1 AI Stock I'm Buying Before It Goes Parabolic in 2026

Key Points

Rising investment in AI infrastructure is fueling demand for specialty chips.

As AI workloads continue to expand, memory and storage solutions will become the new bottleneck.

Micron Technology stands to benefit from AI infrastructure's impact on the memory revolution.

- 10 stocks we like better than Micron Technology ›

In a move that may surprise nobody, artificial intelligence (AI) hyperscalers are planning to double down on their infrastructure spend this year. According to FactSet Research, big tech is forecast to spend over $500 billion expanding their data center footprints and procuring more chips in 2026.

What investors are probably overlooking is that rising capital expenditures (capex) is not just good news for Nvidia, Advanced Micro Devices, Broadcom, or Taiwan Semiconductor Manufacturing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Read on to learn why Micron Technology (NASDAQ: MU) should be the AI chip stock on your radar this year and why I'm going to buy shares.

Image source: Micron Technology.

Why is everyone talking about Micron?

As the AI infrastructure era comes into focus, developers have their eyes on use cases in areas such as agentic AI, robotics, and autonomous systems. From a technical standpoint, these applications are far more sophisticated than building a chatbot.

In essence, AI workloads are going to grow exponentially in the coming years as investments in training and inference scale. From a budgeting standpoint, this means that big tech is no longer acutely focused on procuring as many general-purpose chips as possible.

Expanding AI workloads fuels demand for additional memory and storage. Micron is a major player in the world of high-bandwidth memory (HBM), dynamic random access memory (DRAM), and NAND chips.

Could Micron stock triple in 2026?

Over the last year, shares of Micron have soared 277%. Indeed, with this level of momentum, some investors may be skittish about the stock continuing to rise.

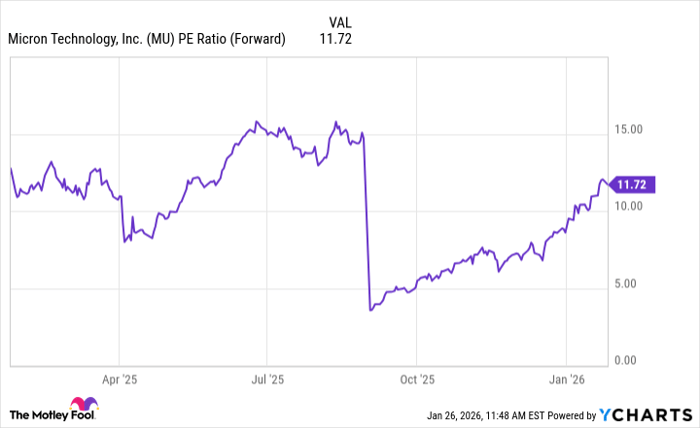

Even with such meteoric gains, however, Micron still trades at a modest forward price-to-earnings (P/E) ratio. This pales in comparison to other leading semiconductor stocks along the AI chip value chain -- which boast forward earnings multiples in the 30ish range at a minimum.

MU PE Ratio (Forward) data by YCharts

For this fiscal year, Wall Street is forecasting Micron's earnings per share (EPS) to triple compared to last year. This seems reasonable given the secular tailwinds fueling investments in AI infrastructure and the specific importance of memory and storage to that narrative.

Should Micron's forward P/E trade more in line with other chip leaders, shares could be headed toward $1,000 -- nearly 150% higher than they are today.

No matter where Micron stock ends up by year-end 2026, I am confident shares will trend meaningfully higher over the long term.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 31, 2026.

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, FactSet Research Systems, Micron Technology, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.