Afraid the AI Boom Is Overheated? This Infrastructure Play Is Your Safety Net.

Key Points

Taiwan Semiconductor manufactures almost all advanced AI chips in data centers.

TSMC's clients include Apple, Nvidia, Tesla, Broadcom, and many other big tech companies.

A drop in AI demand will slow TSMC's growth, but it won't derail its business.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

Artificial intelligence (AI) is far from a new technology. People have been using it for quite some time, whether knowingly or not. However, the current AI boom is a technological turning point that many would argue we haven't seen since the introduction of the internet.

As with any new industry trend, there's been a lot of investor optimism, but at some point, this turns into speculation. We've seen this story plenty of times in the market. This isn't to say AI's a bubble (the technology is here to stay), but current valuations rightfully bring on skepticism.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Fortunately, there's one company that's a key piece to the AI supply chain that you can count on regardless: Taiwan Semiconductor Manufacturing (NYSE: TSM).

Image source: Getty Images.

TSMC's role in the AI world

A good way to understand TSMC's AI role is by working backward from the AI applications and tools people use daily. For those AI tools to be effective, they need to be trained on more data than you can fathom. This data is stored, and AI models are trained inside data centers that contain hardware like graphics processing units (GPUs), AI accelerators, and central processing units (CPUs).

Different companies design these hardware pieces, but they have one thing in common: They rely on TSMC to manufacture their chips and bring them to life. It has a virtual monopoly on manufacturing advanced AI chips because it's the one company tech companies trust the most to be efficient and handle the necessary scale.

Thriving with or without AI

If the current AI boom slows or turns out to be a bubble, many companies will fail or find themselves in trouble, scrambling to pivot their businesses. TSMC isn't one of them. Companies like Apple rely on TSMC to make its smartphone chips; Nvidia relies on it for its GPUs; Tesla relies on it for its self-driving chips; Broadcom relies on it for its networking hardware; and there are plenty more companies you can plug in there.

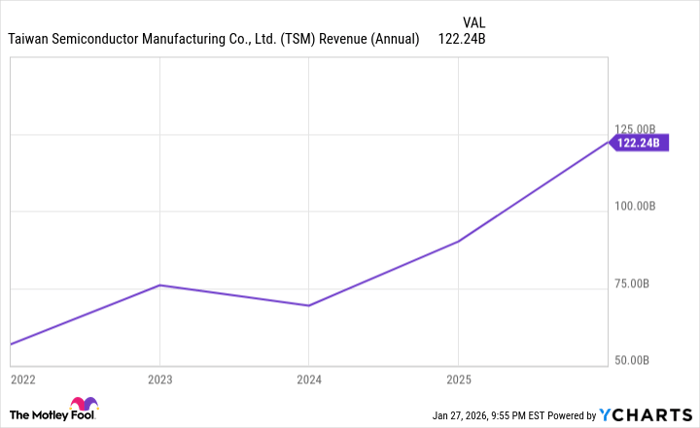

AI-related revenue has undoubtedly contributed to TSMC's growing earnings and demand in recent years. It had its best year ever in 2025, bringing in $122 billion in revenue (up nearly 36% year over year).

TSM Revenue (Annual) data by YCharts

Without AI, TSMC's growth would take a hit, sure. However, it would be far from detrimental to TSMC's overall long-term business.

Tech hardware will continue to need chips, and most tech companies will continue to rely on TSMC. With chip manufacturing having such a high barrier to entry, as long as TSMC continues to invest in improving its technology and expanding its capabilities, it should remain the world's most important chip manufacturer for some time.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 1, 2026.

Stefon Walters has positions in Apple and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.