Ethereum fails to recover from market dump following Gensler's uncertainty over ETH commodity status

- Ethereum will host traditional market participants' tokenization efforts as they look to avoid liquidity fragmentation.

- SEC Chair Gensler maintains uncertain position when asked if ETH is a commodity.

- Ethereum may sustain range-bound movement in the short term.

Ethereum's (ETH) price failed to record any gain on Friday, as it's down by about 1.4%. This follows recent comments from a key BlackRock executive suggesting Ethereum will be the home of upcoming tokenization efforts from traditional market participants.

Daily digest market movers: Tokenization on Ethereum, ETH commodity question

In a panel discussion at a Coinbase event on Thursday, BlackRock's CIO of ETF and Index Investments, Samara Cohen, suggested that permissioned blockchains won't scale.

She mentioned that traditional market participants are gearing their tokenization efforts toward building on open-source Ethereum in order not to fragment liquidity, according to VanEck's Matthew Sigel.

Also read: Ethereum poised for recovery following increased exchange outflows

"If you're serious about open-source, you can't not build on Ethereum," Sigel stated.

Meanwhile, at a Senate hearing on Thursday, Securities & Exchange Commission (SEC) Chair Gary Gensler seemed to maintain an uncertain position when questioned whether ETH is a commodity. He failed to give a yes or no response again. At the same hearing, Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam reiterated that ETH is a commodity. This comes after Gensler confirmed that the SEC will likely approve spot ETH ETF S-1s over the summer.

Many speculated that the SEC had begun considering ETH as a commodity after the 19b-4 approval of spot ETH ETFs. However, Gensler's recent position has caused doubts among crypto community members.

Read more: Ethereum breaches key support, receives ‘digital oil’ tag from world's largest bank

Nate Geraci, President of The ETF Store, also expressed dissatisfaction at how long it took the SEC to approve spot ETH and BTC ETFs despite allowing investors to purchase the underlying assets through publicly-traded companies like Coinbase and Robinhood.

VanEck filed for 1st spot eth ETF in May 2021...

— Nate Geraci (@NateGeraci) June 14, 2024

It's taken regulators 3yrs & *counting* to decide whether you can buy exact same thing in regulated ETF wrapper that they've allowed grandma to purchase on *publicly-traded* COIN & HOOD during same time.

Make it make sense. pic.twitter.com/u2ITOZdE8h

Bloomberg analyst Eric Balchunas replied that these products should have been approved ten years ago.

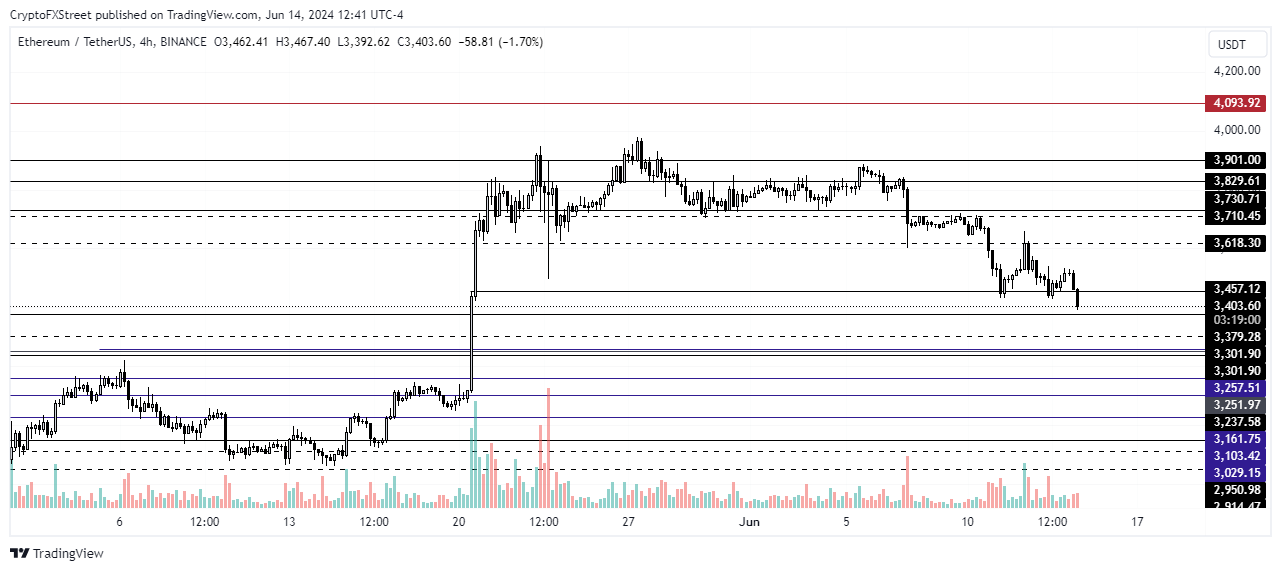

ETH technical analysis: Ethereum may sustain range-bound move

Ethereum is trading around $3,417 on Friday as it has yet to recover from losses experienced in the last 24 hours.

As stated in a previous analysis, in the short term, ETH may not see any substantial price action, but traders expect higher volatility in the coming months. However, QCP analysts noted that higher Ether volatility premiums over Bitcoin will eventually decline as the market prices in spot ETH ETF S-1 approval.

"Currently[,] ETH volume is trading at a 10 volume premium to Bitcoin, and we expect the spread to narrow with ETH overwriters returning as we wait in anticipation of an S-1 Form approval late summer," wrote QCP analysts.

Greekslive data from WuBlockchain also confirms that long traders are becoming more cost-effective as the short-term outlook appears gloomy.

"200,000 ETH options expired with a Put Call Ratio of 0.36, a max pain of $3,600 and a notional value of $710 million. ETH each major short term implied volatility (IV) is below 60%, both have fallen to a lower level, the buyer is more cost-effective," wrote WuBlockchain.

ETH/USDT 4-hour chartAs a result, ETH will likely maintain a range-bound movement between the $3,457 and $3,730 price levels in the coming weeks. If the crypto market experiences an unexpectedly bullish event, a further move to test the $3,900 resistance is expected.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.