GBP/USD steady as soft US CPI revives June Fed cut bets

- GBP/USD holds firm as softer CPI boosts June Fed rate-cut expectations.

- US inflation cools to 2.4%, extending disinflation trend despite resilient labor market.

- Sterling capped by Bank of England easing bets and uncertainty around Keir Starmer.

The GBP/USD holds firm at around 1.3620 as the latest inflation report in the United States, prompted traders to re-price in the likelihood of an interest rate reduction by the Federal Reserve at the June meeting. The pair trades flat yet poised to end the week with a minimal gain of 0.12%.

Sterling holds firm as cooler US inflation data boosts expectations of Federal Reserve easing

The US Consumer Price Index (CPI) in January was cooler than expected, revealed by the US Bureau of Labor Statistics. CPI dipped from 2.7% in December to 2.4% YoY, while core figure was aligned with estimates fo 2.5%, down from 2.6% in the previous month.

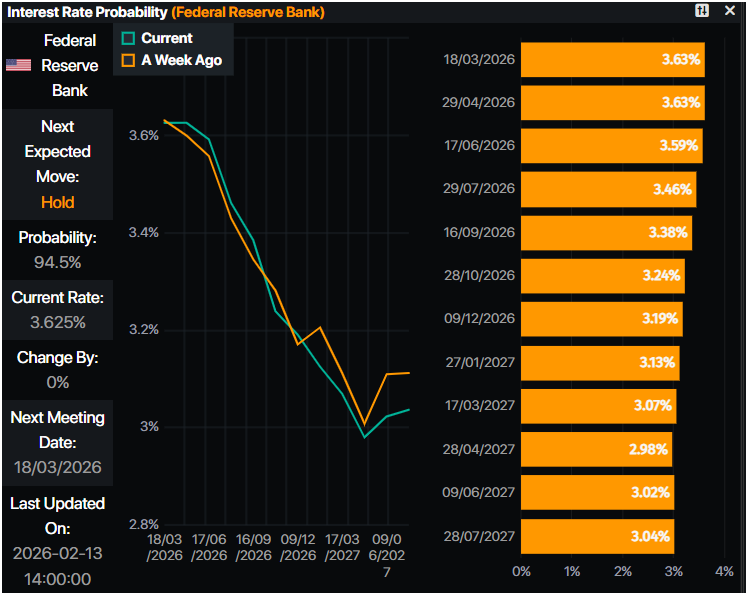

The resumption of the disinflation process pushed traders to price in 63 basis points of Fed easing towards the end of the year, according to Prime Market Terminal data.

Following the data release, Greenback remained steady, as depicted by the US Dollar Index (DXY). The DXY, which tracks the buck’s value against a basket of six currencies, is firm at 96.96.

Now the question is whether the Fed would remain in pause or cut rates, due to the latest inflation print. The labor market had shown signs of strength, while prices are finally edging towards the Fed’s goal. So far, for the June meeting, odds are at a 58% chance for a rate reduction.

In the UK, political turmoil spurred by the linkage of the US ambassador nominees proposed by the Prime Minister Keir Starmer to Jeffrey Epstein, put into question Starmer leadership. Nevertheless, Starmer’s cabinet is on his side, a sign of relief for GBP buyers.

Nonetheless, Pound bulls are not out of the woods, as the recent UK GDP figures and the latest Bank of England (BoE) monetary policy decision had increased the odds for a cut in subsequent meetings.

For the March 19 meeting, there’s a 64% chance for a BoE rate cut of 25 basis points. However, hawkish comments by BoE Huw Pill was hawkish, despite acknowledging that the disinflation process is intact, but not complete.

Pil added that core inflation should be the main focus and that policy needs to remain restrictive.

Next week the UK economic docket will feature job data, inflation and Retail Sales. In the US, traders would digest speeches by Fed policymakers, Durable Goods Orders, jobs data, GDP figures and the Fed preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

GBP/USD Price Forecast: Technical outlook

In the daily chart, GBP/USD trades at 1.3622. The 50-, 100-, and 200-day simple moving averages slope higher, and price holds above the latest reading at 1.3511, sustaining a positive tone. This alignment supports continuation on pullbacks as the trend structure remains firm.

The rising trend line from 1.3035 underpins the advance, offering support near 1.3490. A daily close below that threshold could weaken the structure and open a deeper retracement, while sustained trade above it would allow the pair to extend the climb.

(The technical analysis of this story was written with the help of an AI tool.)

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.35% | -0.19% | -2.82% | -0.32% | -0.80% | -0.26% | -0.96% | |

| EUR | 0.35% | 0.16% | -2.58% | 0.03% | -0.45% | 0.09% | -0.61% | |

| GBP | 0.19% | -0.16% | -2.44% | -0.13% | -0.62% | -0.07% | -0.77% | |

| JPY | 2.82% | 2.58% | 2.44% | 2.65% | 2.14% | 2.72% | 1.87% | |

| CAD | 0.32% | -0.03% | 0.13% | -2.65% | -0.39% | 0.06% | -0.64% | |

| AUD | 0.80% | 0.45% | 0.62% | -2.14% | 0.39% | 0.55% | -0.15% | |

| NZD | 0.26% | -0.09% | 0.07% | -2.72% | -0.06% | -0.55% | -0.70% | |

| CHF | 0.96% | 0.61% | 0.77% | -1.87% | 0.64% | 0.15% | 0.70% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).