- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Reclaims $70,000. Cathie Wood Claims Near Potential Bottom, Will This Time Be Different?

- Gold Price Forecast: XAU/USD falls below $5,050 as traders await US jobs data

- Is the Crypto Rally Dead? Why Bernstein Still Predicts a $150K Bitcoin Peak Despite Waller’s Warnings

- WTI declines below $63.00 as US-Iran talks loom

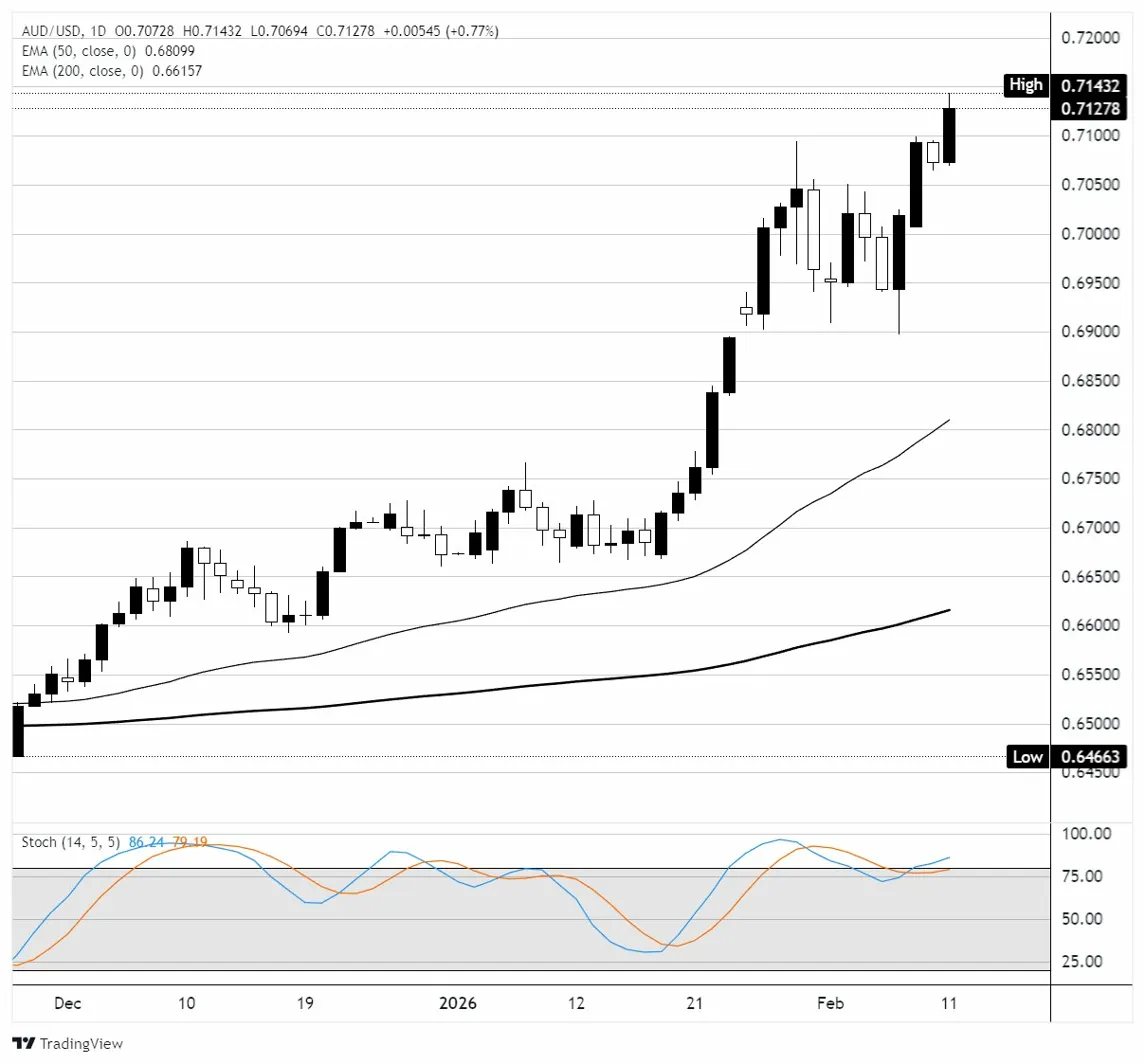

AUD/USD tipped into a three-year peak on Wednesday.

an upbeat NFP print has pushed back Fed rate cut bets, putting policymakers on a diverging collision course on policy statements.

The Australian Dollar surged to its highest level since August 2022 on Wednesday after the delayed US Non-Farm Payrolls (NFP) report came in stronger than expected at 130K, well above the 70K consensus, though massive downward revisions to 2025 payroll data (898K lower for March 2025 alone) painted a weaker picture of the broader labor market. The US Dollar sold off as markets interpreted the benchmark revisions as confirmation of a more entrenched slowdown, with average monthly job gains for 2025 revised to just 15K from the previously reported 49K.

On the Australian side, the Reserve Bank of Australia (RBA) hiked its cash rate by 25 basis points to 3.85% on February 3, the first increase since late 2023, after inflation reaccelerated in the second half of 2025. RBA Deputy Governor Andrew Hauser reinforced a tightening bias on Wednesday, warning that inflation is too high and that further hikes are possible. Thursday brings Australian Consumer Inflation Expectations for February, which could support the hawkish RBA narrative. The main event for the week is Friday's US Consumer Price Index (CPI) for January, with headline year-over-year expected at 2.5% (down from 2.7%) and core CPI month-over-month forecast at 0.3%. A softer print would further erode US Dollar support, while a hot reading could stall the pair's rally. Federal Reserve (Fed) speakers Hammack and Miran also delivered remarks Wednesday, with Miran rated dovish at 3.6 versus an average of 4.0; Fed's Logan and Miran speak again Friday.

AUD/USD price forecast

On the daily chart, AUD/USD is trading near 0.7130, up 0.77% on Wednesday alone, with price pushing to an intraday high of 0.7143. The pair is firmly above both the 50-day Exponential Moving Average (EMA) at 0.6810 and the 200-day EMA at 0.6616, confirming a strong bullish trend structure with higher highs and higher lows since the December low of 0.6466. The rally from late January has been aggressive, with the pair gaining over 600 pips from the consolidation zone around 0.6700. The Stochastic Oscillator (14, 5, 5) reads 86.24/79.19, deep in overbought territory, suggesting momentum is stretched but not yet showing a bearish crossover. Immediate resistance sits at the session high of 0.7143, with the next target at the psychological 0.7200 level. Support lies at the 0.7000 round number, followed by the late-January consolidation range between 0.6930 and 0.7000. A daily close above 0.7143 would open the door toward 0.7200 and potentially 0.7250, while a pullback below 0.7000 would signal a deeper correction toward 0.6930, where the breakout zone and prior resistance-turned-support converge.

AUD/USD daily chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.