Top Crypto Gainers: Zcash, Telcoin, Curve DAO – Rebounds signal upside potential

- Zcash holds the $300 psychological level after Wednesday's 8% surge.

- Telcoin extends the rebound from the 200-day EMA as a Golden Cross pattern emerges.

- Curve DAO token recovers over 8% within a consolidation range, with bulls aiming for the 50-day EMA.

Altcoins, including Zcash (ZEC), Telcoin (TEL), and Curve DAO (CRV), lead the cryptocurrency market recovery in the last 24 hours, fueled by improving investors' sentiment on Vanguard Group’s lifting the ban on crypto Exchange Traded Funds (ETFs) and Charles Schwab group's announcement to offer Bitcoin (BTC) and Ethereum (ETH) trading features in 2026.

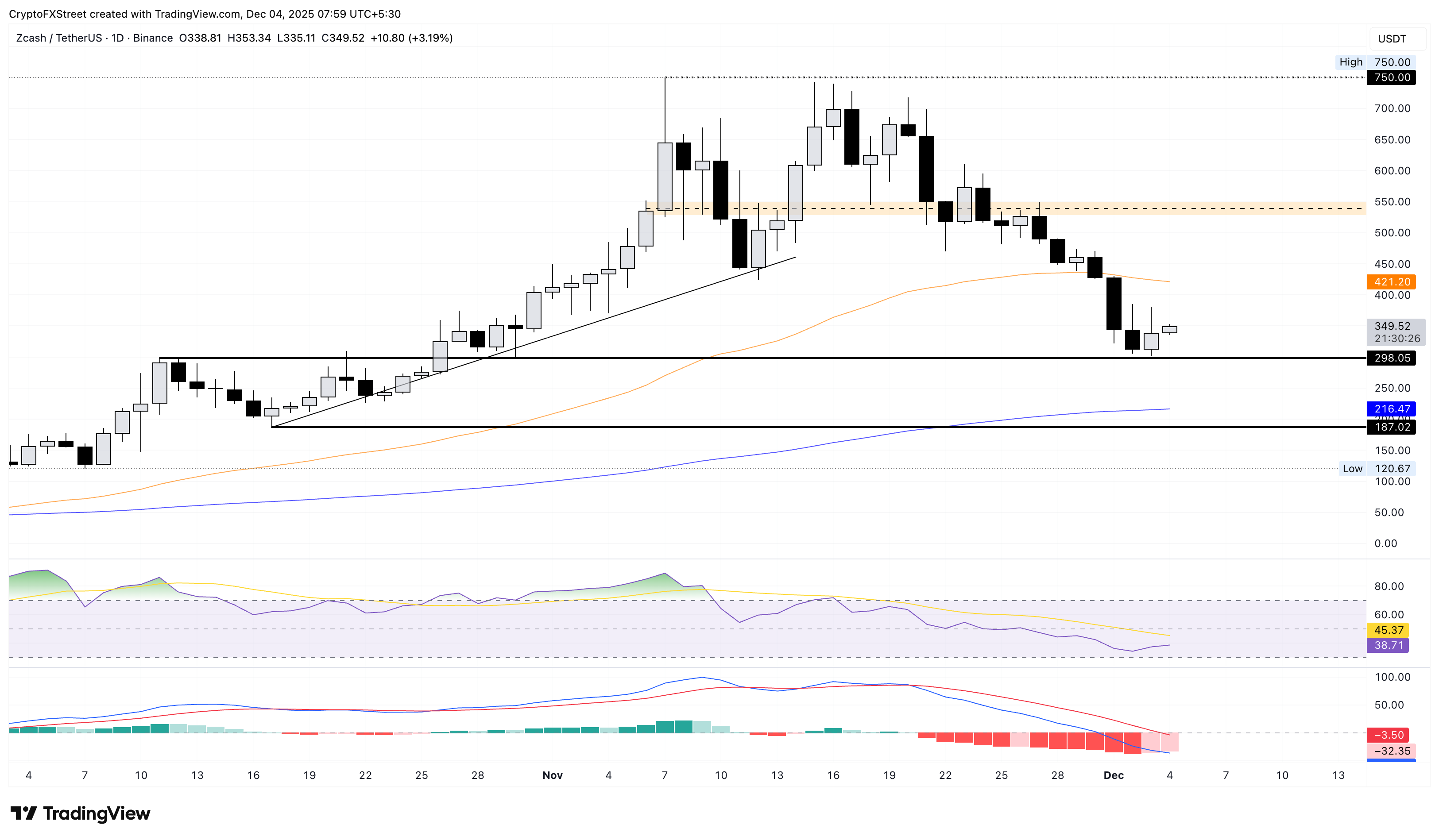

Zcash holds above $300, flashing rebound potential

Zcash edges higher by 3% at press time on Thursday, advancing the 8% gains from the previous day. The privacy coin remains buoyant above the $300 psychological support and aims to reclaim the $350 mark.

A steady recovery in ZEC could aim for the 50-day Exponential Moving Average (EMA) at $421. In the event of a moving-average breakout, Zcash could extend the rebound to the $550-$527 supply zone.

The Relative Strength Index (RSI) at 38 on the daily chart shows a lateral shift before reaching the oversold zone, suggesting a decline in selling pressure. If RSI transitions into an upward slope, it would signal a fresh buying pressure above the midline.

Still, the Moving Average Convergence Divergence (MACD) suggests intense prevailing bearish pressure, as the average lines cross below the zero line.

On the downside, the key support levels for the privacy coin are the $300 psychological mark and the 200-day EMA at $216.

Telcoin extends uptrend amid a Golden Cross pattern

Telcoin maintains a steady recovery of over 7% so far this week, extending the bounce back from its 200-day EMA. At the time of writing, TEL takes a breather of over 1% on Thursday following the 13% gains from the previous day.

The overhead resistances for Telcoin are the August 14 and July 18 highs at $0.006653 and $0.007500, respectively.

Furthermore, the rebound in TEL aims to extend the breakout rally of a falling wedge pattern on the daily chart recorded on November 12. Roughly 70% gains from November fueled the 50-day EMA crossover above the 200-day EMA, resulting in a Golden Cross pattern. Typically, this signals a long-term bullish shift in an asset as the uptrend gains strength.

Along the same lines, the MACD indicator signals a bullish crossover between the average lines, indicating a rise in buying pressure. At the same time, the RSI at 60 hovers above the midline, suggesting a bullish bias.

On the flip side, the key support for Telcoin remains the 50-day EMA at $0.004872.

Curve DAO’s recovery targets the 50-day EMA

Curve DAO token is up 1% at press time on Thursday, building on the 8% rise from the previous day. The rebound in CRV aims for the 50-day EMA at $0.4781, which is close to the resistance trendline connecting the October 15 and 27 highs on the daily logarithmic chart.

The momentum indicators on the same chart indicate bullish potential, as the RSI is at 48 and is poised to cross above the midline. At the same time, the MACD and signal line continue to trend higher.

On the flip side, the crucial support for the CRV token remains at the November 21 low at $0.3651.