Bitcoin price extends losses below $57,000 as market mood sours

- Bitcoin price approaches a crucial support level at $56,000; a close below could see its downtrend persist.

- Lookonchain and Arkham intelligence data show that institutions are selling their BTC holdings.

- On-chain data shows a bearish picture, such as falling daily active addresses and decreasing Coinbase premium index.

Bitcoin (BTC) recovered on Wednesday after retesting its daily support level of around $56,000, but the 2.15% decline on Thursday suggests this rebound may be fleeting. The downtrend may persist if BTC drops below the $56,000 support, evidenced by Lookonchain and Arkham intelligence data indicating institutional selling, alongside bearish on-chain signals such as decreasing daily active addresses and a declining Coinbase premium index.

Daily digest market movers: Bitcoin shows weakness as intuitions sell off their BTC holdings

- Lookonchain data shows that institutions might be selling their BTC holdings. Ceffu, an institutional custody, asset management and off-exchange settlement solutions company, deposited 2,000 BTC from Monday to Wednesday and, in total, 3,063 BTC worth $182 million into the Binance exchange since August 26. This transfer to the crypto exchange could signal that Ceffu is ready to sell these holdings.

Furthermore, Arkham intelligence data shows that eight Bitcoin spot EFTs sold $287 million BTC on Wednesday. This sell-off from institutional investors would increase the selling pressure and weight on Bitcoin’s price.

It seems that institutions are selling $BTC!#Ceffu has deposited 3,063 $BTC($182M) into #Binance since Aug 26.https://t.co/yObVfoTnB1 pic.twitter.com/oaZKEZh2WJ

— Lookonchain (@lookonchain) September 4, 2024

EIGHT ETFs sold $287 MILLION BTC in the past 24 hours.

— Arkham (@ArkhamIntel) September 4, 2024

Except BlackRock.

BlackRock sold 0. pic.twitter.com/rWNw7FraUH

- US Senator Cynthia Lummis had introduced her proposal, the Bitcoin Act. The bill aims for the US to purchase 1 million BTC over five years, signaling institutional interest and potential government backing for Bitcoin and further enhancing its legitimacy and appeal.

“My BITCOIN Act is currently the only viable solution that positions us to cut our national debt in half by 2045,” Senator Cynthia said in an interview with Bankless on Wednesday.

My BITCOIN Act is currently the only viable solution that positions us to cut our national debt in half by 2045. I joined @BanklessHQ to discuss how my commonsense legislation will get us back on track and secure our position as a world leader in financial innovation. https://t.co/CIYVscdsQh

— Senator Cynthia Lummis (@SenLummis) September 4, 2024

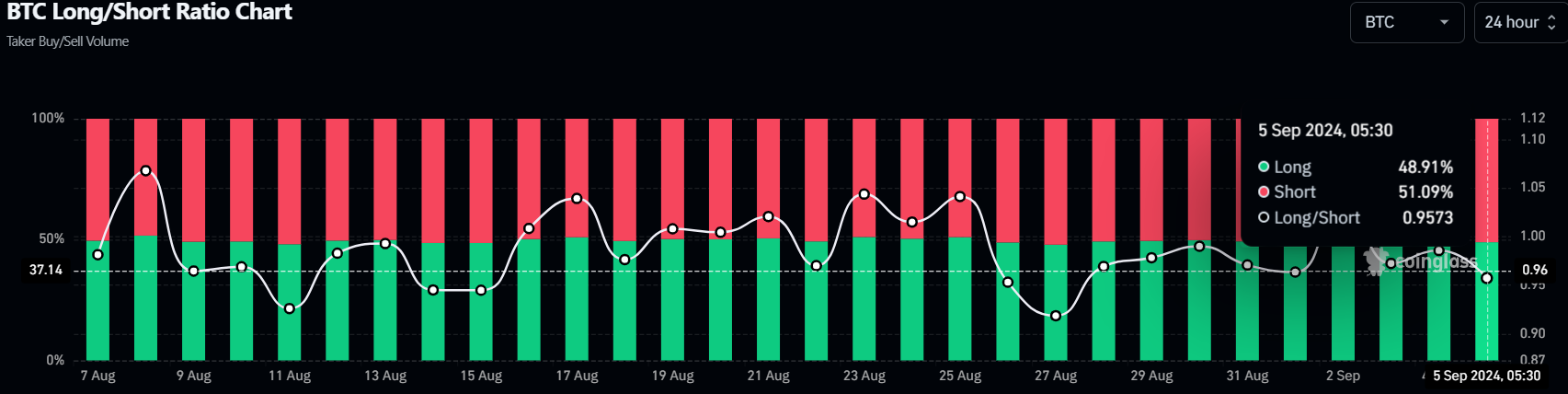

- According to Coinglass, Bitcoin’s long-to-short ratio is 0.95, at its lowest since August 28, meaning more traders anticipate the asset’s price to fall.

Bitcoin long-to-short ratio chart

- Santiment’s Daily Active Addresses index helps track network activity over time. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.

In BTC’s case, Daily Active Addresses fell from 836,960 on August 30 to 707,960 on Thursday, constantly decreasing since mid-March. This indicates that demand for BTC’s blockchain usage is decreasing, which could propel a decline in Bitcoin price.

[13.28.26, 05 Sep, 2024]-638611306566854472.png)

Bitcoin Daily Active Addresses chart

- CryptoQuant’s Bitcoin Coinbase Premium Index shows the gap between Coinbase Pro price (USD pair) and Binance price (USDT pair). Coinbase Premium data is one of the indicators that shows a sign of whale accumulation, as the Coinbase Pro platform is considered the gateway for institutional investors to purchase cryptocurrencies.

In the case of Bitcoin, the index has been declining since August 23 and fell from 0.0130 to 0.0001 from Monday to Wednesday, trading below its 14-day Simple Moving Average (SMA) at 0.0143. This indicates that whales are continuously selling at a lower premium. In addition, it shows a decrease in the interest and activeness of investors in Coinbase.

-638611306990943771.png)

Bitcoin Coinbase Premium Index chart

BTC Technical analysis: BTC recovery could be short-lived

Bitcoin was rejected after retesting its 50% price retracement level at $59,560 (drawn from a high in late July to a low in early August) and dropped 2.78% on Tuesday. It bounced off on Wednesday after retesting the daily support level at $56,022, finally closing the day in the green near $58,000. However, this bounce could be short-lived, as it continues to decline by 2.15% at the time of writing to $56,725 on Thursday.

If BTC continues to decline and closes below the $56,022 daily support level, it could decline further by 3.5% to retest the psychological level of $54,000.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) momentum indicators on the daily chart trade below their respective neutral levels of 50 and zero, respectively. Both indicators suggest weak momentum and a continuation of its downward trend.

BTC/USDT daily chart

However, if Bitcoin’s price breaks above the $59,560 resistance and closes above $62,019, the 61.8% Fibonacci retracement level, the bearish thesis will be invalidated. In this scenario, BTC could extend the positive move by 5.5% to revisit its daily resistance level at $65,379.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.