Here is what you need to know on Wednesday, October 15:

Gold extends its impressive rally to a new record-high above $4,200 on Wednesday as markets assess the latest headlines surrounding the US-China relations. The US economic calendar will feature weekly Mortgage Applications and NY Empire State Manufacturing Index data for October. Policymakers from major central banks will be delivering speeches throughout the day as well.

US President Donald Trump said late Tuesday that they were considering terminating some trade ties with China, causing the US Dollar (USD) to weaken against its rivals.

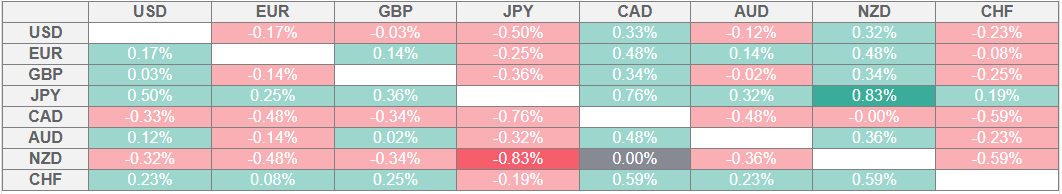

US Dollar Price This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

"I believe that China purposefully not buying our Soybeans, and causing difficulty for our Soybean Farmers, is an Economically Hostile Act. We are considering terminating business with China having to do with Cooking Oil, and other elements of Trade, as retribution," Trump posted on Truth Social. At the time of press, the USD Index was down nearly 0.3% on the day at 98.76.

Meanwhile, Federal Reserve Chairman Jerome Powell adopted a neutral tone in his speech before the National Associations for Business Economics (NABE) Annual Meeting in Philadelphia on Tuesday. Powell acknowledged that downside risks to the labor market had risen, while noting that there was also a risk that the slow pass-through of tariffs could start to look like persistent inflation. "The future path of monetary policy will be driven by data and risk assessments," he added.

France's Prime Minister Sebastien Lecornu announced on Tuesday that he intends to suspend the pension reform, which was designed to raise the retirement age to 64 from 62, until after the 2027 presidential election. Later this week, Lecornu will face two no-confidence motions. After closing in positive territory on Tuesday, EUR/USD continues to edge higher toward 1.1650 in the European session on Wednesday.

Reserve Bank of Australia (RBA) Assistant Governor Sarah Hunter said early Wednesday that recent data has been a little stronger than expected, adding that inflation is likely to be stronger than forecast in the third quarter. After sliding to its weakest level since late August below 0.6450 on Tuesday, AUD/USD stages a rebound and was last seen rising about 0.5% on the day near 0.6520.

GBP/USD benefits from the selling pressure surrounding the USD and recovers to the 1.3350 region in the European morning on Wednesday.

After posting small losses on Tuesday, USD/JPY continues to stretch lower toward 151.00 in the early European session.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.