Ethereum Price Forecast: Investors eye $3,400 following record inflows and BitMine's $500 million ETH acquisition

Ethereum price today: $3,000

- BitMine disclosed over 163,000 ETH holdings worth about $500 million.

- Ethereum investment products saw nearly $1 billion in weekly net inflows, their fourth-largest ever.

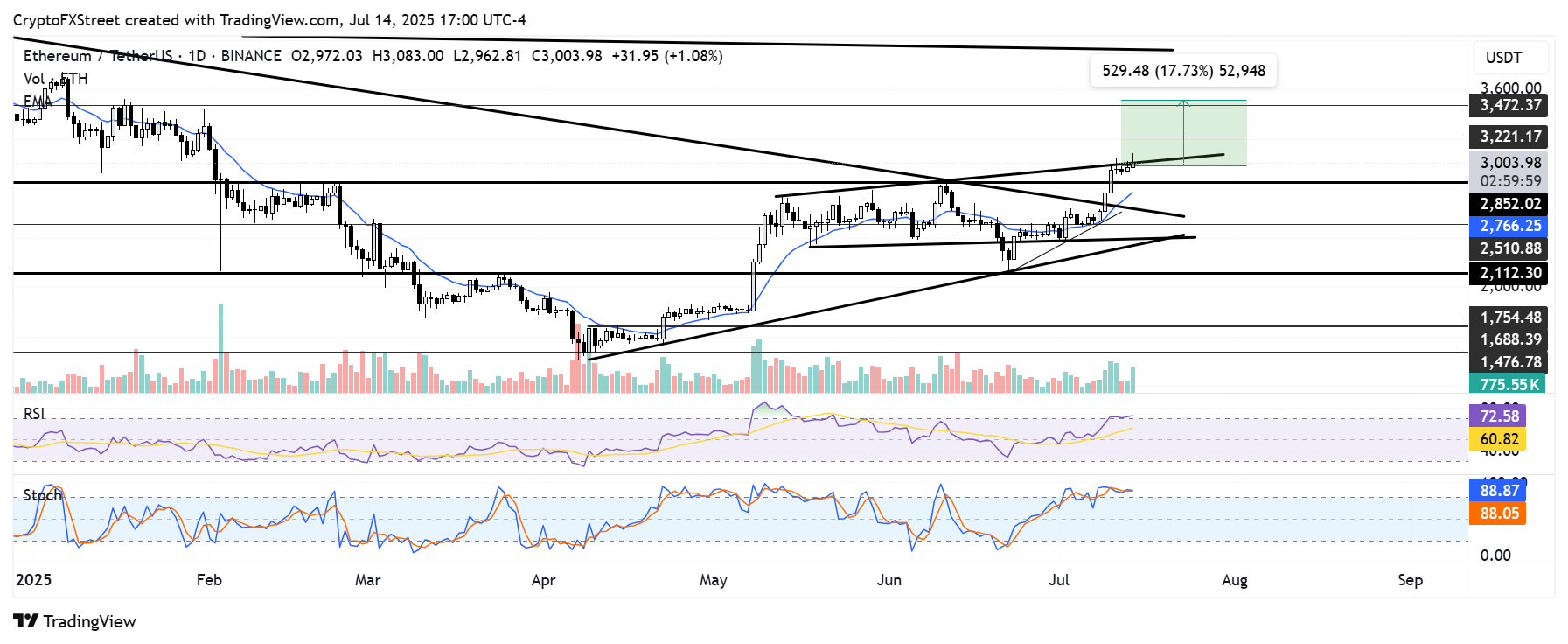

- ETH eyes $3,400 but faces strong resistance near the upper boundary of an ascending right-angled broadening wedge.

Ethereum (ETH) trades near $3,000 on Monday following BitMine's (BMNR) disclosure of over 163,000 ETH holdings. The company's purchase comes as investors have piled in over $990 million into record-breaking inflows into ETH exchange-traded funds (ETFs).

BitMine reveals $500 million stash as ETH ETFs near $1 billion inflows

Nasdaq-listed BitMine Immersion Technologies revealed that it has acquired 163,142 ETH worth over $500 million. The acquisition comes after the company closed its $250 million private placement (PIPE), an effort announced last month to kickstart its pivot from a Bitcoin model to an ETH treasury.

The company's ETH holdings, which are now worth double the $250 million proceeds from its PIPE, place it as one of the top ETH holders among publicly traded firms.

BitMine's Chairman and Fundstrat CIO, Thomas Lee, has shared how he intends to create an ETH version of financial software and BTC treasury company MicroStrategy. He likened the company's approach to a "sovereign put" that makes it attractive to nation-states interested in Bitcoin.

"Similarly, ETH Treasuries, which accumulate 5% of ETH supply, can benefit from a similar 'Wall Street put,'" Lee said in a press release on Monday.

BitMine's ETH disclosure comes after Ethereum investment products recorded $990.4 million in net inflows last week, marking their fourth-largest weekly inflows ever, per CoinShares data. US spot ETH ETFs dominated the flows, with a record weekly net inflow worth nearly $908 million, per SoSoValue.

The positive performance comes amid general bullish sentiments in the crypto market, as revealed by $3.7 billion inflows into digital asset funds last week.

The bullish positioning was ignited by President Trump's Big Beautiful Bill (BBB), "a massive fiscal stimulus package," according to Nick Forster, founder of crypto options exchange Derive, in a note on Monday.

"Historically, similar environments (such as during COVID) sparked sharp rallies in crypto as excess liquidity flowed into risk assets," wrote Forster.

On the derivatives front, investors on Derive are positioning for a potential higher upside in ETH amid the recent surge toward $3,000.

"For ETH, bullish sentiment is even more pronounced. 45% of ETH's open interest on the July 18 expiry is concentrated on the $3,400 strike, with that one strike making up 16% of ETH weekend volume," added Forster. He shared how such positioning indicates the expectation of a major breakout among traders.

Ethereum Price Forecast: ETH faces resistance at broadening wedge upper boundary

Ethereum saw $97.40 million in futures liquidations in the past 24 hours, according to Coinglass data. The total amount of long and short liquidations accounted for $51.18 million and $46.22 million, respectively.

ETH is attempting a move above the upper boundary of an ascending right-angled broadening wedge after claiming the $3,000 mark, but is facing strong resistance. If ETH overcomes this resistance and flips the wedge's upper boundary to a support level, it could stretch its gains to $3,470.

ETH/USDT daily chart

However, a firm decline below $3,000 could see ETH test the $2,850 key level and further down, it could find support near the upper boundary of a symmetrical triangle — just above $2,500.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in their overbought regions, signaling a strong bullish momentum but with potential for a short-term pullback.

A daily candlestick close below $2,500 will invalidate the thesis and potentially send ETH to $2,110.