Should You Buy The Trade Desk After Its 68% Slump in 2025?

Key Points

As the adtech business grows, competition is heating up too.

The Trade Desk is losing some market share to Amazon.

The stock's sharp drop has left it trading at a cheap price.

- 10 stocks we like better than The Trade Desk ›

Some companies like The Trade Desk (NASDAQ: TTD), had a terrible 2025. Its stock fell nearly 70% in 2025, making it among the worst performers in the S&P 500. While many expected a rebound in 2026, that hasn't occurred yet. The stock is also down an additional 16% to start 2026.

Shares of the adtech platform are now down nearly 80% from their all-time high. The biggest question surrounding The Trade Desk's stock is whether it's a value play or a value trap. The former can provide a great investment opportunity, while the latter can spell trouble.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Which one is it? Let's find out.

Image source: Getty Images.

Why is The Trade Desk down so much?

First, we need to address the elephant in the room. Stocks don't just fall by nearly 80% of their own accord -- something had to happen. For The Trade Desk, it's a potent combination of slowing growth and rising competition. The Trade Desk operates an advertising technology platform that places advertisers' ads in the optimal spot. It has connections all over the internet, including websites, podcasts, connected TV, and more. As advertising shifts to a more individualized and targeted model, The Trade Desk should thrive.

However, The Trade Desk was disrupted by none other than Amazon (NASDAQ: AMZN). Amazon's ad service has been growing rapidly, and it generated $17.7 billion in revenue during the third quarter, up 24% year over year. For reference, The Trade Desk's revenue increased at an 18% pace during Q3 and generated $2.8 billion over the past 12 months. The reason Amazon has been stealing growth from The Trade Desk is simple: It has more optimal advertising space.

If you're looking to advertise a product, would you rather advertise on the margins of a website or during a commercial break, or would you rather ensure that your product is at the top of Amazon when a buyer is looking to purchase your exact product? While both have their merits, advertisers have chosen Amazon's model more than The Trade Desk's as of late.

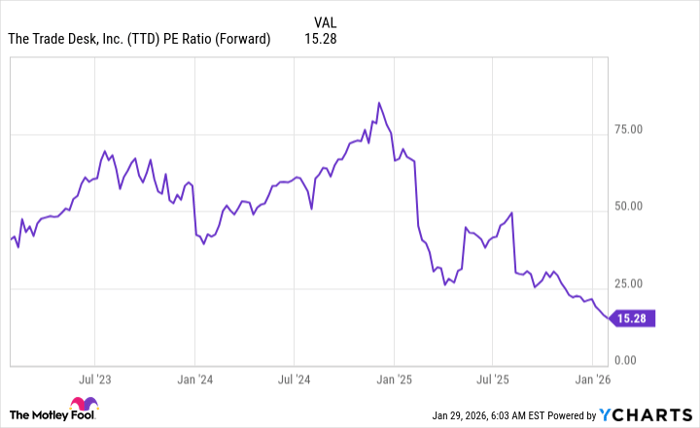

TTD PE Ratio (Forward) data by YCharts. PE = price-to-earnings.

This has caused The Trade Desk's stock to lose premium status and see its valuation tumble. While The Trade Desk used to have a premium valuation of more than 50 times forward earnings, it's now dirt cheap at 15 times forward earnings. For reference, the S&P 500 trades for 22.2 times forward earnings.

A valuation like that indicates a company will be shrinking, not growing. The Trade Desk is still clearly growing at a decent pace although it may not be as fast as investors want. I think this is a prime buying opportunity for the stock, and investors should consider scooping up shares before the stock returns to a more reasonable, market-average valuation level.

However, there is still some risk here as the market may not value the stock at a more reasonable level for some time.

Should you buy stock in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 2, 2026.

Keithen Drury has positions in Amazon and The Trade Desk. The Motley Fool has positions in and recommends Amazon and The Trade Desk. The Motley Fool has a disclosure policy.