Crypto Today: Bitcoin, Ethereum, XRP rebound along with surge in open interest, trading volumes

- Bitcoin extends gains, testing resistance at $107,000, amid prevailing geopolitical tensions.

- Bitcoin derivatives open interest surges to $72 billion as trading volume nears $60 billion in the last 24 hours, signaling a return to risk-on sentiment.

- Ethereum sustains broad consolidation between key support and resistance levels, bolstered by $583 million in inflows last week.

- XRP eyes a breakout from a descending channel as inflows in related financial products improve, reaching $11.8 million.

Cryptocurrencies are broadly recovering on Monday, extending gains from the weekend, which followed instability and heightened volatility on Friday as geopolitical tensions exploded in the Middle East. Bitcoin (BTC) hovers above $107,000, up over 4% from its Friday low of $102,664.

Meanwhile, Ethereum (ETH) and Ripple (XRP) have shown signs of a steadying recovery, bolstered by rising risk-on sentiment, particularly from institutional investors.

Market overview: Bitcoin, Ethereum, and XRP recover despite Israel-Iran conflict

The conflict between Israel and Iran has escalated since the initial strike on Friday. After sustaining a wide-scale strike on nuclear facilities, ballistic missile factories and military commanders, Iran retaliated by launching drones and missile attacks on Israel.

Reuters reports that Iran has rejected calls for a ceasefire, while Israel has vowed to make Tehran pay for Monday's dawn attacks on Tel Aviv and Haifa. The world remains on edge amid looming escalation.

Despite the recovery observed in major digital assets, including Bitcoin, Ethereum, and XRP, the total market capitalization remains close to last week's lows, around $3.40 trillion. Volatility will likely be one of the main concerns for traders this week.

Data spotlight: Digital asset inflows steady despite geopolitical tensions

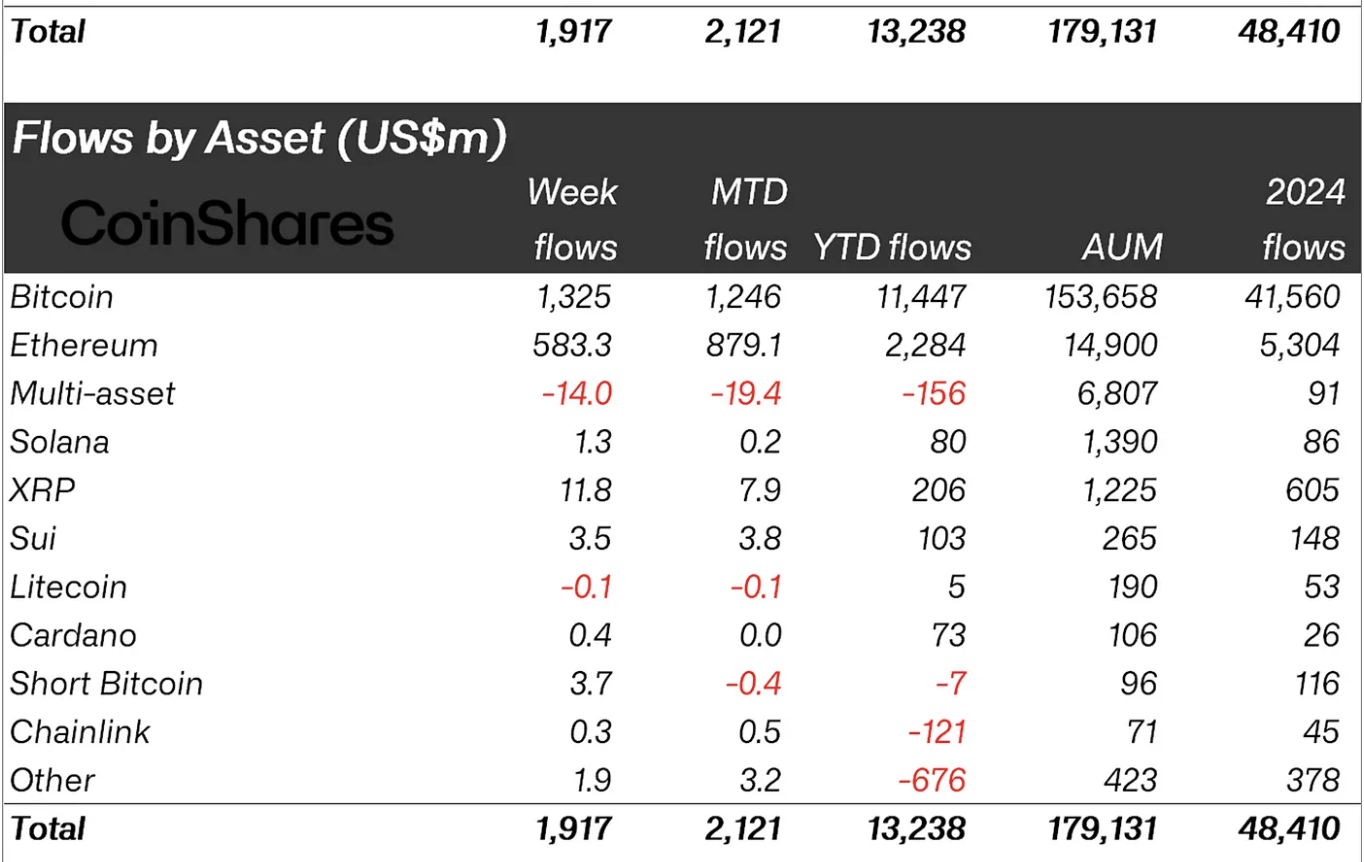

Digital asset investment products saw cumulative inflows of $1.9 billion last week, marking the ninth consecutive week of positive flows and a record year-to-date total of $13.2 billion, according to CoinShares' report.

Bitcoin experienced a significant rebound, with $1.3 billion in inflows, while Ethereum saw a $583 million inflow. This was the smart contracts token's strongest week since February.

Ethereum assets under management (AUM) surged to $14.9 billion, while XRP stood out among altcoins, boasting over $11.8 million in weekly inflows. Sui experienced renewed investor interest, with last week's inflows reaching $3.5 million.

"Bitcoin's resilient price action appears underpinned by continued institutional accumulation," QCP Capital states in the latest market update. "Notably, Metaplanet and Strategy have persisted in buying the dip, while spot BTC Exchange Traded Funds (ETFs) recorded their seventh consecutive week of inflows," the update added.

Digital asset investment weekly inflow data | CoinShares

The derivative market ticked up over the weekend after sustaining massive liquidations on Friday, which exceeded $1 billion in 24 hours. Bitcoin's Open Interest (OI) has increased to $72 billion, along with a 28% surge in trading volume to $58 billion, according to CoinGlass data.

OI represents the number of active futures and options contracts that have yet to be settled or closed. An increase in OI, in tandem with volume, often signals an improving risk-on sentiment and increased market participation. In other words, traders are willing to bet on Bitcoin's price recovering despite the tensions in the Middle East.

Bitcoin derivatives market stats | CoinGlass

Chart of the day: Bitcoin edges higher, targeting $110,000

Bitcoin's price hovers slightly at around $107,037 at the time of writing, rising slightly on the day. Short-term technical indicators, such as the 4-hour Moving Average Convergence/Divergence (MACD), indicate a bullish outlook bolstered by a buy signal.

Traders will likely continue to seek exposure to BTC if the MACD indicator sustains the buy signal sent on Sunday when the blue MACD line crossed above the red signal line.

The Relative Strength Index (RSI) reinforced the bullish grip and momentum after rising above the 50 midline from near-oversold levels on Friday. Further movement toward the overbought territory could pave the way for additional gains toward the key resistance at $110,000.

BTC/USD 4-hour chart

Traders should consider a potential correction below $107,000, especially if the uptrend toward $110,000 loses steam. In such a scenario, key areas of interest would be $106,188, where the 50-period Exponential Moving Average (EMA) and the 100-period EMA converge, and the 200-period EMA at $104,696.

Altcoins update: Ethereum, XRP offer technical recovery signals

Ethereum's price has remained largely above the 200-period EMA support on the 4-hour chart at around $2,503, marking its lower consolidation limit. Following Friday's sell-off, the ETH price gained bullish momentum, breaking above two key levels: the 100-period EMA, currently at $2,582, and the 50-period EMA at $2,592.

The MACD indicator has maintained a buy signal since Sunday, encouraging traders to seek exposure to ETH. If institutional and retail interest in Ethereum steadies this week, the uptrend could accelerate toward the coveted $3,000 level.

ETH/USDT 4-hour chart & XRP/USDT daily chart

Meanwhile, the price of XRP is printing the second green daily candle after the sell-off that tested the 200-day EMA support at around $2.09 on Friday. The cross-border remittance token is trading at around $2.20 at the time of writing, up over 1.5% on the day.

Traders may anticipate a buy signal if the blue MACD line crosses above the red signal line in upcoming sessions. If demand for XRP overwhelms selling pressure, a breakout toward a recent peak of $2.65 will be on the cards.

Other key areas for monitoring include the buyer congestion at $2.00 and the seller congestion at $2.40, likely to determine the direction of the trend in the near term.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.