Today’s Market Recap: Fed Patience Meets Tech Optimism as AI Demand Reignites Markets

Track the Market Trend

TradingKey - On January 28, 2026, U.S. equity markets posted modest moves following the Federal Reserve’s widely expected policy decision. The S&P 500 edged down 0.01% to close at 6,978.03. The Nasdaq Composite gained 0.17% to finish at 23,857.45, approaching record territory, while the Dow Jones Industrial Average ticked up 0.02% to 49,015.60.

Storage company Seagate Technology (STX) recorded a 19% gain after reporting earnings that exceeded expectations, driving strength across the storage segment. Shares of Micron (MU) advanced more than 6%, and Western Digital (WDC) climbed 10%. Meanwhile, shares of ASML’s ADR fell 2.2% at the close despite an initial gain of over 2% in early trading.

After-hours earnings saw divergent reactions among tech majors. Meta Platforms (META) surged more than 8% after delivering results ahead of forecasts. Tesla (TSLA) rose 2%, though revenue declined even as the company topped earnings estimates. Microsoft (MSFT) dropped over 4%, as investors appeared to weigh higher AI-related capital expenditures despite better-than-expected figures.

Mixed earnings weighed on segments of the industrial sector. Badger Meter (BMI), which provides water management technology and software, sank 11.00% to $146.32 following a revenue shortfall.

Separately, RBC Capital Markets reaffirmed its “Outperform” rating on Intuit (INTU), viewing the stock’s recent pullback as a potential buying opportunity. Shares of C3.ai (AI) advanced 4.21% to $13.13 on merger speculation.

Precious metals rallied sharply. Spot gold jumped 4% for its largest single-day gain this year, rising nearly $200 to approach $5,400 per ounce. Spot silver climbed more than 4%, nearing Monday’s record high of $117.70.

As anticipated, the Federal Reserve left interest rates unchanged, maintaining the federal funds target range at 3.50% to 3.75%. In the post-meeting press conference, Chair Jerome Powell said the economic outlook had become “more balanced,” noting improvements in labor market conditions and headline inflation. The CME FedWatch Tool now reflects increased market expectations for two rate cuts in 2026, with June viewed as the likely starting point.

Market Headline

The Federal Reserve held interest rates steady, signaling a patient approach to future cuts. As anticipated, the Fed kept its benchmark rate unchanged at 3.5%–3.75%. Chair Jerome Powell emphasized that additional hikes are not considered the base-case scenario, citing easing inflationary pressures and stabilizing labor markets. Fed Chair nominee Christopher Waller endorsed a 25-basis-point cut later this year. Powell noted that most of the inflationary impact from tariffs has already been absorbed and expects tariff-driven inflation to subside by mid-2026. He declined to comment on the dollar’s trajectory.

U.S. officials reiterated support for a strong dollar, rejecting intervention in the yen’s decline. Bessant, a leading U.S. economic advisor, reaffirmed the administration’s strong dollar policy and ruled out any direct intervention to support the yen. He argued that a narrowing U.S. trade deficit should organically support the dollar and that sound macroeconomic fundamentals remain key. Despite his comments, the yen weakened by over 1% intraday. JPMorgan (JPM) analysts pointed out that Bessant left room for potential verbal—or even real—intervention should market volatility worsen.

Tesla's Q4 results beat forecasts despite a revenue drop and upcoming strategic shifts. Tesla exceeded earnings expectations in the fourth quarter, supported by improving margins and preliminary deployment of full self-driving capabilities. The company disclosed a $2 billion investment in xAI and confirmed that its Cybercab and Optimus robot manufacturing programs are moving toward mass production. However, Q4 revenue declined 3% year-over-year, and EPS fell 17%, though both metrics came in above forecasts. Shares rose over 4% in after-hours trading before reversing, as Tesla projected 2026 capital expenditures to exceed $20 billion and announced it would discontinue production of the Model S and Model X.

Meta delivered standout Q4 results and aggressive 2026 investment plans. Meta significantly outperformed market expectations, driven by robust demand for its AI-powered advertising platform. Q4 revenue and Q1 2026 guidance beat consensus forecasts, and the company raised full-year capital expenditures guidance to as much as $135 billion—nearly twice last year’s output. Investors welcomed the report, sending Meta shares up more than 11% in after-hours trading.

ASML (ASML) posted record-breaking Q4 orders as AI infrastructure spending accelerated. ASML reported a sharp increase in demand for advanced lithography systems, with orders in Q4 reaching €13.2 billion—nearly double analysts’ estimates and up from €5.4 billion in Q3. Total backlog surged to €38.8 billion. The company raised its 2026 growth outlook, citing strong momentum in semiconductor demand driven by large-scale AI infrastructure investments. ASML shares initially jumped 10% before paring gains.

Microsoft beat earnings estimates but raised investor concerns with surging capex. Microsoft delivered stronger-than-expected second-quarter results, including revenue and EPS growth. However, a 66% year-over-year surge in capital expenditures to a new record, coupled with decelerating cloud revenue growth, triggered investor caution. The stock fell about 5% in after-hours trading. Analysts pointed to extended AI investment ROI timelines as a near-term overhang.

SK Hynix posted its strongest quarterly earnings ever, driven by AI memory. The company reported Q4 operating profit of 19.2 trillion won (approx. $13.5 billion), more than doubling year-over-year and beating analyst forecasts. Revenue rose to 32.8 trillion won, propelled by high-bandwidth memory (HBM) demand. The firm’s Korean-listed shares climbed over 6% in after-hours trade. HBM became a key revenue driver, with full-year sales more than doubling.

Corning (GLW) achieved record Q4 core revenue on optical communications strength. Fourth-quarter core revenue rose 14% year-over-year, fueled by robust demand in its optical communications segment and reflecting double-digit profit growth. The company expects an acceleration of sales in Q1 2026, projecting 15% year-over-year core revenue growth. New contracts tied to global AI infrastructure expansion served as primary contributors to the quarter’s strength.

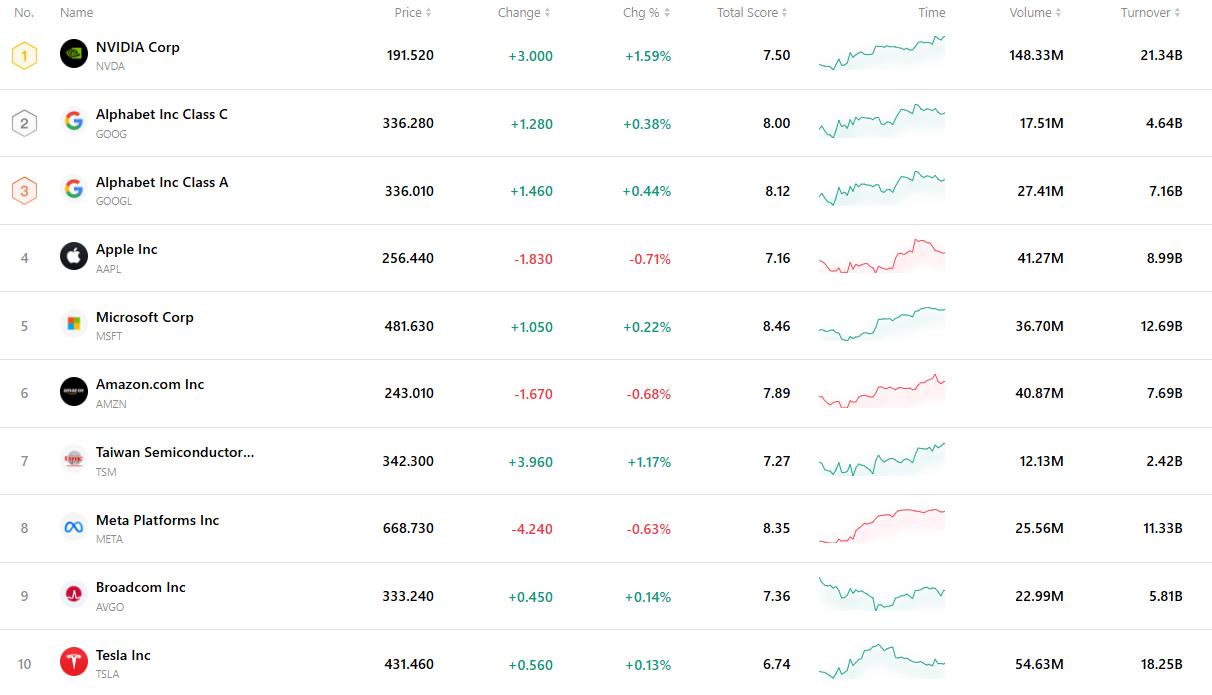

Top 10 Most Traded Stocks

The chart below highlights the ten most actively traded stocks in the current market. With their substantial trading volumes and high liquidity, these names serve as key benchmarks for tracking global market dynamics.