Bitcoin Price Forecast: BTC hits fresh high above $110,000 with low selling pressure as on-chain metrics strengthen

- Bitcoin extends its rally on Thursday, trading above $110,000 and eyeing the $120,000 milestone.

- BTC’s open interest surpasses $80 billion while selling pressure remains muted, highlighted by low exchange inflow activity.

- The Texas Senate passed the Strategic Bitcoin Reserve bill , which awaits the Governor’s signature, signaling growing institutional support.

Bitcoin (BTC) continues its rally, setting a new all-time high of $111,880 on Thursday, eyeing the $120,000 milestone. On-chain data further supports the bullish thesis, with open interest at new highs and low exchange inflow activity, a sign of reduced selling pressure. Additionally, the Texas Senate passed the Strategic Bitcoin Reserve bill SB21 on Wednesday, another factor supporting institutional support to the main crypto.

Bitcoin price soars as on-chain metrics shine

CoinGlass’ data shows that the futures’ Open Interest (OI) in BTC surpassed $80 billion on Thursday, a new all-time high, reflecting strong market engagement. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current BTC price rally.

BTC open interest chart. Source: Coinglass

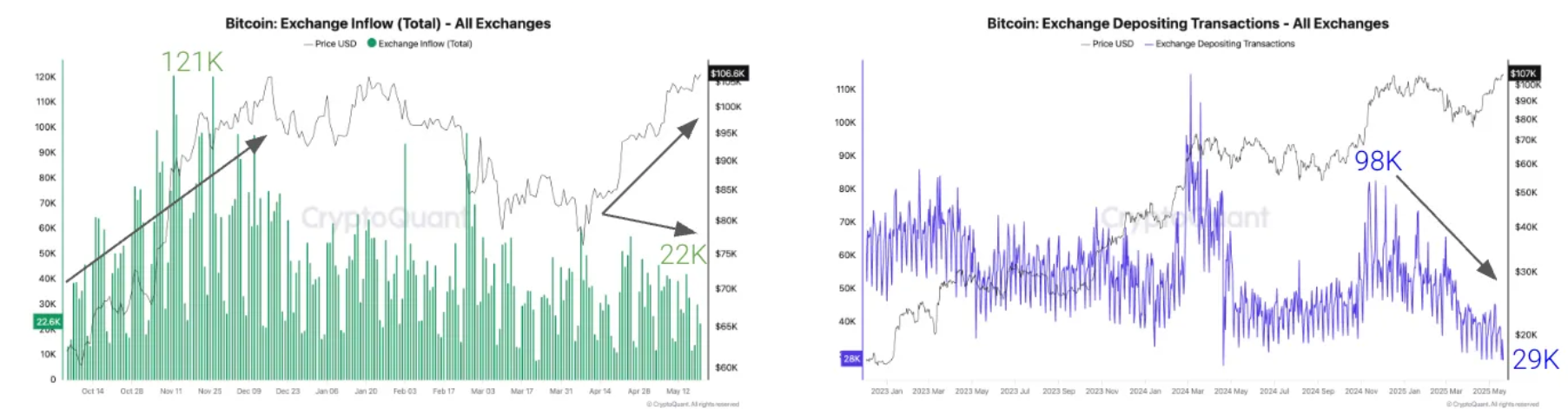

Selling pressure remains subdued, as indicated by low exchange inflow activity. According to data from a CryptoQuant report showed in the chart below, Bitcoin inflows to exchanges stand roughly at 22,000 BTC, a sharp decline from the 121,000 BTC seen in November, when Bitcoin first surpassed the $100,000 mark.

Historically, higher exchange inflows have signaled increased selling pressure. As the current levels are muted, they suggest reduced intent to sell among investors, which could support further price increases.

Adding to the positive metrics, the number of individual deposits to exchanges has dropped significantly, falling from 98,000 in November to just 29,000 on Wednesday, reinforcing the view that investor selling activity remains limited despite elevated prices.

Bitcoin Exchange inflow total (Left). Bitcoin Exchange depositing transactions (Right). Source: CryptoQuant

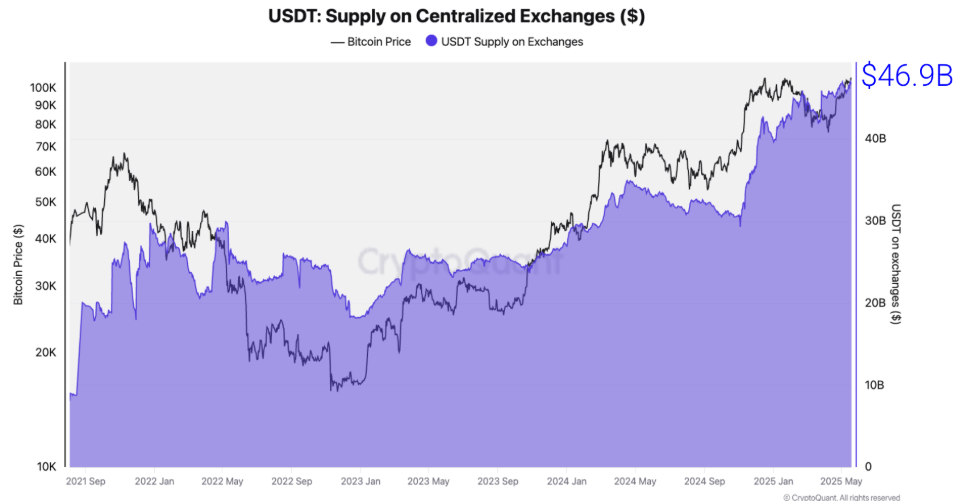

USDT inflows to exchanges further support the bullish outlook. On Wednesday, USDT inflows at exchanges reached a new all-time high of $46.9 billion. The growth in stablecoin balances signals increasing market liquidity, which generally tends to support digital asset prices.

USDT supply on centralized exchanges chart. Source: CryptoQuant

Texas advances bill to create Strategic Bitcoin Reserve

The Texas House of Representatives advances Senate Bill 21 (SB21), known as the Texas Bitcoin Reserve Bill, after its second reading on Tuesday. The bill proposes the creation of a Texas Strategic Bitcoin Reserve, allowing the state to invest in Bitcoin and other top digital assets. Only cryptocurrencies with a 12-month average market cap of at least $500 billion, such as Bitcoin, will be eligible for inclusion, ensuring the focus remains on established assets.

SB-21 heads to the Texas Governor’s desk for final approval. If signed, Texas could become a pioneer in state-level digital asset reserves, possibly setting a precedent for others and influencing national policy on crypto integration.

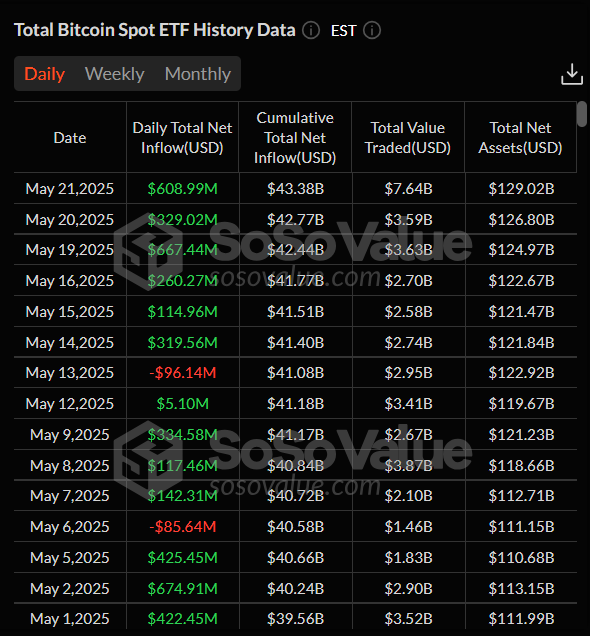

Institutional demand continues to support Bitcoin's price rise. According to SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded an inflow of $608.99 million on Wednesday, continuing its six-day streak of inflows since May 14. The Bitcoin price should benefit if institutional inflows continue and intensify, putting it closer to its next key milestone at $120,000.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

"As long as ETF flows hold and macro doesn’t deliver a shock, this rally has room to extend. Pullbacks should be seen as entry opportunities, not signs of reversal," Bitfinex market analysts told FXStreet.

The next key levels to watch, according to Bitfinex, are $114K-$118K (minor liquidity walls) and then $123K-$125K, where large options open interest is building.

Bitcoin Price Forecast: BTC bulls aim for $120,000

On Wednesday, BTC rallied and broke above its all-time high of $109,588. At the time of writing on Thursday, it continues to trade higher, setting a new ATH of $111,880.

BTC enters a price discovery mode: if it continues its upward trend, it could extend the rally toward a key psychological level of $120,000.

The Relative Strength Index (RSI) on the daily chart reads 76, above its overbought level of 70, indicating strong bullish momentum. However, traders should be cautious as the chances of a pullback are high due to its overbought condition. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator also showed a bullish crossover on Wednesday, giving buy signals and indicating an upward trend.

BTC/USDT daily chart

If BTC faces a pullback, it could extend the correction to retest its key support at $105,000.