Prediction: This Popular Cryptocurrency Will Plunge 50% (or More) by Year-End 2026

Key Points

During the first half of 2025, XRP rallied to a seven-year high.

Smart investors realized the momentum was driven more by hype than by fundamental progress with the token.

With few catalysts on the horizon and intensifying competition, XRP could be headed for another sell-off.

- 10 stocks we like better than XRP ›

After its strongest rally in seven years, XRP (CRYPTO: XRP) has entered 2026 with an uncertain future. What once looked like the next breakout digital token is at risk of significant downward pressure in the months ahead.

Let's reassess XRP's performance from last year and explore why further volatility could be on the horizon. Is XRP about to turn into a falling knife? Read on to find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Why did XRP soar in early 2025?

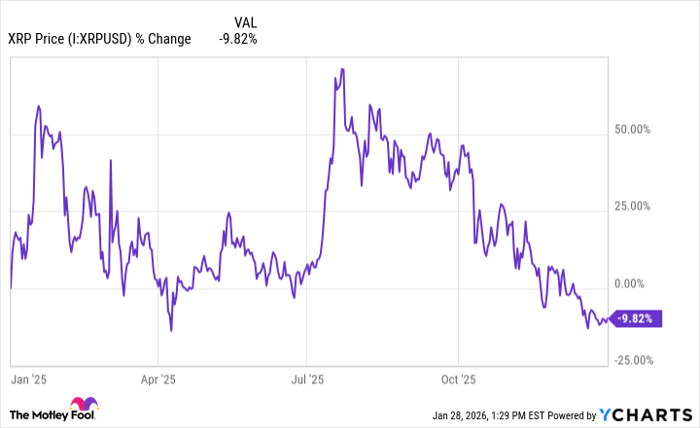

During the first half of 2025, XRP surged by about 70%, reaching a price of $3 for the first time since 2018. However, the token plummeted during the second half of the year, ultimately ending 2025 down 10%.

XRP Price data by YCharts.

In reality, XRP's rally had nothing to do with the underlying fundamentals of the token. Rather, its run-up was entirely driven by a speculative narrative.

XRP is a cryptocurrency that is issued by the payments company Ripple. For years, Ripple and the Securities and Exchange Commission (SEC) had been in a legal tiff around whether XRP should be considered a security -- similar to a stock or bond -- when it's sold.

Last year, the SEC dropped its lawsuit against Ripple, giving the company -- and the crypto landscape more broadly -- a major victory over a tough regulatory environment. It didn't take long for retail investors to create a narrative that XRP had become legitimized and could soon become the next cornerstone of institutional crypto portfolios.

Image source: Getty Images.

XRP has a structural issue, and investors are finally realizing it

I see two primary headwinds that influenced XRP's reversal last year. First, the broader cryptocurrency market witnessed heavy selling pressure as capital began rotating into safe havens like gold and silver, as well as more-durable secular themes such as artificial intelligence stocks.

The token's value proposition could actually be working against it. The crypto landscape is riddled with loads of altcoins that have little or no utility. XRP actually does serve a purpose, though.

Ripple's system allows customers to send money overseas both quickly and cost-effectively. Banks using its network have the option to denominate their transactions in XRP as a means to circumvent foreign exchange fees. But as it stands today, most businesses are still using fiat currency in their transactions.

Second, many banks are also experimenting with stablecoins, a far less volatile asset. Given the preference for fiat currency, accelerating use of stablecoins, and the fact that the incumbent network -- the Society for Worldwide Interbank Financial Telecommunication (SWIFT) -- is also testing a digital infrastructure, smart investors are surely questioning what Ripple's future looks like. By extension, sluggish adoption of Ripple could prove detrimental to XRP's future.

Where will XRP be trading by year-end 2026?

XRP has the potential to be explosive, but all signs are pointing to a questionable adoption curve. What's more, its current valuation of $116 billion is actually still pricing in a good bit of optimism driven by the speculative rally from last year.

Against this backdrop, I think meaningful valuation contraction is in store for 2026. This is not to say that the crypto doesn't have any value or is doomed. Rather, I simply think the token's market cap is too high to justify.

By year-end, I think XRP's price could normalize closer to $1, at which point it could be worth a look.

Should you buy stock in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $448,476!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,180,126!*

Now, it’s worth noting Stock Advisor’s total average return is 945% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 31, 2026.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends XRP. The Motley Fool has a disclosure policy.