Up a Staggering 360%, Is It Too Late to Buy Opendoor Technologies Stock?

Key Points

Opendoor's trading volumes are now nearly half of what they were just six months ago.

Despite its fantastic returns, it continues to struggle with profitability.

However, the company's new CEO is leveraging artificial intelligence to help turn the business around.

- 10 stocks we like better than Opendoor Technologies ›

Opendoor Technologies (NASDAQ: OPEN) is probably not a stock you heard much about last year -- it lost nearly two-thirds of its value in 2024. The company is in the business of flipping houses at a time when the housing market hasn't been all that strong, which may explain the abysmal performance.

But it's been a different story for the stock this year. While the housing market is by no means red hot, investors appear to be bullish on Opendoor's future, and its low valuation may have enticed many people to take a chance on the business. As of Nov. 28, its year-to-date gains were impressive at around 360%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Has the stock run out of room to rise higher, or could it still be a good buy at its current levels?

Image source: Getty Images.

Has Opendoor's stock run out of steam?

Opendoor's stock took off in July and continued its rally into September. But outside of that range, the stock hasn't been moving all that much. Last month, it was flat.

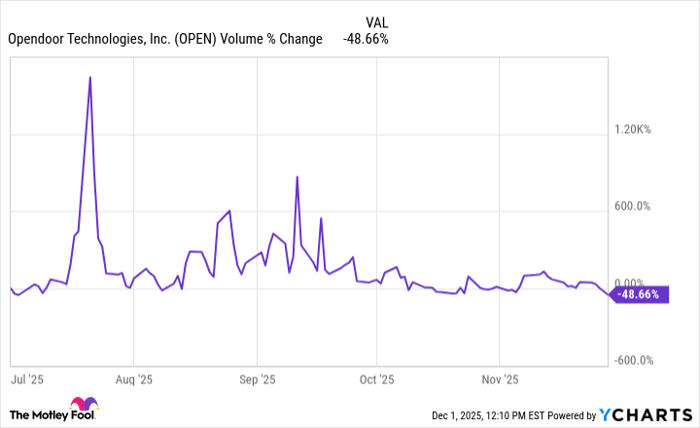

One way to gauge the overall interest in a stock is by looking at trading volumes to see how often the stock is changing hands. In the summer, when Opendoor was surging in value, unsurprisingly, volumes were up significantly as well. It's a sign that interest from retail investors was high.

OPEN Volume data by YCharts

Lately, however, trading volumes trended lower. Retail investors may have moved on from Opendoor, which, from the start, looked like a risky meme stock due to its underwhelming financials.

The company's financials need a lot of work

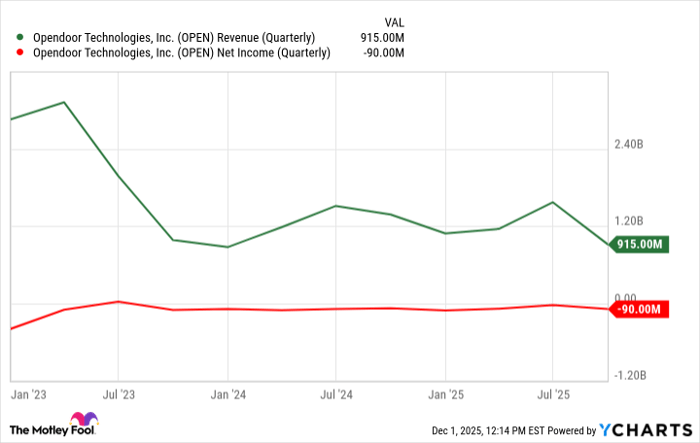

A big reason why investors weren't thrilled with Opendoor last year was that its financial performance simply wasn't that great. It was unprofitable and its top line was going in the wrong direction. You may be surprised to learn that despite its impressive rally this year, those problems haven't gone away.

OPEN Revenue (Quarterly) data by YCharts

The company recently brought on a new CEO, Kaz Nejatian, who joined the company earlier this year. Nejatian, who was previously with e-commerce giant Shopify, hopes to turn the business around by making it more efficient with the help of artificial intelligence (AI).

While making processes leaner can help improve productivity and bring down costs, the nature of house flipping is that it can be extremely risky and difficult to generate profits. Opendoor is a great example of that, as its gross profit margin has averaged a lowly rate of just 8% over the past 12 months. AI may help the business improve, but I'd be skeptical about the company's ability to turn a profit anytime soon.

Why I'd stay away from Opendoor's stock

Opendoor's financials are full of red flags that investors shouldn't overlook. Between declining revenue, poor margins, and persistent operating losses, there are no shortage of challenges ahead for the company. Its sudden and brief rally reinforces the idea that this is nothing more than a meme stock that skyrocketed for no justifiable reason, and that it is merely a speculative investment.

The one quality the stock had that looks to be disappearing nowadays is excitement from retail investors. Without that, there's little reason to expect that Opendoor's stock can rally much higher from where it is today, unless it drastically improves its financials. That's not an easy task, and investing in the business based on that assumption is a big risk.

While Opendoor may look modestly priced, trading at just 1.2 times its trailing revenue, that doesn't mean the stock can't go lower as its lack of profitability and growth are still huge problems. There are many better growth stocks out there to consider than Opendoor; the stock just isn't worth the risk.

Should you invest $1,000 in Opendoor Technologies right now?

Before you buy stock in Opendoor Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opendoor Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,717!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,111,405!*

Now, it’s worth noting Stock Advisor’s total average return is 1,018% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.