USD/CAD holds ground, weak Canadian data caps losses

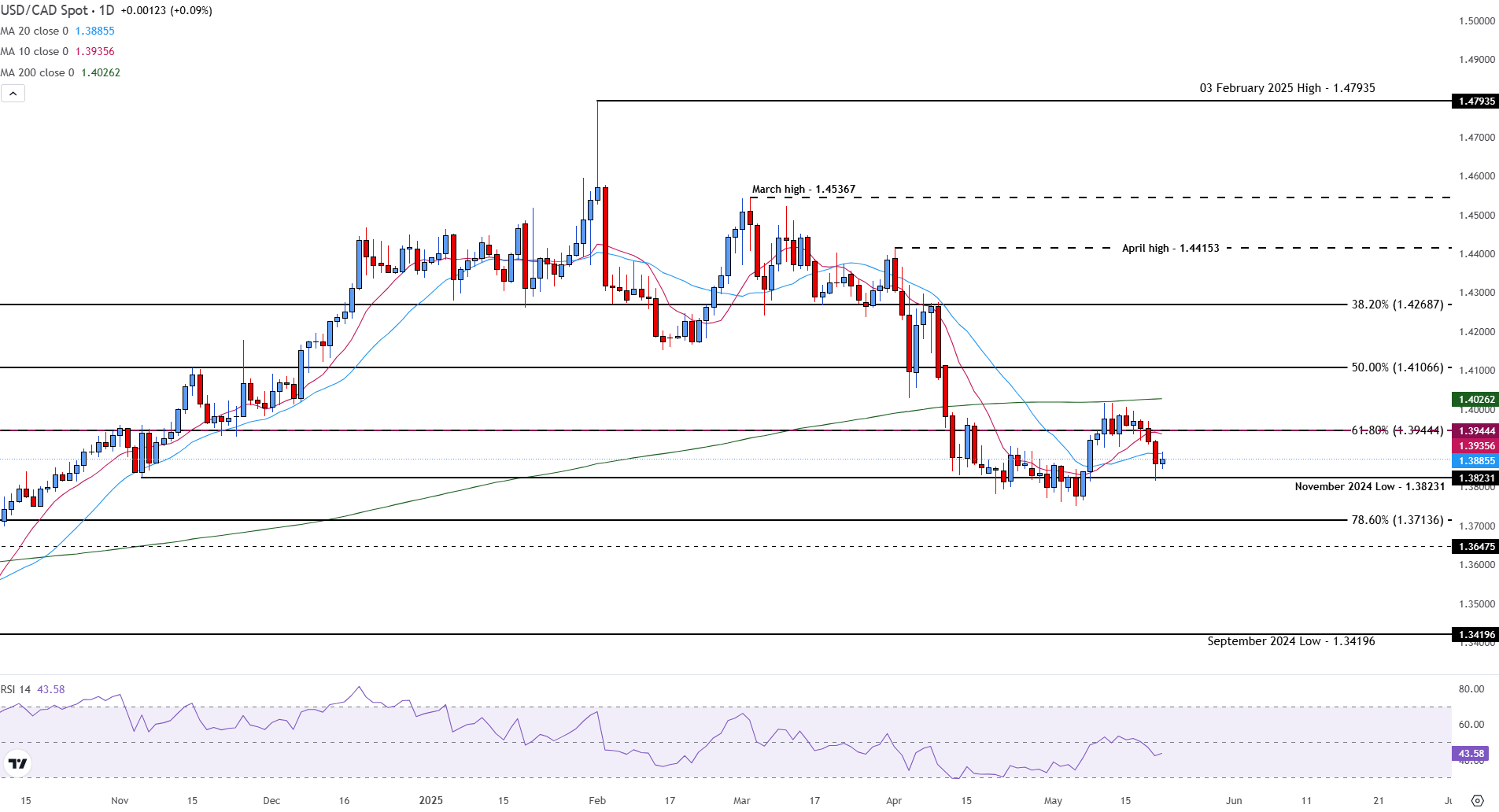

- USD/CAD faces resistance near a crucial technical level at 1.3944.

- Canada's factory prices fell again, increasing chances of a rate cut and weakening the CAD.

- Support at the November low of 1.3823 holds as RSI shows weak momentum but not yet oversold.

The US Dollar (USD) continues to face pressure from broad-based macro concerns, including high fiscal deficits, prolonged elevated interest rates, and rising geopolitical tensions.

These structural issues have driven a gradual shift away from the greenback, with investors seeking diversification into other currencies and safe-haven assets.

Despite these headwinds, intermittent support for the USD persists. Recent US economic data showed resilient services and manufacturing PMI figures, signaling continued activity in key sectors.

However, falling housing price expectations have raised concerns about the sustainability of US growth, especially in a sector traditionally critical to consumer wealth and sentiment.

On the Canadian side, the economic picture has weakened, helping limit USD/CAD’s downside.

Most notably, the Industrial Product Price Index (IPP) for April declined 0.8% MoM, down from a 0.5% increase in March, and below the expected -0.5%.

This sharper-than-anticipated drop highlights softening factory gate prices, suggesting lower inflationary pressure at the producer level.

This has led markets to price in a higher probability of a Bank of Canada (BoC) rate cut, weakening the Canadian Dollar (CAD) vs the US Dollar, and supporting USD/CAD near recent lows.

USD/CAD clings to Moving Average resistance at 1.3886

On the daily chart, USD/CAD is retesting resistance at the 20-day Simple Moving Average (SMA) at 1.3886. A sustained move above this level would bring the 61.8% Fibonacci retracement of the September low to the February high at 1.3944 into focus, a key level that has repeatedly capped rallies since early May.

If bulls manage to break above 1.3944, the next target would be the psychological 1.4000 level, followed by the 200-day SMA at 1.4026, which marks a major barrier for any trend reversal.

USD/CAD daily chart

On the downside, USD/CAD continues to find support at the November 2024 low of 1.3823, which has held through recent selloffs. A break below that level and psychological support at 1.3800 would expose the 78.6% Fib retracement at 1.3714, and potentially the September high at 1.3648.

The Relative Strength Index (RSI) currently sits at 44.47, below the neutral 50 mark. While this reflects bearish momentum, the reading is not yet in oversold territory, suggesting that further downside is possible before a technical rebound.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.