Prediction: 2 Stocks That Will Be Worth More Than SoundHound AI 5 Years From Now

Key Points

SoundHound AI is losing a lot of money and trades at a premium price.

Both Nelnet and Oscar Health should generate much more in earnings than SoundHound AI in the coming years, and have lower market caps today.

SoundHound AI stock is overvalued, while Nelnet and Oscar Health look undervalued.

- 10 stocks we like better than SoundHound AI ›

Just have artificial intelligence (AI) in your company name, and the market will bid it up to astronomical heights in 2025. This is what happened to SoundHound AI (NASDAQ: SOUN). The upstart focused on voice and conversational AI capabilities was trading at under $2 a share at the beginning of 2024, but has since zoomed higher to around $12 a share as of this writing in late November, 2025. That is a sixfold gain in less than two years.

But when you actually take a look at the underlying business, it is clear that SoundHound AI is overvalued and a risky stock to invest in at current prices. Here are two stocks with smaller market caps that will be larger than SoundHound AI five years from now, making them better bets for your portfolio today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Nelnet's diversified business

Nelnet (NYSE: NNI) is a company you may not have heard of, except perhaps as your student loan servicer. The underfollowed company has built up a portfolio of different investments and operating assets over the last two decades of being a public company, including in student loans, consumer banking, education software, sports film software, and solar energy investments.

It has a student loan portfolio that is projected to spit out $1 billion in cash flow over its life, although federal law now restricts private companies such as Nelnet from underwriting new loans. Loan servicing -- which is still legal and a much more durable business -- generated $151 million in revenue and $46 million in operating income last quarter. Education software generated $129 million in revenue and $25 million in operating income. Add in smaller parts of the business such as the growing Nelnet Bank and the company is now producing over $100 million in quarterly net income, or $415 million over the last 12 months.

Today, Nelnet trades at a market cap of $4.5 billion, giving the stock a price-to-earnings ratio (P/E) of just over 10. What's more, Nelnet holds minority investments on its balance sheet that should add to the intrinsic value of the stock, including a roughly 20% stake in sports film software provider Hudl, a start-up unicorn that could be worth billions of dollars when it eventually goes public.

Image source: Getty Images.

Oscar Health's profit rebound

While not as profitable as Nelnet today, Oscar Health (NYSE: OSCR) has perhaps even more potential for earnings growth in the coming years. It is a disruptive health insurance company, using modern software, AI, and flexible insurance plans to gain market share in the affordable care act (ACA) marketplace, otherwise known as Obamacare. The company now has over 2 million members from close to a standing start a decade ago.

Oscar Health stock has fallen for two reasons. First, rising healthcare costs in 2025 have blindsided most health insurers, leading to rising medical loss ratios and operating losses. The company had an operating loss of $129 million last quarter. Second, pandemic-era extended subsidies for individual health insurance buyers on the ACA marketplace are set to expire at the end of this year, which will lead an estimated 20% to 30% of the current addressable market to stop paying for health insurance.

Management is setting its health insurance pricing for 2026 in response to these two headwinds. Oscar Health's average premiums are set to rise by 28% in 2026, a huge increase that is in line with other health insurers. Even if the company loses customers next year for the first time, it should be able to make up for it in the price-per-plan increases across the board.

Guidance calls for $12 billion in premium revenue this year, a number that may not move higher in 2026 when you combine rising monthly rates and the potential loss of some customers. However, Oscar Health believes it can price plans to get to profitability next year. Even if it earns just a small net margin of 4%, that would equate to $480 million in earnings for a company with a current market cap of $3.7 billion, or a P/E ratio under 10.

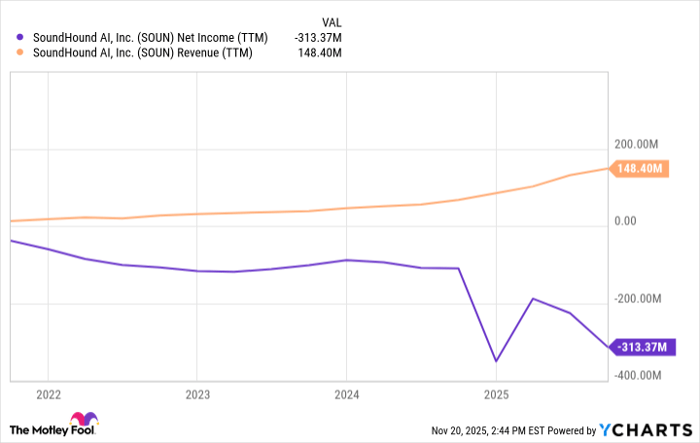

SOUN Net Income (TTM) data by YCharts

SoundHound AI's weak comparison

Both Nelnet and Oscar Health have the capability to generate hundreds of millions in growing net income each year. Today, SoundHound AI is generating less than $150 million in revenue. It is also losing money, and has been for years, with a net loss of $313 million over the last 12 months. The company has posted solid revenue growth, but has done so in an entirely inefficient manner that has no clear path to moving into the black.

Plus, SoundHound AI stock has a market cap of $5 billion, which is larger than both Oscar Health and Nelnet. Looking at the underlying fundamentals, it is clear that SoundHound AI stock is a sell and both Oscar Health and Nelnet are buys today. I wouldn't be surprised if both stocks are significantly larger than SoundHound AI five years from now.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Brett Schafer has positions in Nelnet. The Motley Fool has positions in and recommends Nelnet. The Motley Fool has a disclosure policy.