO Thomas Lee stated that the pivot toward an ETH treasury stems from regulatory tailwinds favoring Ethereum, especially through the GENIUS stablecoin bill. The bill, which passed the Senate in June, could reach the President's desk if House lawmakers reach a positive resolution on it in the ongoing Crypto Week.

The increased attention from ETH treasuries has caused a ripple effect across both the ETH spot and derivative markets. Demand from institutional investors has been rising with US spot ETH exchange-traded funds pulling in $3.27 billion in net inflows since May, per SoSoValue data.

The strong interest in ETH is also reflected in the derivatives market, where open interest (OI) has been rising steadily since the beginning of the month. Open interest is the total amount of outstanding contracts in a derivatives market. Ethereum's OI has increased by 1.84 million ETH in July.

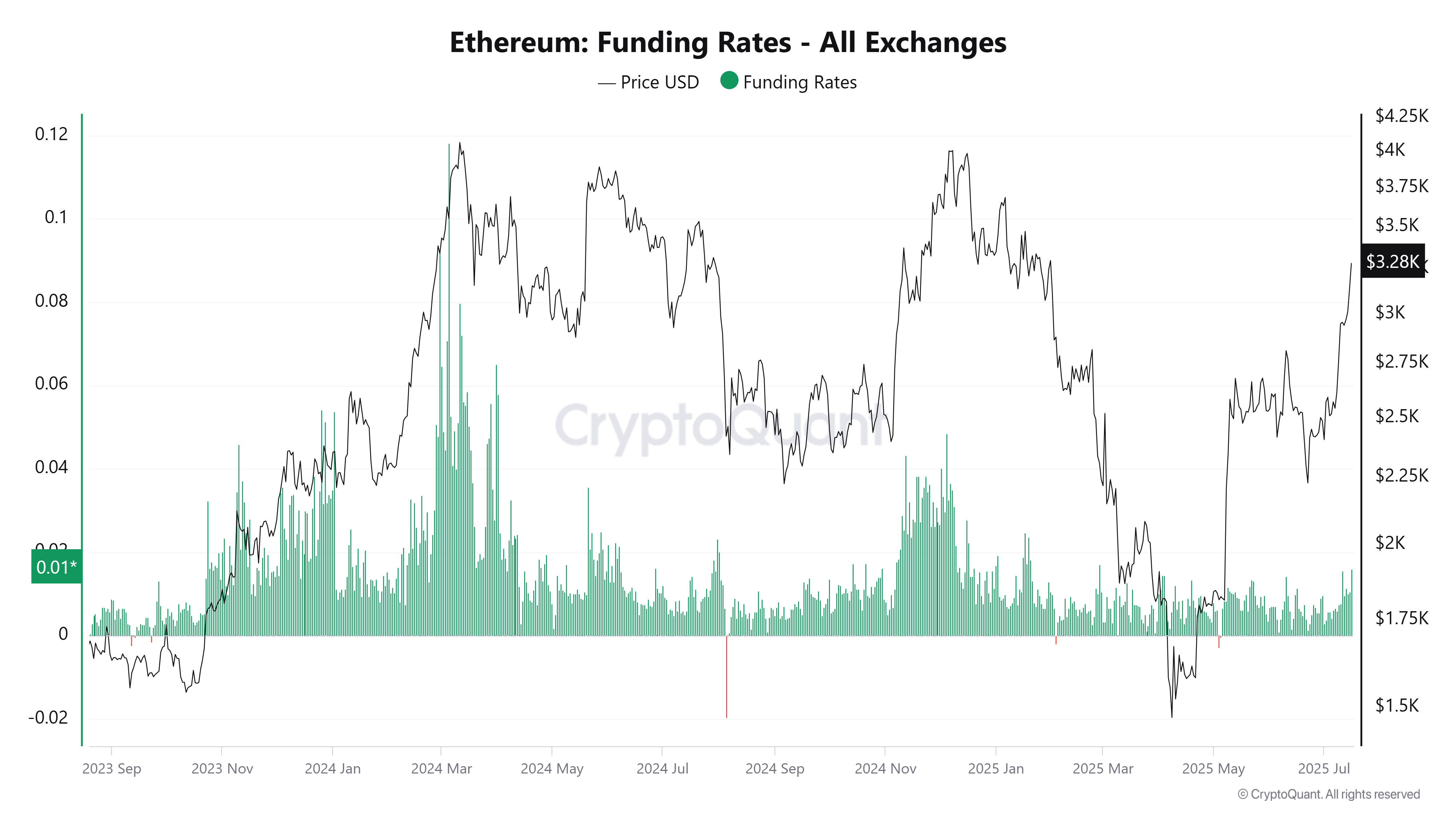

Despite the strong growth in ETH's OI and price over the past week, its funding rate has remained modest compared to past rallies. This suggests fresh positioning without overleveraging, which are signs of a healthy rally.

ETH Funding Rates. Source: CryptoQuant

Meanwhile, on-chain data also supports the price growth, ETH's transaction count has remained elevated since May after Ethereum underwent the Pectra upgrade.

The Pectra upgrade introduced several features to the Ethereum mainnet, including an improvement to ETH's staking mechanism. As a result, the amount of staked ETH has been on an upward trajectory in the past month. Between June 1 and July 15, investors have piled in a net deposit of 1.51 million ETH into staking platforms, with over one-third of that figure potentially coming from treasury companies.

-1752707908314.png)

ETH Total Value Staked. Source: CryptoQuant

Ethereum Price Forecast: ETH sets sight on $3,600

Ethereum experienced $197.68 million in futures liquidations over the past 24 hours, with long and short positions liquidated to the tune of $30.01 million and $167.66 million, respectively.

After sustaining a firm close above the upper boundary of a key ascending trendline resistance — extending from May 13 — on Tuesday, ETH has begun another leg up that could stretch its rally toward $3,600.

-1752708005913.png)

ETH/USDT daily chart

The top altcoin has also surged above the resistance near $3,220, and is on the verge of hitting the next key level at $3,470. However, a failure to hold the $3,220 level could see ETH decline back toward the ascending trendline. Further down, the $2,850 level, strengthened by the 14-day Exponential Moving Average (EMA), could help provide support.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are deep in their overbought regions, indicating strong bullish momentum. However, sustained moves in the overbought regions also increase the risk of a correction.

A daily candlestick close below $2,500 will invalidate the thesis and potentially send ETH to $2,110 if the support at $2,400 fails.