2 No-Brainer High-Yield Energy Stocks to Buy for Reliable Income Right Now

Key Points

When investing in high-yield energy stocks, investors should stick with companies that can support their growing payouts with free cash flow.

ConocoPhillips has one of the best exploration and production portfolios of any U.S. company.

Kinder Morgan is benefiting from rising energy demand driven by artificial intelligence and growing U.S. natural gas exports.

- 10 stocks we like better than ConocoPhillips ›

The energy sector is off to the races -- up 12.9% year to date at the time of this writing. That puts energy ahead of materials as the best-performing stock market sector so far in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Investors looking for high-yield energy stocks to buy now have come to the right place.

Here's why ConocoPhillips (NYSE: COP) and Kinder Morgan (NYSE: KMI) can add a jolt to your passive income stream in 2026.

Image source: Getty Images.

ConocoPhillips blends upside potential with dividend reliability

ConocoPhillips is the largest U.S. exploration and production company by market capitalization and the third-largest overall U.S. oil and gas company by market cap behind ExxonMobil and Chevron.

A few years ago, ConocoPhillips got rid of its variable dividend to focus on growing its ordinary quarterly dividend. The company has a goal to deliver top-quartile dividend growth relative to the S&P 500 (SNPINDEX: ^GSPC) -- meaning it not only expects to consistently raise its payout but also to do so at a rapid rate.

ConocoPhillips can support its dividend growth because of its highly efficient asset portfolio. It plans to lower its free cash flow (FCF) breakeven level to the low $30 range per West Texas Intermediate (WTI) crude oil barrel by the end of the decade. WTI -- which is the U.S. benchmark crude oil price -- is in the mid $60 per barrel range at the time of this writing. And even during the oil crash of 2020, WTI prices still averaged $39.16 for the year and haven't averaged below $30 for a calendar year since 2002.

ConocoPhillips plans to lower its breakeven by combining technological advancements in exploration and production, efficiency improvements, and a focus on high-quality plays rather than growing production for its own sake.

With a 3.3% dividend yield, ConocoPhillips stands out as the best overall upstream oil and gas stock to buy now and one of the best all-around energy stocks for long-term investors.

Kinder Morgan is back in growth mode

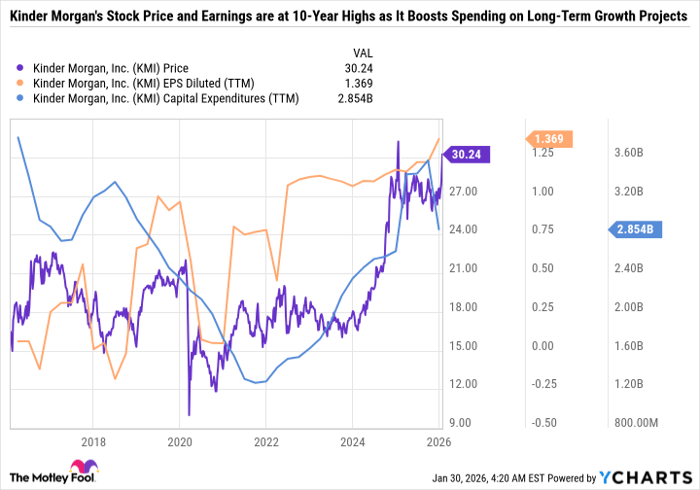

Kinder Morgan is hovering around a 10-year high after releasing fourth-quarter and full-year 2025 results. Kinder Morgan's 2026 budgeted adjusted net income is 5% higher than 2025, and it expects adjusted earnings per share to increase by 5% compared to 2025.

Kinder Morgan is able to predict its earnings with a high degree of accuracy because 70% of its 2026 budgeted cash flows are take-or-pay or hedged. Take-or-pay means that customers book pipeline and storage capacity regardless of whether they actually use it.

Kinder Morgan's growth forecast may seem mediocre, but keep in mind it's coming off its highest earnings in a decade.

KMI data by YCharts

As you can see in the chart, Kinder Morgan's capital expenditures have been on the rise since the start of 2022. Initially, it was just a recovery from the pandemic. But there are plenty of long-term growth catalysts at play that are justifying increased energy infrastructure spending.

Artificial intelligence (AI) is driving grid expansion, and natural gas remains the largest contributor to the U.S. power generation mix. Additionally, the U.S. is now the largest liquefied natural gas (LNG) exporting nation in the world. And Kinder Morgan plays an integral role in the LNG industry by transporting natural gas from areas of production, like West Texas, to areas of LNG liquefaction and export along the U.S. Gulf Coast.

Unlike in years past, when Wall Street criticized oil and gas industry spending and pressured companies to focus on lean, high-FCF operations, Kinder Morgan now has the green light to invest in long-term projects. This sentiment shift should support higher FCF, and in turn, larger dividends.

With a 3.9% dividend yield, Kinder Morgan is an excellent high-yield dividend stock to pair with ConocoPhillips in 2026.

Should you buy stock in ConocoPhillips right now?

Before you buy stock in ConocoPhillips, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ConocoPhillips wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 2, 2026.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron and Kinder Morgan. The Motley Fool recommends ConocoPhillips. The Motley Fool has a disclosure policy.