Ethereum Price Forecast: ETH investors resume buying amid strong ETF inflows and low exchange reserves

Ethereum price today: $2,570

- Ethereum exchange reserves have flipped toward accumulation, reaching an all-time low of 18.57 million ETH.

- Ethereum ETFs posted $583 million in weekly net inflows, their strongest performance since December.

- MEXC's Tracy Jin gives a cautious ETH price growth prediction despite positive developments surrounding the Ethereum ecosystem.

- ETH faces rejection at the 200-day SMA after holding the $2,500 support through the weekend.

Ethereum (ETH) briefly crossed above $2,600 on Monday following a switch to accumulation in the top altcoin's exchange reserve and $583 million in inflows into ETH investment products last week.

Ethereum exchange reserves hit all-time low amid $583 million ETF inflows

Ethereum resumed bullish action on Monday after its exchange reserve flipped back to a downtrend, declining from 18.72 million ETH on Saturday to an all-time low of 18.57 million ETH over the past 24 hours. As the total value of exchange reserves drops, it indicates rising buying pressure.

-1750124822895.png)

ETH Exchange Reserve. Source: CryptoQuant

During the period, ETH's total value staked also grew by 80K ETH, signifying a stronger bullish sentiment among investors, according to data from Beaconcha.in.

The shift toward accumulation in ETH follows a strong week of institutional buying pressure, which pushed net inflows in global Ethereum products to $583 million last week, according to CoinShares data.

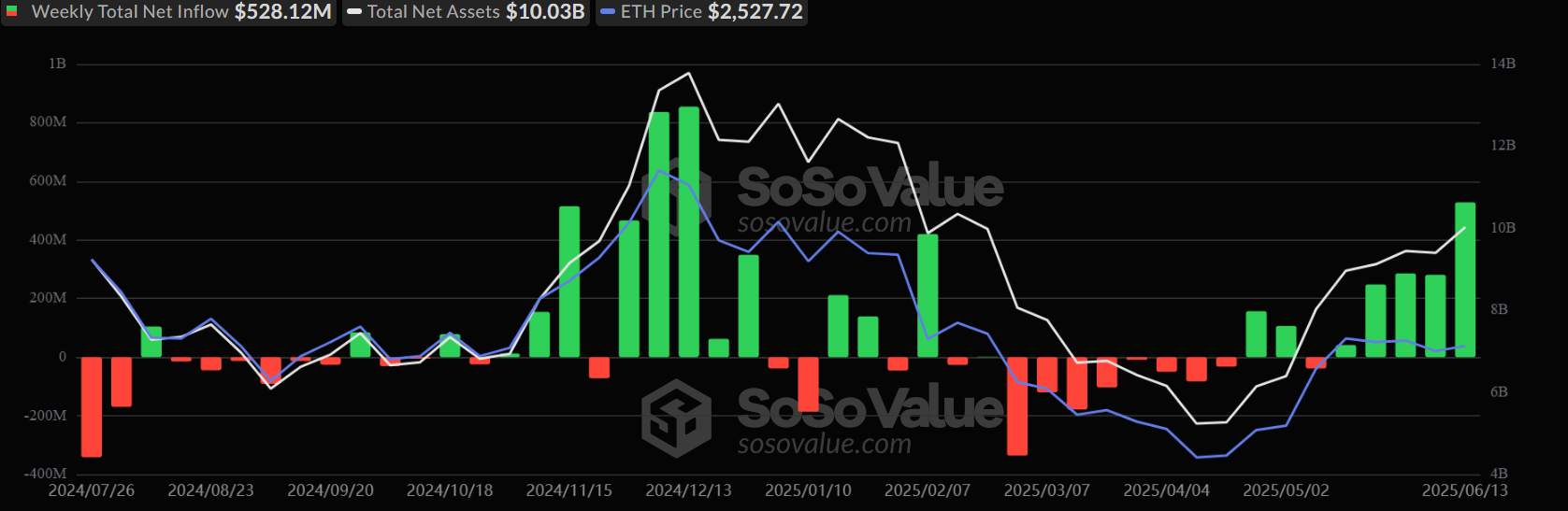

The buying pressure was spearheaded by $528.12 million inflows into US spot ETH exchange-traded funds (ETFs), their highest weekly performance since December 2024. The products recorded a 19-day run of net inflows before breaking the streak on Friday, with mild outflows of $2.18 million following the escalation of tensions in the Middle East.

US spot ETH ETF Flows. Source: SoSoValue

"Ethereum's recovery is being supported by the 'digital oil' narrative and ecosystem fundamentals, like the Pectra upgrade and increased stablecoin activity, with almost 50% of all stablecoins on the Ethereum network," said Tracy Jin, COO of crypto exchange MEXC.

"It's also good to see that the rules around staking and new stablecoin-related ETFs are coming into effect, which is helping to boost investor confidence," she added.

Despite the positive developments surrounding ETH recently, Jin maintained a cautious end-of-year price prediction for ETH.

"ETH could be between $2,800 and $3,600 by the end of the year, with the possibility of going even higher if ETF staking and network developments speed up," Jin said.

Ethereum Price Forecast: ETH sees rejection at 200-day SMA

Ethereum experienced $134.04 million in futures liquidations, with long and short liquidations totaling $70.55 million and $63.49 million, respectively, over the past 24 hours, per Coinglass data.

ETH held support near $2,500 through the weekend and tested the 200-day Simple Moving Average (SMA) as dynamic resistance before experiencing a rejection. The top altcoin could test the $2,850 key resistance if it flips the 200-day SMA support. A rejection at $2,850 will imply a double-top formation.

ETH/USDT daily chart

On the downside, if the $2,500 support fails, ETH needs to hold the lower boundary of a key channel, strengthened by the 50-day SMA, to prevent a decline to the $2,260 to $2,110 support range.

The Relative Strength Index (RSI) is above its neutral level and could test its moving average line, while the Stochastic Oscillator (Stoch) is below its neutral level. A successful crossover above in both indicators will strengthen the bullish momentum.