Silver Soared 144% in 2025. History Says It Could Crash in 2026.

Key Points

Silver prices have surged amid speculative demand and concerns about supply constraints in China.

The bull run probably won't last for the long haul.

- These 10 stocks could mint the next wave of millionaires ›

Although many investors have been focused on traditional growth opportunities like big tech, the often-overlooked precious metals sector has quietly stolen the show. Silver, in particular, has been on a generational run, with prices up by an eye-popping 240% during the past 12 months alone, as concerns mount about supply constraints in China and political uncertainty in the U.S.

Let's dig deeper into why history suggests the rally might not last for the long haul.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Why is silver rallying?

This month, silver prices crossed $100 per ounce for the first time in history, the latest peak in a speculative frenzy. Geopolitical turmoil is likely the most significant factor pushing prices up. The Trump administration has steered the U.S. toward a more volatile and unpredictable trade policy -- with tariffs ranging from 10% to 50% for most of the world. And this could be making international investors unsure about the U.S. dollar's future as a safe asset and the global reserve currency.

The dollar index (which measures the dollar against a basket of other major currencies) has declined by almost 10% during the past 12 months, which suggests some investors are pulling out of the country.

Image source: Getty Images.

Other factors, like rising deficit spending and concerns about central bank independence, are also causing a loss of faith in the dollar. Trump has repeatedly pressured the Federal Reserve to lower interest rates. And while Fed Chairman Jerome Powell has resisted, the confrontation will naturally lead to a reduction of trust in the U.S. monetary system.

By late 2025, the silver rally was already in full swing. But China added fuel to the fire by announcing a slew of export restrictions that go into effect this year. Under the policy, only 44 companies will be eligible to export the metal from 2026 to 2027. However, while the news sparked fear in financial markets, its real-world impact has been muted.

Bloomberg reports that a similar licensing regime has been in place since 2019 without leading to supply bottlenecks. Furthermore, China exported 5,100 tons of silver last year -- the highest volume of exports in 16 years.

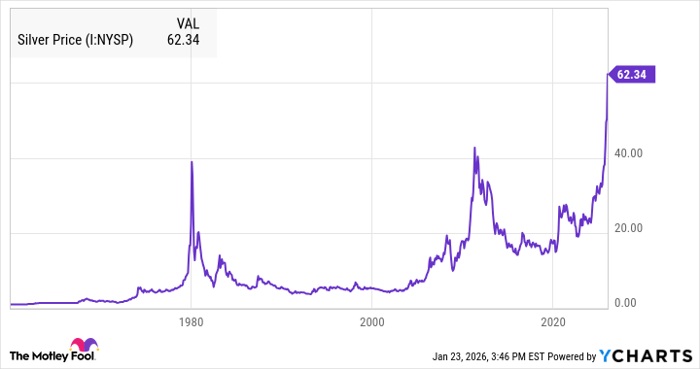

Silver has a history of booms and busts

During the past 100 years, silver has had several speculative rallies that all ended in a crash. The most recent one occurred in 2011 after the Great Recession. And the factors that drove the previous silver boom are similar to the ones at play today.

The U.S. experienced its first-ever credit rating downgrade that year. And according to the Wall Street Journal, investors were also concerned about other macroeconomic challenges like the eurozone debt crisis and the potential for runaway inflation.

However, silver's post-recession rally was short-lived. And by 2015, the precious metal had already shed roughly 70% of its value before starting to climb again into the rally we see today.

Silver Price data by YCharts

These rallies don't last because they are based on hype and speculation instead of sustainable demand. Silver is much more than just a precious metal. Industrial demand represents about 59% of consumption. And much of this goes to the solar and electric-vehicle industries, which benefit from its conductive properties. When prices rise to uneconomical levels, silver can be replaced with other metals such as copper or aluminum.

This month, Bloomberg reported that major Chinese solar cell manufacturer LONGi Green Energy Technology has already started replacing silver with base metals to reduce costs. Investors should expect the trend to continue in solar and other industries until prices fall to reasonable levels. Over the long term, expect mining output to increase, putting even more downward pressure on prices by increasing supply.

What should investors do next?

Whenever a commodity rises to unprecedented levels, it's tempting to think that this time will be different. But it rarely is. Silver has had booms and busts several times, alongside other once-booming natural resources like crude oil and cobalt.

The current rally looks likely to fizzle out when speculative hype dies down and industrial demand shifts. Investors should take profits or avoid buying into this rally for now.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 949%* — a market-crushing outperformance compared to 195% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of January 27, 2026.

The Motley Fool has a disclosure policy.