Ripple fails to rally as lawsuit win falls short, here’s what to expect from XRP

- SEC vs. Ripple lawsuit ended in a $125 million fine for securities law violation by the payment remittance firm, however both parties consider it a win.

- Ripple noted a massive spike in XRP price after the ruling, but the rally fades as traders digest the likelihood of SEC appeal.

- XRP slips under key psychological support at $0.60, erasing 7% of its value on Friday.

The US Securities & Exchange Commission (SEC) vs. Ripple lawsuit ended after a long-drawn legal battle with the court asking the firm to pay $125 million in fines. Judge Analisa Torres noted that the firm is likely to violate federal securities laws if it hasn’t already, raising concerns about an SEC appeal.

XRP suffered a correction on Friday, down to $0.5778 at the time of writing.

Daily Digest Market Movers: XRP could lose legal clarity if SEC appeals ruling

- XRP retains its status as a non-security, with Judge Analisa Torres making no change to the July 2023 ruling in the final lawsuit outcome.

- Eleanor Terret, a journalist at Fox Business, however, believes that the SEC has reason to appeal the ruling on XRP’s status as a security.

- While Judge Torres’ ruling cements XRP's status as a non-security in secondary market sales, if the SEC appeals, this could affect the sentiment of traders.

NEW: I reached out to the @SECGov for comment on the @Ripple ruling and a spokeswoman gave me this statement:

— Eleanor Terrett (@EleanorTerrett) August 8, 2024

“The Court granted the SEC's motion for remedies including an injunction barring Ripple from committing additional violations of the securities laws and significant… https://t.co/TC2xk7pBD2

- With XRP’s legal clarity analysts expected news of an Exchange Traded Fund (ETF) application soon.

Ripple/XRP-Stuart Alderoty-Is The Ripple Case Over?, 21 Shares- When XRP ETF?#DigPerspectives

— Digital Perspectives (@DigPerspectives) August 9, 2024

Includes Paid Promotion pic.twitter.com/4rtSUWGyP0

- The SEC is unlikely to appeal the fine imposed on the firm since it is nearly twelve times the amount that Ripple offered to pay.

- XRP erased recent gains from the lawsuit ruling and dipped under the key psychological support level at $0.60.

Technical analysis: XRP erases gains and extends losses by 7%

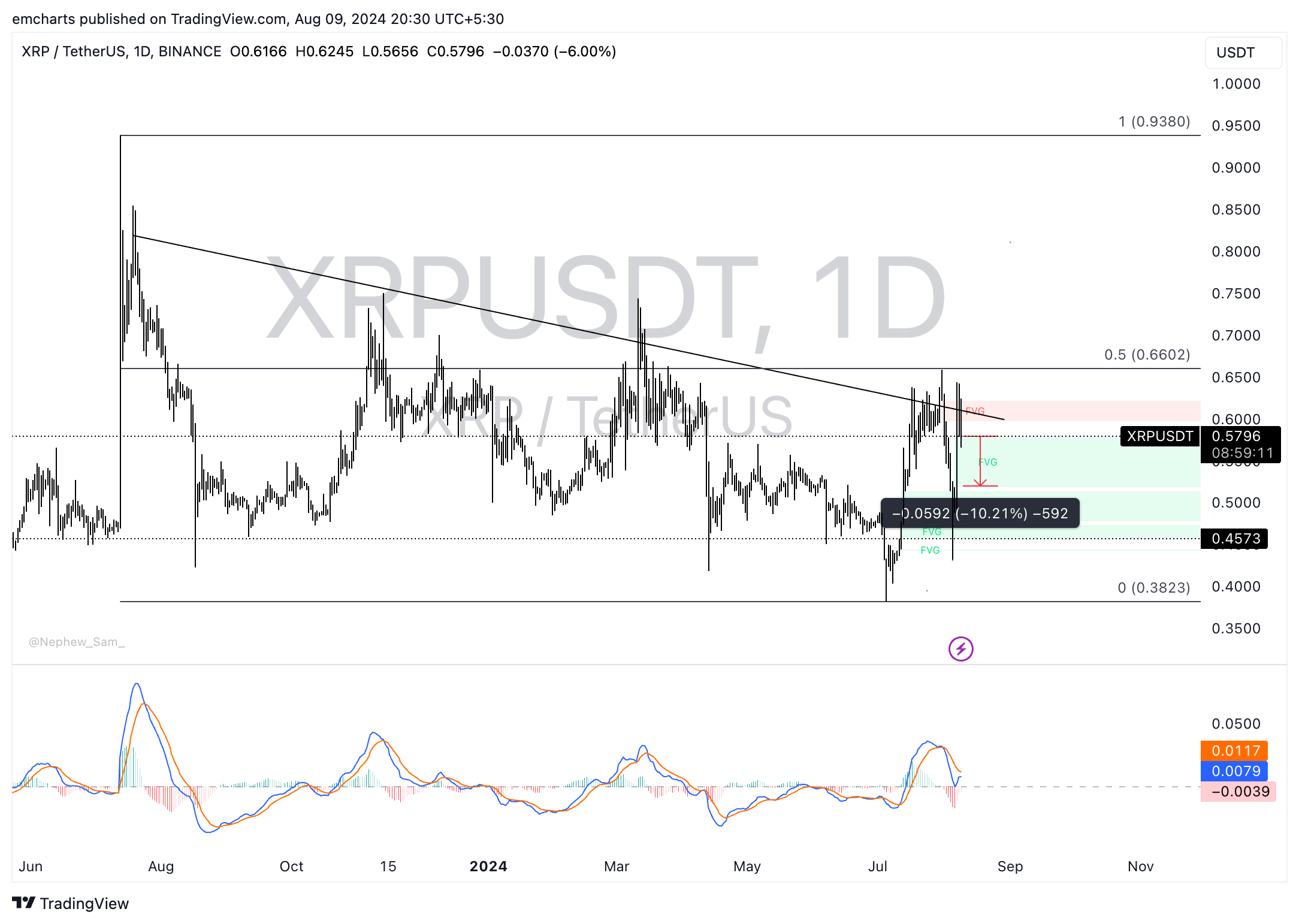

XRP is in a multi-month downtrend per the daily chart. The altcoin erased gains from the lawsuit victory and suffered a correction on Friday. XRP lost 7% value on the day and dropped under key support at $0.60.

XRP Ledger’s native token could extend its losses further by another 10% and collect liquidity in the Fair Value Gap (FVG) between $0.5188 and $0.5785. Ripple could find support at the upper and lower boundary of the FVG.

XRP/USDT daily chart

A daily candlestick close above $0.60 could invalidate the bearish thesis, and XRP could rally towards the $0.6602 target, the 50% Fibonacci retracement of the decline from July 13, 2023, to July 5, 2024.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.