1 Super-Safe High-Yield Dividend King Stock to Buy Even if There's a Stock Market Sell-Off in 2026

Key Points

Kimberly-Clark is guiding for another mediocre year in 2026.

The personal care company is undergoing a multiyear restructuring and reorganization initiative.

At the same time, it is buying Kenvue and integrating its struggling product portfolio.

- 10 stocks we like better than Kimberly-Clark ›

There are countless factors that could lead to a stock market sell-off in 2026, such as elevated valuations, artificial intelligence (AI) stocks running up too far and too fast, geopolitical risks, tariff policy, or an economic slowdown. But there are also plenty of reasons to be optimistic, such as strong corporate balance sheets, generally high profit margins, U.S. leadership across multiple sectors of the stock market, and a long runway for AI-fueled growth.

Still, risk-averse investors may be looking for safe stocks they can count on no matter what the market does in 2026. Dividend Kings are companies that have raised their payouts for at least 50 consecutive years. On Jan. 27, Kimberly-Clark (NASDAQ: KMB) raised its dividend for the 54th consecutive year and reported fourth-quarter and full-year 2025 earnings.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With a 5% yield, here's why it stands out as a no-brainer dividend stock to buy now.

Image source: Getty Images.

More weak results from Kimberly-Clark

Kimberly-Clark specializes in paper products, such as paper towels, tissues, toilet paper, diapers, adult care, and feminine care. It has several leading consumer brands, including Kleenex, Huggies, Scott, Cottonelle, Viva, Kotex, Poise, Depend, Andrex, Pull-Ups, Goodnites, Intimus, Plenitud, Sweety, Softex, and WypAll. All of these brands are No. 1 or No. 2 in market share in their respective product categories in 70 countries. About two-thirds of Kimberly-Clark's sales come from North America, and the rest is international.

Historically, Kimberly-Clark has been a stodgy, moderate-growth company that investors can rely on, even during recessions, because demand for its products is less sensitive to economic swings than discretionary categories. But Kimberly-Clark has been in a brutal downturn, in lockstep with the rest of the household and consumer products industry, as consumers resist price hikes amid inflation and adjust to higher living costs.

Kimberly-Clark finished 2025 with 1.7% organic sales growth thanks to a 2.5% increase in volume (offset by a 0.9% decrease in price), gross margins of 36%, flat adjusted operating profit, and a 3.2% increase in adjusted earnings per share (EPS).

For 2026, Kimberly-Clark is guiding for 2% organic sales growth, flat adjusted EPS, and a mid-to-high single-digit increase in adjusted operating profit based on a constant-currency basis, which takes out fluctuations in currencies that Kimberly-Clark can't control.

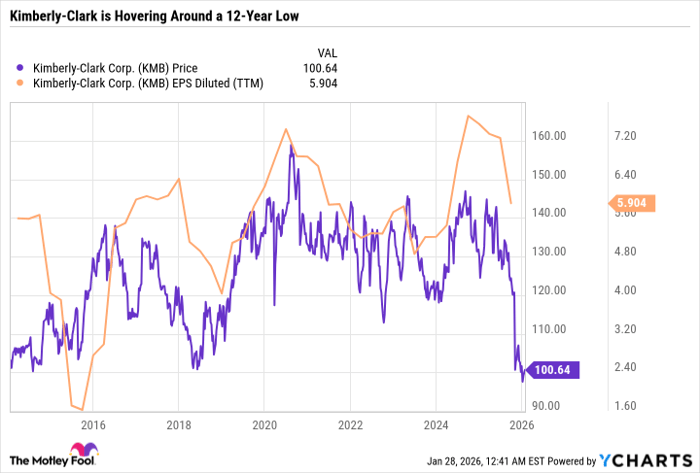

The market was already bracing for mediocre results, as the stock only fell half a percent in the session after the earnings release. But zoom out, and Kimberly-Clark is treading water around its lowest level in 12 years.

KMB data by YCharts

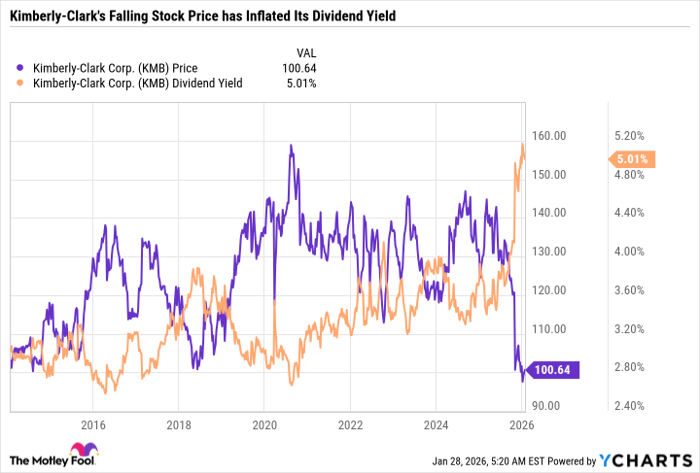

The sell-off, paired with Kimberly-Clark's continued dividend raises, has pushed its yield up to 5%. Whereas historically, Kimberly-Clark has more or less hovered around the 3% dividend yield range.

KMB data by YCharts

Anytime a stock's yield soars, it's good to check that the company can afford the higher payout.

Kimberly Clark's earnings and free cash flow still exceed its dividend expense -- so it doesn't have to fund the dividend with debt. That's a good sign that the dividend is sustainable. And Kimberly-Clark gave investors a vote of confidence by raising the dividend the same day it released its full-year 2025 results.

Kimberly-Clark's bold bet on Kenvue

In addition to sluggish growth, another factor weighing on Kimberly-Clark is its bold acquisition of Kenvue (NYSE: KVUE) -- which spun off from Johnson & Johnson in August 2023 as a stand-alone, pure-play consumer health company with iconic brands like Band-Aid, Tylenol, Aveeno, Listerine, and Neutrogena. Kenvue's brief stint as a public company was a struggle, with the stock price down more than 30% from the initial spin-off price at the time of Kimberly Clark's announcement on Nov. 3, 2025.

It's worth noting that because J&J was a Dividend King, and Kenvue raised its dividend when it was a stand-alone company, it was still technically a Dividend King before being acquired by Kimberly-Clark.

Kenvue's brands are far outside of Kimberly-Clark's paper products wheelhouse. But Kimberly-Clark believes that it can get a lot of value out of Kenvue's brands by covering a greater portion of consumer life stages, from baby and child care to women's health and active aging.

Kimberly-Clark just wrapped up the second year of its Powering Care strategy, which aims to reduce costs, implement organizational restructuring, and boost growth and margins.

Because Kimberly-Clark is already in turnaround mode, the Kenvue acquisition comes at a good time. Based on Kimberly-Clark's conservative assumptions, it expects to generate $2.1 billion in annual synergies, mainly from $1.9 billion in cost synergies within three years after the acquisition closes. It also expects to "achieve solid EPS accretion" in year two after the acquisition closes. The acquisition is expected to close in the second half of this year.

A top value stock to buy in 2026

Buying Kimberly-Clark is a bet on the combined strength of its brands and those it will acquire from Kenvue. In its fourth quarter 2025 prepared remarks, Kimberly-Clark said it remained committed to disciplined capital deployment, growing the business, maintaining a strong balance sheet, and increasing its dividend.

In general, I'm a big fan of contrarian acquisitions made during an industrywide downturn rather than during an expansion period. Especially ones that include high-yield dividend stocks with affordable payouts. Turnarounds and acquisitions can be messy and often come with a slew of missteps. Making those mistakes during a downturn is better than failing to capitalize on an expansion period.

Kimberly-Clark has the makings of a perfect income stock to buy and hold for at least three to five years. The stock is dirt cheap, trading at just 13 times forward earnings. The 5% yield provides an excellent source of passive income. And Kimberly-Clark has already ripped off the proverbial bandage by issuing weak 2026 guidance and tempering investor expectations for the next three years while it transforms its existing products and Kenvue's brands.

In other words, it's basically telling investors not to expect blowout results for several years, which is why some short-term investors have sold out of the stock. But long-term-focused investors are getting the chance to scoop up shares on the cheap, with the dividend still as reliable as ever and an elevated yield to boot.

Add it all up, and Kimberly-Clark is a value investor's dream come true for 2026.

Should you buy stock in Kimberly-Clark right now?

Before you buy stock in Kimberly-Clark, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kimberly-Clark wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 31, 2026.

Daniel Foelber has positions in Kenvue and Kimberly Clark. The Motley Fool has positions in and recommends Kenvue. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.